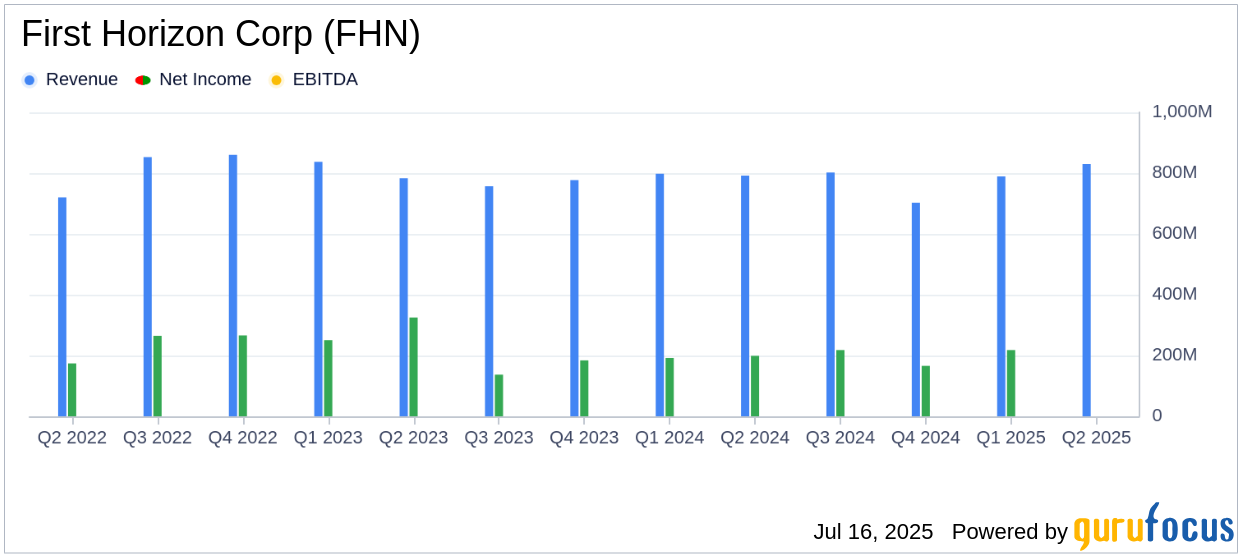

On July 16, 2025, First Horizon Corp (FHN, Financial) released its 8-K filing, reporting a net income available to common shareholders of $233 million, translating to an earnings per share (EPS) of $0.45. This performance exceeded the analyst estimate of $0.41 EPS and demonstrated a $0.04 increase from the previous quarter. The company's revenue for the quarter was $830 million, slightly below the estimated $832.46 million but still reflecting a robust financial position.

Company Overview

First Horizon Corp is the parent company of First Tennessee Bank, a prominent regional bank with approximately 200 branches across Tennessee. The company operates through several segments, including Commercial, Consumer & Wealth, Wholesale, and Corporate, with the majority of its revenue generated from the Commercial, Consumer & Wealth segment. This segment provides a range of financial products and services, including traditional lending and deposit-taking, to clients primarily in the southern USA and other selected markets.

Performance Highlights and Challenges

First Horizon Corp's second-quarter performance was marked by a notable increase in net interest income, which rose by $10 million to $645 million, driven by loan portfolio growth. However, the net interest margin slightly decreased by 2 basis points to 3.40%, primarily due to higher deposit costs associated with increased brokered deposit balances. Noninterest income also saw an increase of $7 million, reaching $189 million, supported by higher deferred compensation income and increased service charges and fees.

Financial Achievements

The company's financial achievements are significant in the banking industry, where maintaining a strong net interest income and managing noninterest expenses are crucial for profitability. First Horizon Corp's ability to grow its loan portfolio and manage its expenses effectively highlights its operational efficiency and strategic focus on growth.

Key Financial Metrics

Key metrics from the income statement include a total revenue of $830 million, a 2% increase from the previous quarter, and a net income of $244 million, reflecting a 10% increase. The company's efficiency ratio improved to 59.20%, indicating better cost management. The return on average assets increased to 1.20%, and the return on average common equity rose to 11.1%, showcasing enhanced profitability.

| Metric | Q2 2025 | Q1 2025 | Change |

|---|---|---|---|

| Net Interest Income | $645 million | $634 million | +2% |

| Noninterest Income | $189 million | $181 million | +4% |

| Net Income Available to Common Shareholders | $233 million | $213 million | +9% |

| EPS | $0.45 | $0.41 | +10% |

Analysis and Commentary

First Horizon Corp's performance in the second quarter of 2025 underscores its strategic focus on growth and operational efficiency. The increase in net interest income and noninterest income, coupled with effective cost management, has positioned the company well in a competitive banking environment. The company's President and CEO, Bryan Jordan, remarked,

We are pleased with our strong performance this quarter, underscoring our unwavering commitment to safety and soundness, profitability and growth."This statement reflects the company's dedication to delivering long-term value to its shareholders and clients.

Conclusion

First Horizon Corp's second-quarter results demonstrate its resilience and strategic focus on growth, despite challenges in the banking sector. The company's ability to exceed analyst EPS estimates and maintain strong financial metrics highlights its robust business model and commitment to delivering value to its stakeholders. As the company continues to navigate the evolving economic landscape, its focus on growth and operational efficiency will be key to sustaining its performance.

Explore the complete 8-K earnings release (here) from First Horizon Corp for further details.