Capital Southwest (CSWC, Financial) has released its preliminary expectations for the first quarter, projecting a net asset value (NAV) per share between $16.55 and $16.65. The company also provided estimates for its non-accruals, which represent a portion of its total investment portfolio. These non-accruals are anticipated to constitute 2.6% when measured at cost, and 0.8% at fair value. This information is crucial for investors tracking the financial health and investment strategy of CSWC.

Wall Street Analysts Forecast

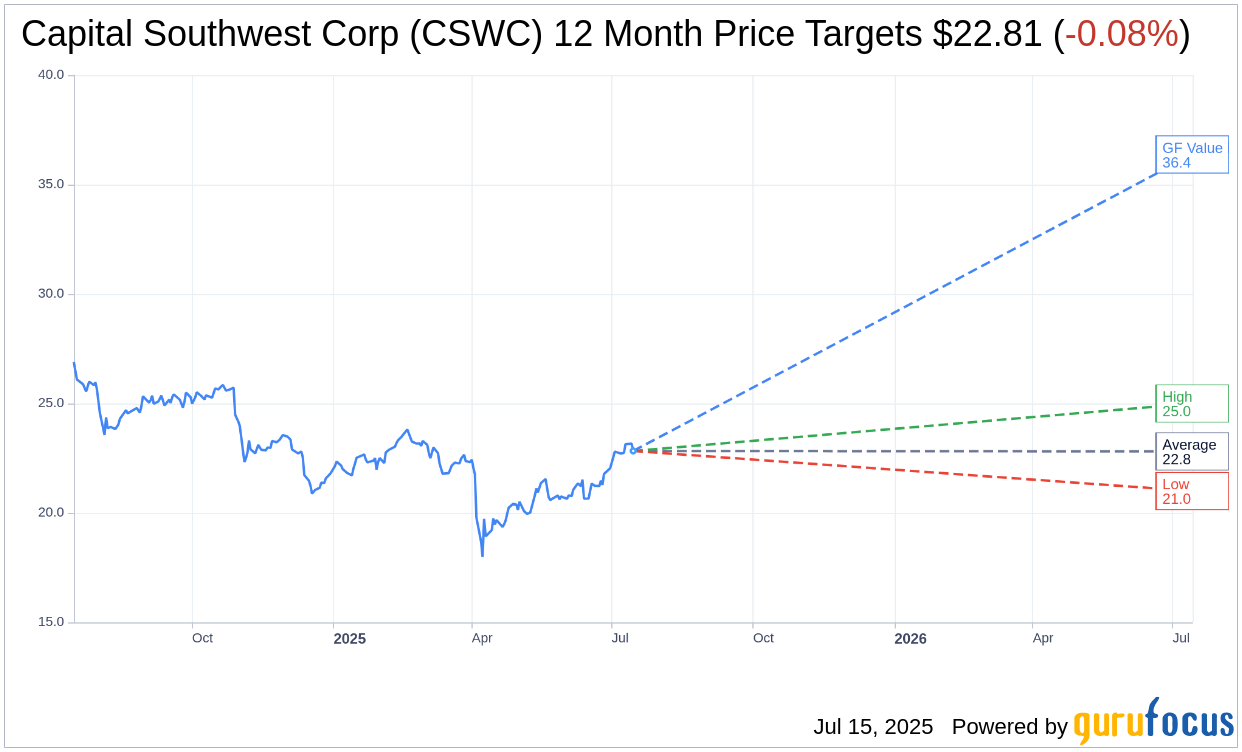

Based on the one-year price targets offered by 8 analysts, the average target price for Capital Southwest Corp (CSWC, Financial) is $22.81 with a high estimate of $25.00 and a low estimate of $21.00. The average target implies an downside of 0.08% from the current price of $22.83. More detailed estimate data can be found on the Capital Southwest Corp (CSWC) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Capital Southwest Corp's (CSWC, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Capital Southwest Corp (CSWC, Financial) in one year is $36.38, suggesting a upside of 59.35% from the current price of $22.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Capital Southwest Corp (CSWC) Summary page.

CSWC Key Business Developments

Release Date: May 15, 2025

- Investment Portfolio Growth: Increased by approximately $300 million, or 21%, from $1.5 billion to $1.8 billion.

- Weighted Average Leverage: Reduced to 3.5 times in the investment portfolio.

- Nonaccruals at Fair Value: Decreased from 2.3% to 1.7%.

- Unrealized Appreciation: Grew from $38.5 million to $53.2 million.

- Debt Capital Raised: Over $300 million, including a $230 million convertible bond issuance.

- Equity Proceeds: Raised over $180 million through the ATM program.

- Dividend Growth: Regular dividend increased from $2.24 to $2.31 per share, with an additional $0.23 per share in supplemental dividends.

- Pretax Net Investment Income: $0.56 per share; adjusted to $0.61 per share excluding one-time expenses.

- Undistributed Taxable Income Balance: Increased to $0.79 per share from $0.68 per share.

- New Commitments: $150 million in total, including $113 million in first lien senior secured debt.

- Regular Dividend Declared: $0.58 per share for the June 2025 quarter, with a $0.06 supplemental dividend.

- Net Asset Value (NAV) per Share: Increased to $16.70 from $16.59.

- Balance Sheet Liquidity: Approximately $384 million in cash and undrawn leverage commitments.

- Regulatory Leverage: Debt-to-equity ratio of 0.89:1.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Capital Southwest Corp (CSWC, Financial) grew its investment portfolio by approximately $300 million, or 21%, from $1.5 billion to $1.8 billion.

- The company reduced its nonaccruals at fair value from 2.3% to 1.7%, indicating improved portfolio quality.

- CSWC raised over $300 million in new debt capital commitments, including a $230 million convertible bond issuance.

- The company received approval for a second SBIC license, allowing access to an additional $175 million in debt capital.

- CSWC maintained a strong dividend growth, increasing its regular dividend from $2.24 per share in fiscal year 2024 to $2.31 per share in fiscal year 2025, with additional supplemental dividends.

Negative Points

- The geopolitical environment and trade policy changes have created uncertainty, impacting the lower middle market and potentially slowing M&A activity.

- Certain industries, such as manufacturing and consumer discretionary products, are experiencing increased costs due to tariffs.

- CSWC identified 7% of its debt portfolio at fair value as moderate risk due to tariff exposure.

- The company experienced net realized and unrealized losses due to restructurings of two portfolio companies.

- There is potential for spread compression in the lower middle market as lenders compete for deals outside directly impacted industries.