Key Takeaways:

- UBS anticipates lower Q2 results for Six Flags due to reduced visitor numbers but maintains a 'Buy' rating.

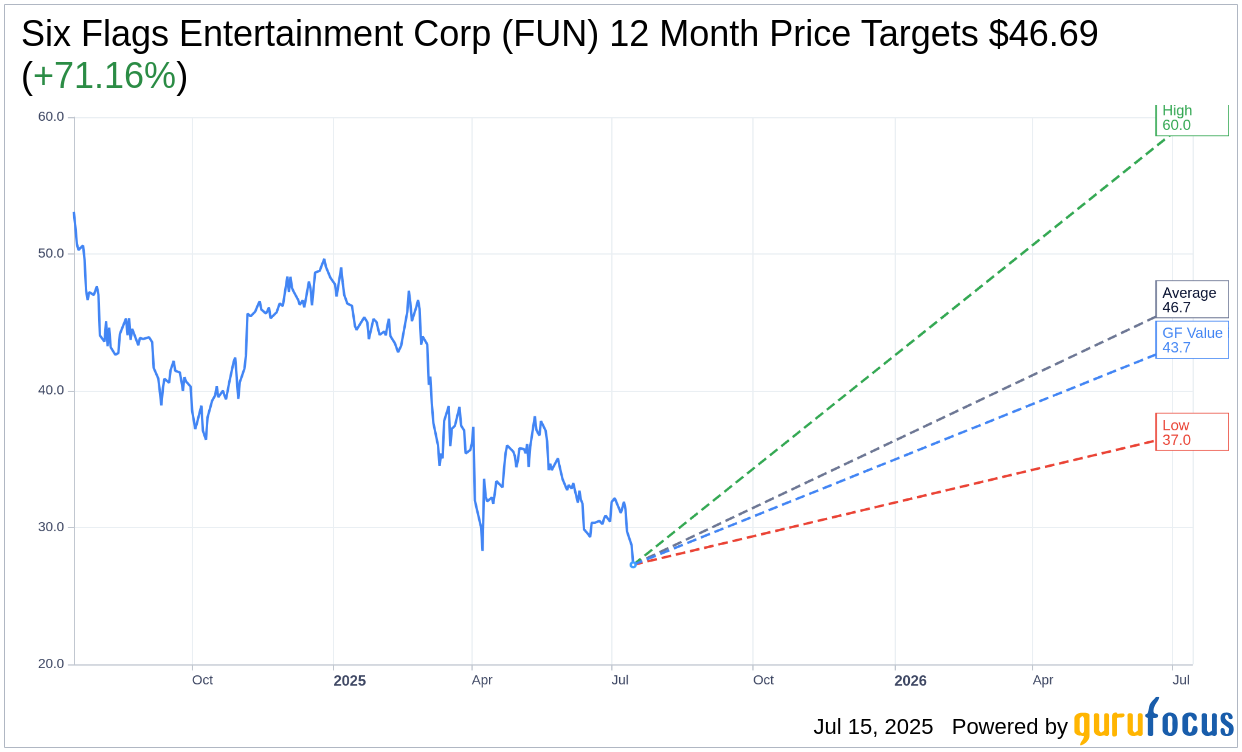

- Analysts project significant upside potential, with the average price target suggesting a 71.16% increase.

- GuruFocus' estimated GF Value indicates a 60.3% upside from the current stock price.

Six Flags Entertainment's Q2 Outlook

Six Flags Entertainment (FUN, Financial) is expected to face challenges in its second-quarter performance, primarily due to a decline in visitor numbers, as highlighted by UBS. Despite these headwinds, which may lead to a miss in Q2 estimates and a downward adjustment in annual EBITDA guidance, UBS remains optimistic. The firm maintains a 'Buy' rating on Six Flags, pointing to potential revenue synergies and structural improvements as long-term growth catalysts.

Analysts' Price Targets and Recommendations

Current analyst opinions reveal a promising outlook for Six Flags Entertainment Corp (FUN, Financial), with 13 analysts offering a one-year average price target of $46.69. This average target hints at a notable upside of 71.16% from the current stock price of $27.28. The target range spans a high estimate of $60.00 to a low estimate of $37.00, indicating diverse perspectives on the stock's future performance. For a deeper dive into these forecasts, visit the Six Flags Entertainment Corp (FUN) Forecast page.

The consensus recommendation from 15 brokerage firms positions Six Flags Entertainment Corp (FUN, Financial) as an "Outperform" with an average rating of 1.9. This rating scale ranges from 1 (Strong Buy) to 5 (Sell), reinforcing the positive sentiment among analysts regarding Six Flags' future prospects.

Evaluating Six Flags' GF Value

According to GuruFocus estimates, the one-year projected GF Value for Six Flags Entertainment Corp (FUN, Financial) is $43.73. This evaluation suggests a potential upside of 60.3% from the current price of $27.28, offering a compelling case for investors considering the fair market value. The GF Value is derived from the stock's historical trading multiples, past business growth trajectories, and anticipated future performance. To explore more detailed insights, please visit the Six Flags Entertainment Corp (FUN) Summary page.