ASML has projected its gross margin for the third quarter to range between 50% and 52%. This forecast provides insight into the company's expected profitability for the period. Investors may consider this information when evaluating their positions in ASML, as it reflects the company's financial health and potential performance. The gross margin serves as a key indicator of how efficiently a company is producing its goods and managing its production costs. Stakeholders will likely keep a close watch on upcoming reports to see if ASML meets its projected figures.

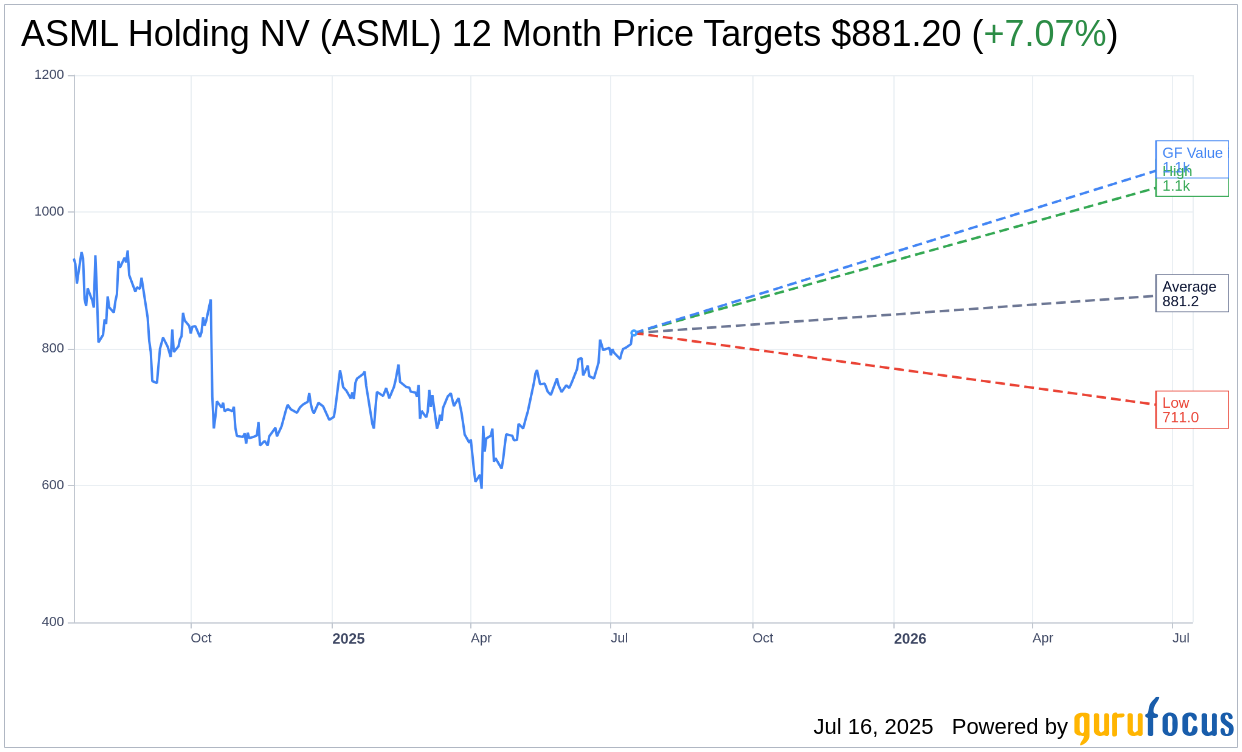

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for ASML Holding NV (ASML, Financial) is $876.13 with a high estimate of $1,044.01 and a low estimate of $706.91. The average target implies an upside of 6.45% from the current price of $823.02. More detailed estimate data can be found on the ASML Holding NV (ASML) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, ASML Holding NV's (ASML, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ASML Holding NV (ASML, Financial) in one year is $1076.88, suggesting a upside of 30.84% from the current price of $823.02. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ASML Holding NV (ASML) Summary page.

ASML Key Business Developments

Release Date: April 16, 2025

- Total Net Sales: EUR7.7 billion.

- Net System Sales: EUR5.7 billion (EUV: EUR3.2 billion, Non-EUV: EUR2.5 billion).

- Install Base Management Sales: EUR2 billion.

- Gross Margin: 54%.

- R&D Expenses: EUR1.161 billion.

- SG&A Expenses: EUR281 million.

- Effective Tax Rate: 16.7%.

- Net Income: EUR2.4 billion.

- Earnings Per Share (EPS): EUR6.

- Cash, Cash Equivalents, and Short-term Investments: EUR9.1 billion.

- Free Cash Flow: Minus EUR475 million.

- Net System Bookings: EUR3.9 billion (EUV: EUR1.2 billion, Non-EUV: EUR2.8 billion).

- Dividend: EUR1.52 per ordinary share for Q1 2025; total 2024 dividend proposal of EUR6.40 per ordinary share.

- Share Purchases: EUR2.7 billion in Q1 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ASML Holding NV (ASML, Financial) reported total net sales of EUR7.7 billion for Q1 2025, in line with guidance.

- The company achieved a gross margin of 54%, exceeding expectations due to favorable EUV product mix and customer productivity milestones.

- Net income for Q1 2025 was EUR2.4 billion, representing 30.4% of total net sales, with an earnings per share of EUR6.

- ASML Holding NV (ASML) continues to see strong demand in the AI sector, which is expected to drive growth in 2025 and 2026.

- The company is making significant progress in EUV technology, with milestones achieved in both low NA and high NA platforms, supporting customer roadmaps and cost optimization.

Negative Points

- ASML Holding NV (ASML) experienced a negative free cash flow of EUR475 million in Q1 2025 due to customer payment dynamics and investments in fixed assets.

- There is increased uncertainty in the business environment due to ongoing discussions about tariffs, which could impact ASML Holding NV (ASML) and its customers.

- The gross margin for the second half of 2025 is expected to be lower than the first half due to potential tariff impacts and lower upgrade revenue.

- ASML Holding NV (ASML) faces challenges with the geopolitical situation, particularly regarding tariffs that could affect the semiconductor supply chain.

- The company anticipates a wider range of gross margins for Q2 2025 due to uncertainties around tariffs and their absorption in the value chain.