On July 14, 2025, Huntington Bancshares Inc (HBAN, Financial) released its 8-K filing, announcing its acquisition of Veritex Holdings, Inc. and providing preliminary second-quarter results. Huntington, a regional US bank with approximately $200 billion in assets, is expanding its presence in the high-growth Texas markets through this strategic acquisition. The bank offers a comprehensive suite of consumer and commercial banking services, with a strong focus on the Midwestern market.

Performance and Challenges

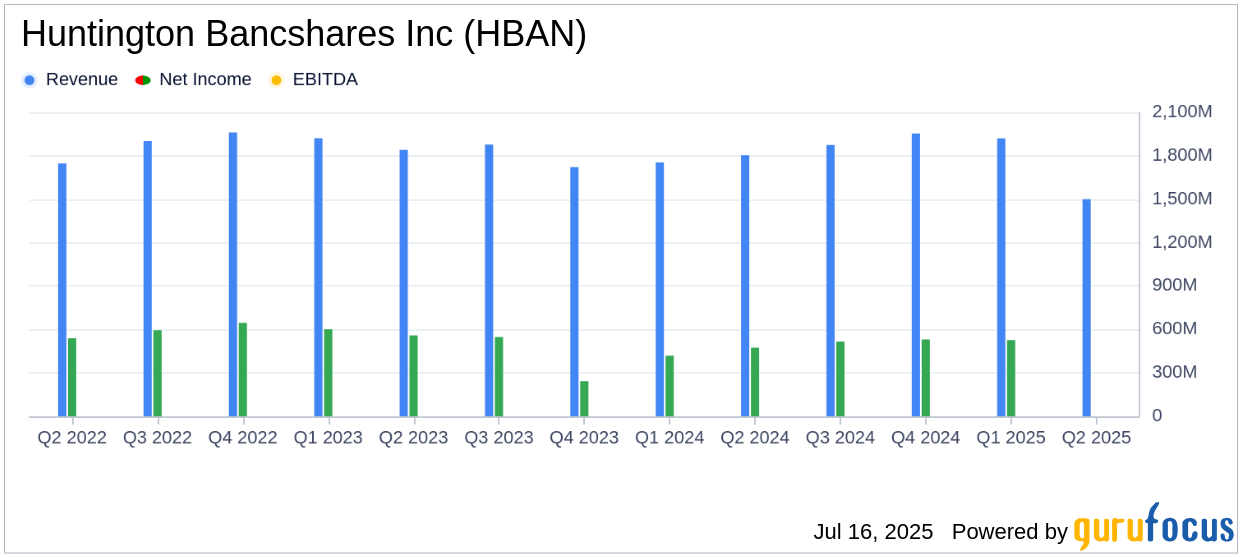

Huntington Bancshares Inc reported earnings per share (EPS) of $0.34 for the second quarter of 2025, which is below the analyst estimate of $0.35. This EPS is unchanged from the previous quarter but represents a 13% increase from the same quarter last year. The bank's net interest income rose to $1.5 billion, marking a 3% increase from the prior quarter and a 12% increase year-over-year. Despite these gains, the EPS was impacted by a $58 million decrease in earnings from securities repositioning and other notable items.

Financial Achievements

The acquisition of Veritex is a significant strategic move for Huntington, as it accelerates the bank's growth in the dynamic Texas market. Veritex, with approximately $13 billion in assets, $9 billion in loans, and $11 billion in deposits, will enhance Huntington's market presence in Dallas/Fort Worth and Houston. This acquisition is expected to be modestly accretive to Huntington’s earnings per share and neutral to regulatory capital at close.

Key Financial Metrics

Huntington's average loans and leases increased to $133.2 billion, a 2% rise from the previous quarter and an 8% increase from the year-ago quarter. Average deposits also grew to $163.4 billion, up 1% from the prior quarter and 6% year-over-year. The bank reported net charge-offs of 0.20% of average total loans and leases for the quarter, which is 6 basis points lower than the previous quarter, indicating strong credit performance.

| Metric | Q2 2025 | Q1 2025 | Q2 2024 |

|---|---|---|---|

| EPS | $0.34 | $0.34 | 13% increase |

| Net Interest Income | $1.5 billion | 3% increase | 12% increase |

| Average Loans and Leases | $133.2 billion | 2% increase | 8% increase |

| Average Deposits | $163.4 billion | 1% increase | 6% increase |

| Net Charge-Offs | 0.20% | 6 basis points lower | - |

Analysis and Outlook

The acquisition of Veritex is poised to bolster Huntington's growth trajectory, particularly in the Texas market, which is one of the fastest-growing economies in the United States. The strategic expansion aligns with Huntington's long-term commitment to growth and community support. The bank's financial performance, marked by increased net interest income and strong credit metrics, underscores its resilience and adaptability in a competitive banking landscape.

This combination supports our ambitions and reflects our long-term commitment to the state of Texas, one of the most dynamic and fastest-growing economies in the country," said Steve Steinour, Chairman, President and CEO of Huntington Bancshares.

Huntington's strategic initiatives, coupled with its robust financial performance, position the bank well for future growth. However, the slight miss on EPS estimates highlights the challenges of managing securities repositioning and other notable items. As the bank integrates Veritex, it will be crucial to maintain its strong credit performance and capitalize on the expanded market opportunities in Texas.

Explore the complete 8-K earnings release (here) from Huntington Bancshares Inc for further details.