J.B. Hunt Transport Services, Inc. (JBHT, Financial) reported second-quarter revenue of $2.93 billion, meeting market expectations. The quarter was marked by a 6% rise in Intermodal loads and a 13% growth in Truckload loads. Additionally, productivity in Dedicated Contract Services rose by 3%, and Integrated Capacity Solutions saw a 6% boost in revenue per load.

However, these gains were partially counterbalanced by a 10% decrease in Final Mile Services revenue and reduced revenue per load in the JBI and JBT segments. The Integrated Capacity Solutions segment also experienced a 9% drop in load volume, while the average number of trucks in the Dedicated Contract Services segment declined by 3%. Excluding fuel surcharge revenue, the company's operating revenue increased by 1% compared to the same period in the previous year.

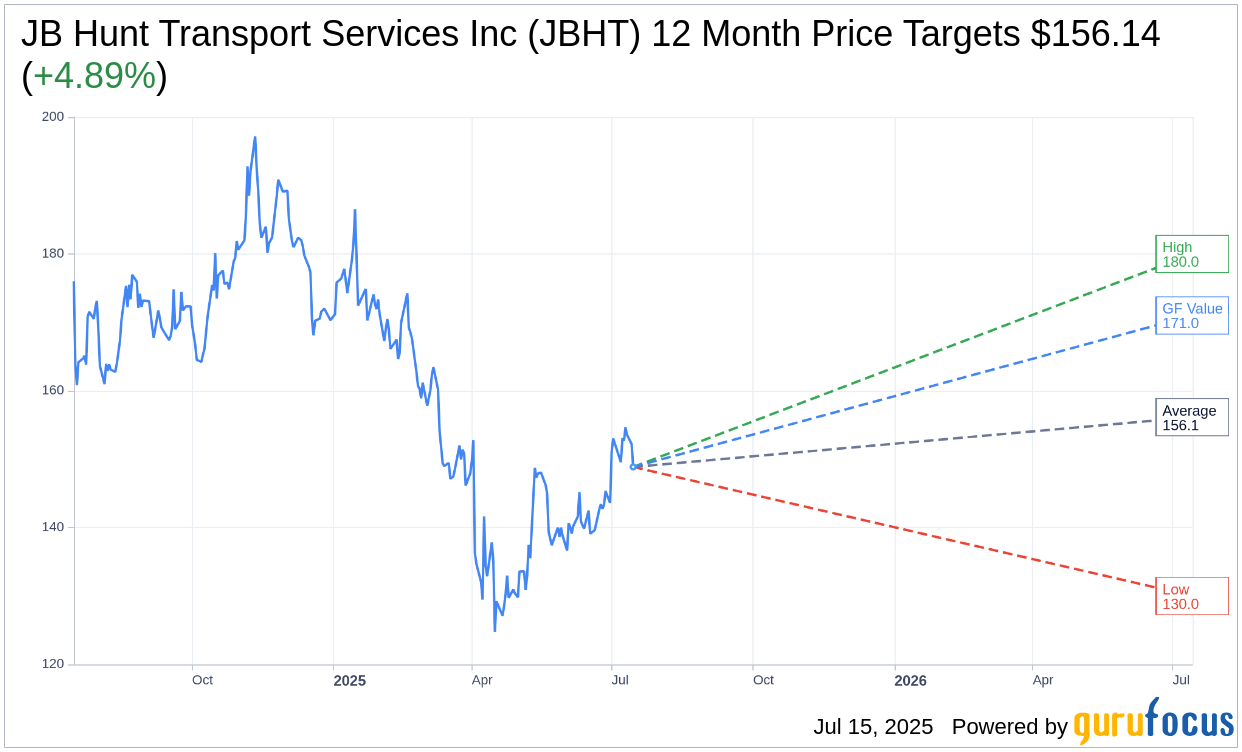

Wall Street Analysts Forecast

Based on the one-year price targets offered by 23 analysts, the average target price for JB Hunt Transport Services Inc (JBHT, Financial) is $156.14 with a high estimate of $180.00 and a low estimate of $130.00. The average target implies an upside of 4.89% from the current price of $148.86. More detailed estimate data can be found on the JB Hunt Transport Services Inc (JBHT) Forecast page.

Based on the consensus recommendation from 27 brokerage firms, JB Hunt Transport Services Inc's (JBHT, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for JB Hunt Transport Services Inc (JBHT, Financial) in one year is $171.01, suggesting a upside of 14.88% from the current price of $148.86. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the JB Hunt Transport Services Inc (JBHT) Summary page.

JBHT Key Business Developments

Release Date: April 15, 2025

- Revenue: Declined 1% year-over-year.

- Operating Income: Decreased 8% compared to the prior year quarter.

- Diluted EPS: Decreased 4% year-over-year.

- Intermodal Volumes: Up 8% year-over-year, setting a first-quarter volume record.

- Net Capital Expenditures: Expected to be between $500 million to $700 million for 2025.

- Stock Repurchase: $234 million repurchased during the first quarter, with $650 million remaining on authorization.

- New Senior Notes Issued: $750 million issued to extend debt maturity.

- Truck Sales in Dedicated Segment: Approximately 260 trucks sold in the first quarter.

- Customer Count in ICS: Increased by more than 20% compared to the first quarter last year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- JB Hunt Transport Services Inc (JBHT, Financial) achieved record first-quarter intermodal volumes, indicating strong demand and operational excellence.

- The company has successfully reduced people costs by over $200 million through headcount attrition and performance management.

- JB Hunt Transport Services Inc (JBHT) has a strong safety culture, with further improvements in key safety metrics and a significant safety accomplishment in their maintenance team.

- The company has a strong brand and customer sentiment, receiving several awards during the quarter.

- JB Hunt Transport Services Inc (JBHT) has a diverse set of customers and a strong pipeline in their dedicated segment, with approximately 260 trucks of new deals sold in the first quarter.

Negative Points

- Revenue declined by 1%, operating income decreased by 8%, and diluted EPS decreased by 4% compared to the prior year quarter, primarily due to lower yields and inflationary cost pressures.

- The company faces inflationary cost headwinds, including noticeable increases in insurance premiums for the third consecutive year.

- Demand for big and bulky products in the Final Mile segment remains muted, with weak demand for furniture, exercise equipment, and appliances.

- The truckload market continues to exceed demand, leading to competitive pricing pressures.

- The uncertain macro environment and trade policy remain top concerns for customers, impacting supply chain strategies and potentially affecting future demand.