Key Takeaways:

- ASML Holding (ASML, Financial) exceeds revenue and earnings expectations, bolstering its stronghold in the semiconductor market.

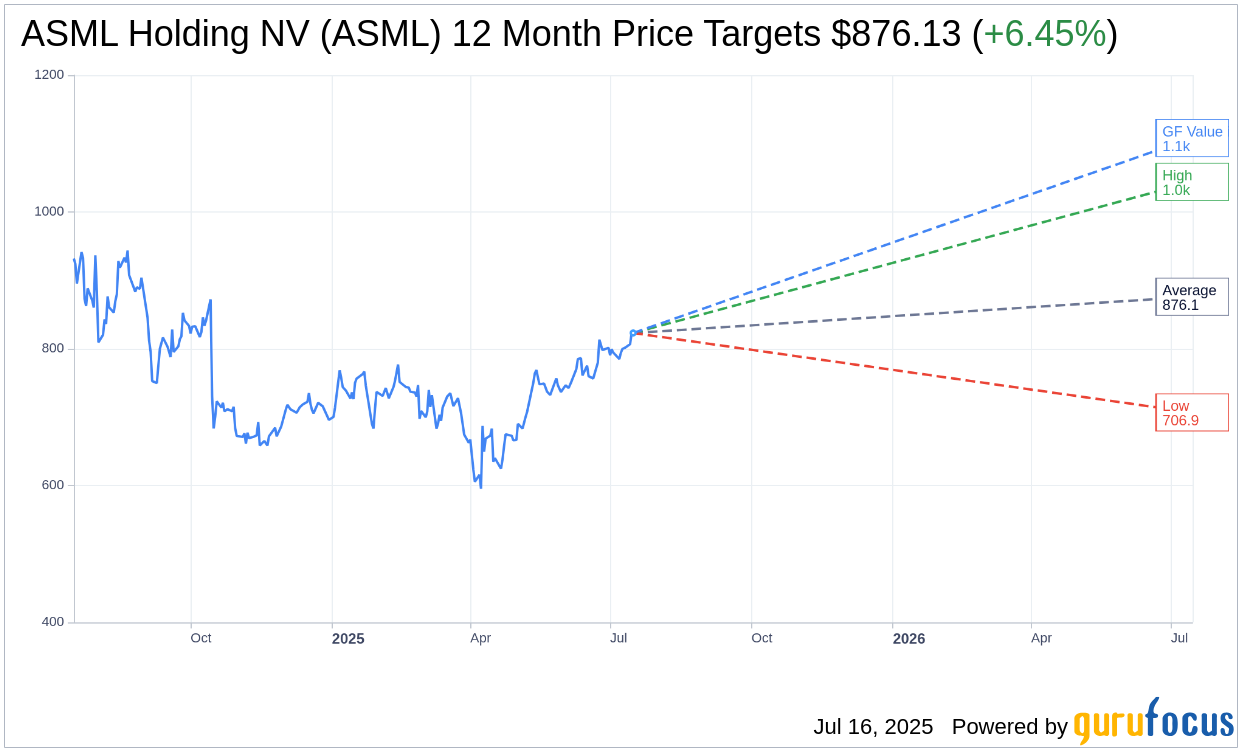

- Analysts forecast potential growth, projecting a 6.45% upside based on current price targets.

- GuruFocus estimates indicate a significant 34.65% upside with the GF Value model.

ASML Holding NV (ASML) has announced its latest financial results, showcasing performance that surpasses both revenue and earnings projections. The company's robust guidance for the third quarter and revised outlook for fiscal year 2025 further solidify its pivotal role in the semiconductor industry.

Analyst Price Targets for ASML

Wall Street analysts have set an average one-year price target of $876.13 for ASML Holding NV (ASML, Financial). These forecasts include a high of $1,044.01 and a low of $706.91, indicating a potential upside of 6.45% from the current trading price of $823.02. More comprehensive data on these estimates is available on the ASML Holding NV (ASML) Forecast page.

Brokerage Firm Recommendations

The consensus from 16 brokerage firms positions ASML Holding NV with an average recommendation rating of 2.0, signifying an "Outperform" status. This rating falls within a scale of 1 (Strong Buy) to 5 (Sell), indicating favorable expectations among market analysts.

GF Value Estimation

According to GuruFocus metrics, the estimated GF Value for ASML Holding NV (ASML, Financial) stands at $1108.17 over the next year. This estimation suggests a compelling upside of 34.65% from the current price of $823.02. The GF Value represents the fair market price of the stock, calculated based on historical trading multiples, past business growth, and future performance forecasts. For more in-depth data, visit the ASML Holding NV (ASML) Summary page.