M&T Bank (MTB, Financial) has announced a Common Equity Tier 1 (CET1) capital ratio of 10.98% for the second quarter. Additionally, the bank reported a tangible equity per share value of $112.48 during this period. The net charge-off rate was recorded at 0.32% for Q2.

The bank emphasized its ongoing ability to deliver consistent profitability, which has facilitated a noteworthy return of capital to its shareholders while ensuring resilience as the year progresses. M&T Bank has recognized a reduction in its stress capital buffer and remains steadfast in its commitment to effective risk management, benefiting all stakeholders involved.

This summer, M&T teams will continue to actively engage with clients to offer tailored financial solutions and contribute to community development through volunteer efforts. The bank's proactive approach aims to positively impact the lives of those they serve.

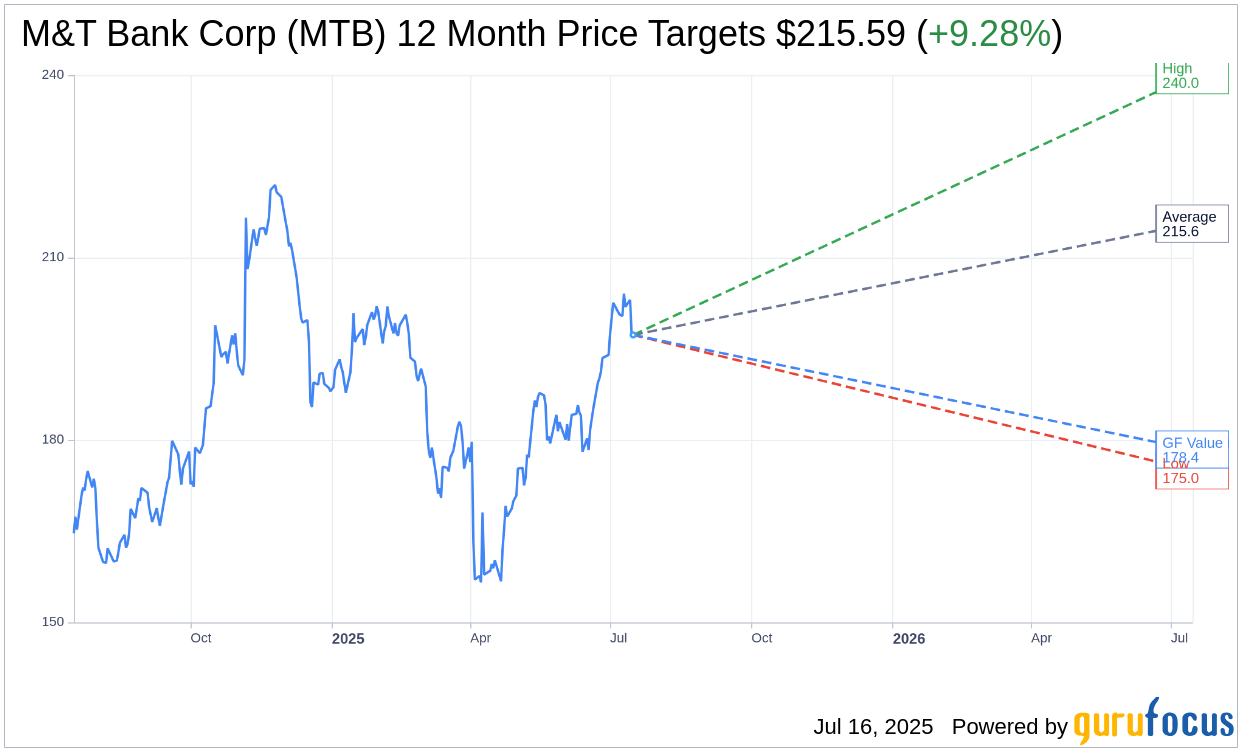

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for M&T Bank Corp (MTB, Financial) is $215.59 with a high estimate of $240.00 and a low estimate of $175.00. The average target implies an upside of 9.28% from the current price of $197.28. More detailed estimate data can be found on the M&T Bank Corp (MTB) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, M&T Bank Corp's (MTB, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for M&T Bank Corp (MTB, Financial) in one year is $178.43, suggesting a downside of 9.55% from the current price of $197.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the M&T Bank Corp (MTB) Summary page.