On July 15, 2025, Loop Industries Inc (LOOP, Financial) released its 8-K filing detailing its financial performance for the first quarter of fiscal year 2026. The company, known for its innovative approach to recycling PET plastic and polyester fiber, continues to advance its projects in India and Europe, despite facing financial hurdles.

Company Overview

Loop Industries Inc (LOOP, Financial) is a technology and licensing company dedicated to promoting sustainable plastic solutions. The company utilizes proprietary technology to recycle waste PET plastic and polyester fiber into high-quality materials, contributing to a circular economy and reducing reliance on fossil fuels.

Financial Performance and Challenges

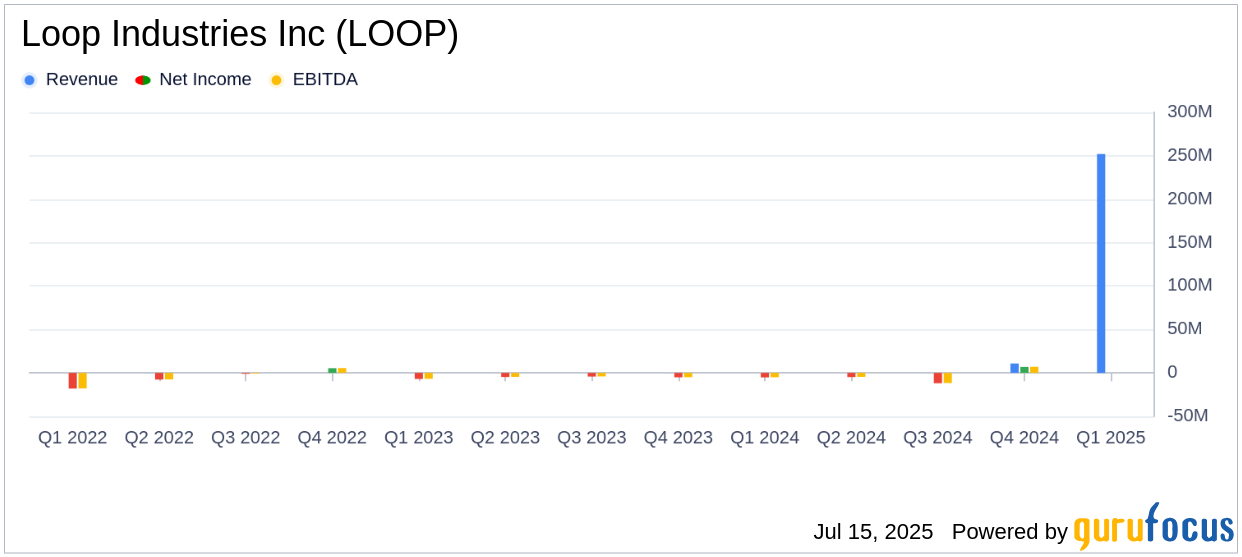

For the quarter ended May 31, 2025, Loop Industries reported revenues of $252,000, a significant increase from $6,000 in the same period last year. However, this figure fell short of the analyst estimate of $1.24 million. The company's net loss for the quarter was $3.447 million, an improvement from the $5.189 million loss in the previous year, yet still reflecting ongoing financial challenges.

Key Financial Achievements

Loop Industries achieved a notable reduction in cash operating expenses, which decreased by $2.2 million year-over-year to $2.6 million. This reduction is crucial for the company as it seeks to manage its resources effectively while pursuing ambitious projects in India and Europe.

Income Statement Highlights

| Metric | Q1 2025 | Q1 2024 | Change |

|---|---|---|---|

| Revenues | $252,000 | $6,000 | $246,000 |

| Net Loss | $(3.447) million | $(5.189) million | $1.742 million |

Analysis of Financial Metrics

The decrease in research and development expenses by $863,000 to $1.374 million and general and administrative expenses by $1.262 million to $1.649 million were significant contributors to the improved net loss. These reductions highlight Loop Industries' efforts to streamline operations and focus on core activities.

Progress in India and Europe

Loop Industries is making strides in its international projects. In India, the company is finalizing site selection for its Infinite Loop facility and has signed a $1.5 million engineering services agreement. In Europe, Loop is collaborating with Reed Societe Generale Group to select a site for its first manufacturing facility.

“We are encouraged by the progress of our off-take discussions with apparel and CPG brands for the Infinite Loop™ India facility. The low-cost structure of this facility positions us to offer our customers a superior product at highly competitive prices,” said Daniel Solomita, Founder and CEO of Loop.

Conclusion

While Loop Industries Inc (LOOP, Financial) faces financial challenges, its strategic initiatives in India and Europe demonstrate a commitment to growth and sustainability. The company's ability to manage expenses and advance key projects will be critical in achieving long-term success in the competitive chemicals industry.

Explore the complete 8-K earnings release (here) from Loop Industries Inc for further details.