Voyager Therapeutics (VYGR, Financial) has announced a new initiative aimed at tackling Alzheimer's disease by modulating apolipoprotein E, a key genetic risk factor. This program leverages a unique intravenous TRACER capsid technology, which can cross the blood-brain barrier to deliver a multifunctional payload. The goal is to reduce the expression of the APOE4 variant, which is highly associated with Alzheimer's, while increasing levels of the protective APOE2 variant.

Preclinical results have been promising, showing that a single intravenous dose of this TRACER capsid in APOE4 knock-in mice significantly lowered APOE4 and elevated APOE2 in critical brain areas relevant to Alzheimer's. Voyager plans to share initial findings from this program at a scientific conference scheduled for 2025. This development marks a significant step in their Alzheimer's research efforts.

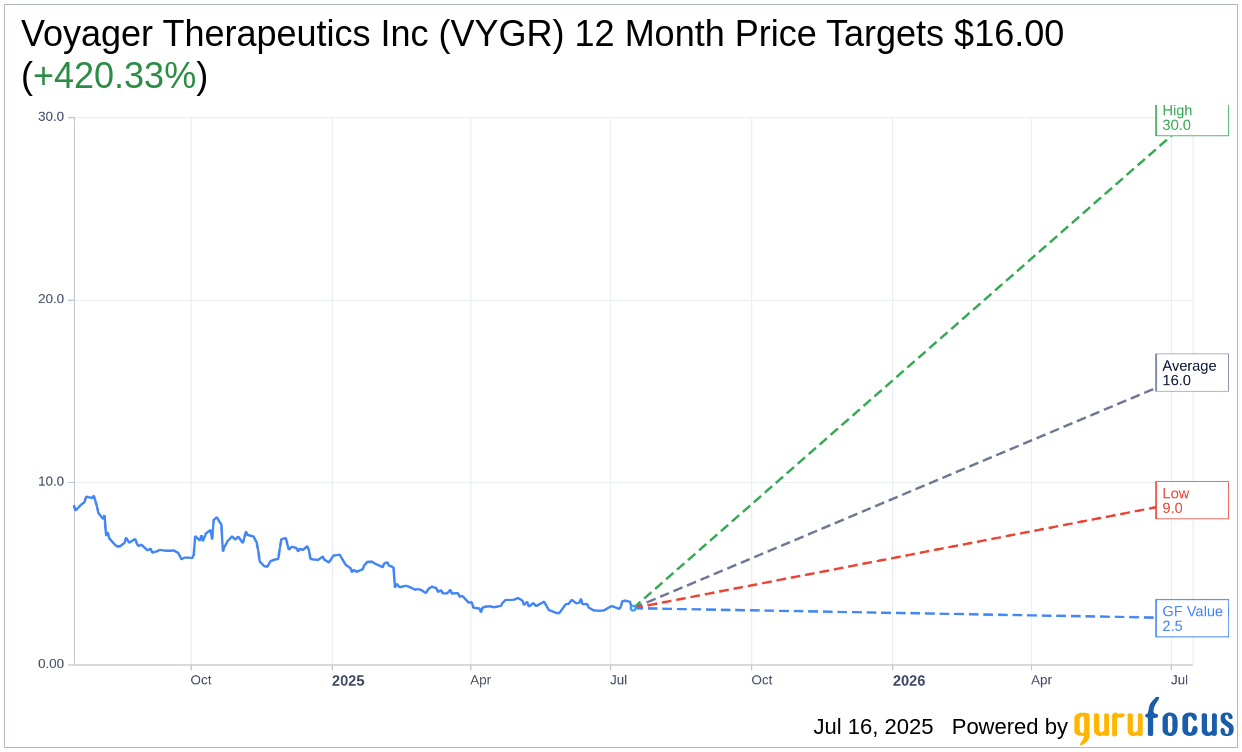

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Voyager Therapeutics Inc (VYGR, Financial) is $16.00 with a high estimate of $30.00 and a low estimate of $9.00. The average target implies an upside of 420.33% from the current price of $3.08. More detailed estimate data can be found on the Voyager Therapeutics Inc (VYGR) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Voyager Therapeutics Inc's (VYGR, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Voyager Therapeutics Inc (VYGR, Financial) in one year is $2.53, suggesting a downside of 17.72% from the current price of $3.075. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Voyager Therapeutics Inc (VYGR) Summary page.

VYGR Key Business Developments

Release Date: March 11, 2025

- Cash: $332 million as of the end of 2024.

- Potential Future Milestone Payments: $8.2 billion from partnerships.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Voyager Therapeutics Inc (VYGR, Financial) has a robust pipeline with 4 wholly owned and 13 partnered programs, providing multiple opportunities for clinical data generation.

- The company reported $332 million in cash at the end of 2024, with potential future milestone payments totaling $8.2 billion, indicating strong financial health.

- Voyager's partnerships have been a significant source of non-diluted revenue, contributing to its financial stability.

- The tau silencing gene therapy program, VY1706, has advanced into IND enabling studies, showing promising data with 50% to 73% knockdown of tau messenger RNA in non-human primate studies.

- Voyager's anti-tau antibody, VY7523, performed well in a single ascending dose study, showing no serious adverse events and consistent pharmacokinetics with approved Alzheimer's treatments.

Negative Points

- The SOD1 silencing gene therapy program has moved back into the research stage due to the payload not meeting the target profile, requiring a new payload to be identified.

- Despite progress, the field of gene therapy continues to face setbacks, which could impact Voyager's pipeline and commercial viability.

- The company's reliance on partnerships for revenue could pose a risk if future collaborations do not materialize as expected.

- Voyager's tau silencing program is still in preclinical stages, with IND filing not expected until 2026, indicating a long timeline before potential market entry.

- The competitive landscape in the tau space is intense, with multiple external readouts expected, which could impact Voyager's positioning and strategy.