Loop (LOOP, Financial) announced its first-quarter revenue of $252,000, significantly missing the market consensus of $718,500. Despite this shortfall, the company is optimistic about ongoing negotiations with apparel and consumer packaged goods (CPG) brands for its InfiniteLoopIndia facility. The facility's cost-efficient structure is expected to allow the company to deliver high-quality products at competitive prices, aligning with profitability and return on investment goals.

CEO Daniel Solomita expressed confidence that securing these partnerships will generate the necessary cash flow for future capacity expansion. Additionally, Loop is enthusiastic about its upcoming Infinite Loop Europe project, which aims to benefit from the company's in-house engineering services once a project location is selected. The adoption of modular construction solutions is anticipated to improve the profitability and efficiency of this project and future endeavors, expediting their market introduction and enhancing sustainable solutions.

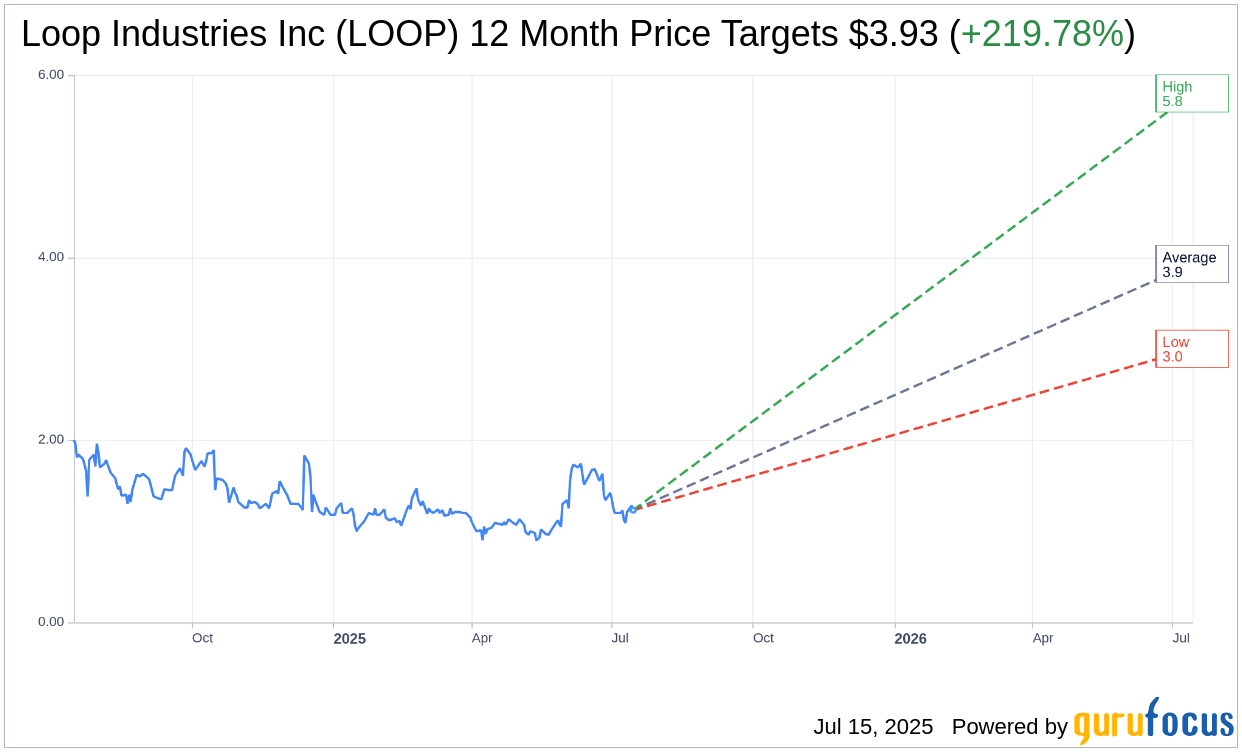

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Loop Industries Inc (LOOP, Financial) is $3.93 with a high estimate of $5.80 and a low estimate of $3.00. The average target implies an upside of 219.78% from the current price of $1.23. More detailed estimate data can be found on the Loop Industries Inc (LOOP) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Loop Industries Inc's (LOOP, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.