- Impressive Growth: The Bank of New York Mellon Corporation reports a 27% increase in earnings per share for Q2 2025.

- Analyst Insights: Wall Street analysts set an average price target implying a slight upside potential.

- Valuation Concerns: GuruFocus estimates suggest the stock might be overvalued.

The Bank of New York Mellon Corporation (NYSE: BK) has achieved remarkable financial performance in the second quarter of 2025. Earnings per share have soared to $1.93, representing a significant 27% increase compared to the previous year. Meanwhile, revenue has reached record heights, surpassing $5 billion for the first time, due to strong growth in investment services and enduring client partnerships.

Wall Street Analysts Forecast

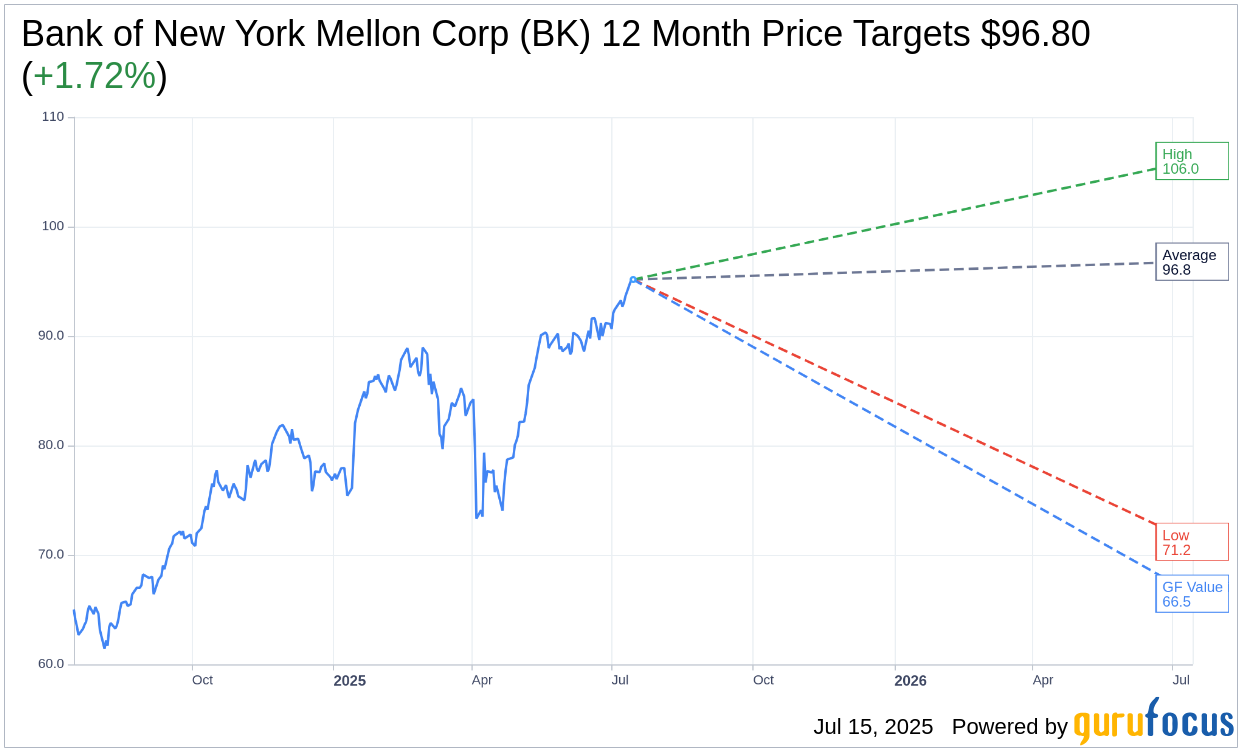

According to the one-year price targets set by 14 analysts, the average target price for Bank of New York Mellon Corp (BK, Financial) is $96.80. This comes with a high estimate of $106.00 and a low estimate of $71.21. The current price of $95.16 suggests a potential upside of 1.72%. For more nuanced insights, investors can explore more specifics on the Bank of New York Mellon Corp (BK) Forecast page.

The consensus recommendation from 17 brokerage firms positions Bank of New York Mellon Corp (BK, Financial) as "Outperform," with an average brokerage recommendation of 2.2 on a scale where 1 indicates Strong Buy and 5 signals Sell.

GuruFocus Value Estimations

According to GuruFocus estimates, the GF Value for Bank of New York Mellon Corp (BK, Financial) in one year is projected at $66.46. This suggests a potential downside of 30.16% from the current price of $95.16. The GF Value is a proprietary calculation of what the stock should ideally trade at, derived from historical trading multiples, past business growth, and anticipated future performance. To delve deeper into these metrics, visit the Bank of New York Mellon Corp (BK) Summary page.