Key Takeaways:

- ASML Holding posts significant growth with a 23% year-over-year sales increase and impressive net bookings rise.

- Analysts project an average target price increase of 6.45%, highlighting potential stock appreciation.

- GuruFocus estimates suggest a notable 34.65% upside in ASML's fair value within a year.

ASML Holding NV (ASML, Financial) has delivered a strong performance in its second quarter, showcasing a remarkable 23% increase in total sales compared to the same period last year. The company also reported a substantial 41% growth in net bookings, amounting to €5.54 billion. This performance not only surpassed revenue and earnings expectations but also prompted the company to update its outlook for the upcoming third quarter and fiscal year 2025.

Wall Street Analysts Forecast

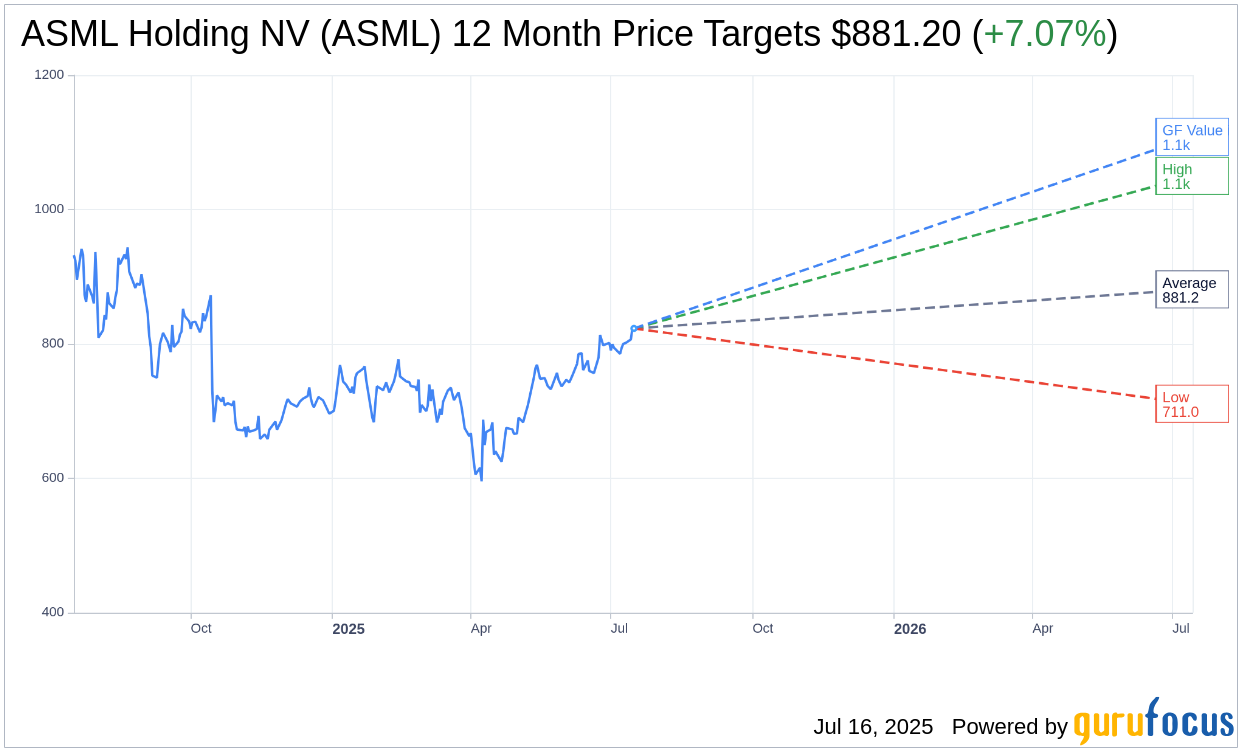

Based on the projections from 12 analysts, the average one-year price target for ASML Holding NV (ASML, Financial) stands at $876.13. Individually, the estimates vary, with a high of $1,044.01 and a low of $706.91. This average target suggests a potential 6.45% upside from the current stock price of $823.02. Investors can explore more detailed estimate data on the ASML Holding NV (ASML) Forecast page.

The consensus recommendation from 16 brokerage firms places ASML's average brokerage recommendation at 2.0, which translates to an "Outperform" status. This rating is part of a scale ranging from 1 to 5, where 1 indicates a Strong Buy and 5 signifies a Sell.

According to GuruFocus estimates, the estimated GF Value for ASML Holding NV (ASML, Financial) in one year is $1108.17, implying a considerable 34.65% upside from the current price of $823.02. The GF Value reflects GuruFocus' view of the fair value that ASML stock should command, based on its historical trading multiples, past business growth, and future performance expectations. For a deeper insight, visit the ASML Holding NV (ASML) Summary page.