Truist has revised its price target for Churchill Downs (CHDN, Financial), reducing it from $150 to $145, while maintaining a Buy rating for the stock. According to analysts, the gaming sector has largely bounced back from the challenges seen in the first quarter, driven by tariff impacts. So far, there are no indicators of weakened consumer spending. Analysts note that while regional, local, and digital gaming markets show positive trends, the performance in Las Vegas seems to be experiencing some fluctuations this summer.

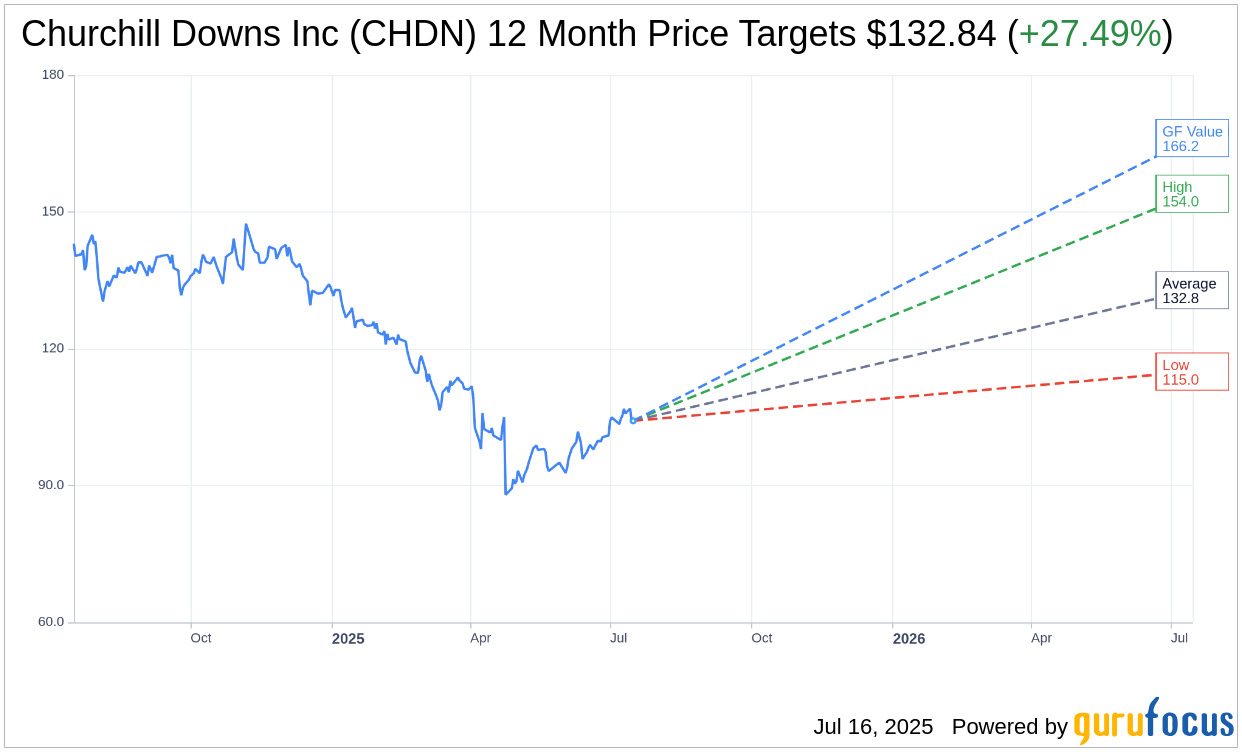

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Churchill Downs Inc (CHDN, Financial) is $132.84 with a high estimate of $154.00 and a low estimate of $115.00. The average target implies an upside of 27.49% from the current price of $104.20. More detailed estimate data can be found on the Churchill Downs Inc (CHDN) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Churchill Downs Inc's (CHDN, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Churchill Downs Inc (CHDN, Financial) in one year is $166.22, suggesting a upside of 59.52% from the current price of $104.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Churchill Downs Inc (CHDN) Summary page.