Financial services company FIS (FIS, Financial) has seen a price target increase by Baird, moving up from $82 to $86. This adjustment comes as the firm finalizes its predictions in anticipation of the upcoming second-quarter financial results. The current rating for FIS remains Neutral, indicating Baird's balanced outlook on the company's performance.

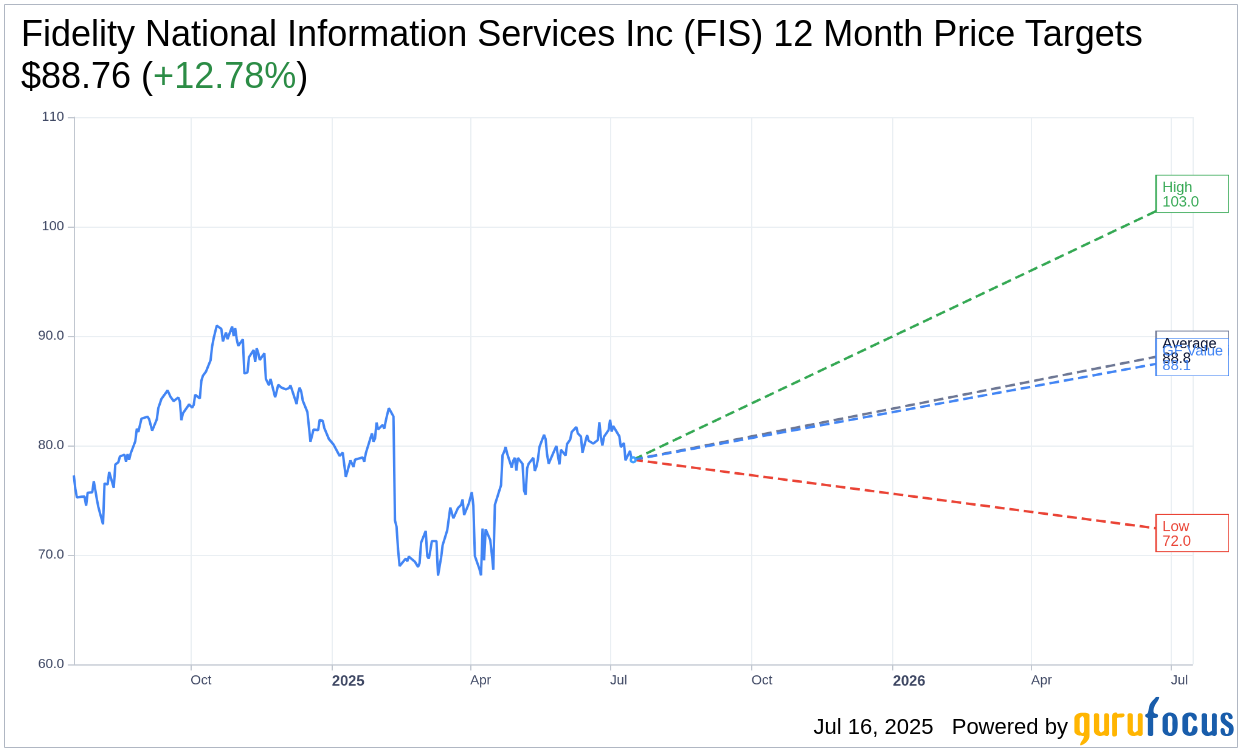

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for Fidelity National Information Services Inc (FIS, Financial) is $88.76 with a high estimate of $103.00 and a low estimate of $72.00. The average target implies an upside of 12.78% from the current price of $78.70. More detailed estimate data can be found on the Fidelity National Information Services Inc (FIS) Forecast page.

Based on the consensus recommendation from 27 brokerage firms, Fidelity National Information Services Inc's (FIS, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Fidelity National Information Services Inc (FIS, Financial) in one year is $88.07, suggesting a upside of 11.91% from the current price of $78.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Fidelity National Information Services Inc (FIS) Summary page.

FIS Key Business Developments

Release Date: May 06, 2025

- Adjusted Revenue Growth: 4%, ahead of expectations.

- Recurring Revenue Growth: Accelerated to 4% from 2% last quarter.

- Adjusted EBITDA: $958 million, with a margin of 37.8%.

- Adjusted EPS: $1.21, up 11% year-over-year.

- Free Cash Flow: $368 million, with a conversion rate of 71%.

- Capital Expenditures: $233 million, or 9% of revenue.

- Shareholder Returns: $670 million, including $450 million in share repurchases.

- Banking Revenue Growth: 2%, with recurring revenue growth at 3%.

- Capital Markets Revenue Growth: 9%, with recurring revenue growth of 6%.

- Adjusted EBITDA Margin for Capital Markets: Expanded by 90 basis points.

- Full Year Outlook: Reaffirmed with total shareholder return of 11% to 13%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Fidelity National Information Services Inc (FIS, Financial) reported a strong start to 2025 with adjusted revenue growth of 4%, exceeding expectations.

- Recurring revenue growth accelerated from 2% last quarter to 4%, indicating strong demand for FIS's core solutions.

- The company achieved an adjusted EBITDA at the high end of its outlook, with a free cash flow conversion exceeding 70%.

- FIS announced strategic transactions, including the sale of its Worldpay stake and acquisition of the Issuer Solutions business, expected to strengthen its financial profile and value proposition.

- The company returned $670 million to shareholders through share repurchases and dividends, demonstrating strong capital management.

Negative Points

- Professional services revenue declined by 5% due to the completion of large projects, impacting overall revenue growth.

- Banking EBITDA margin contracted to 40.1%, reflecting high license and termination fees from the previous year.

- The company faces a tough year-on-year comparison on EMI, impacting EPS growth.

- Capital expenditures were 9% of revenue, which may indicate high ongoing investment requirements.

- There is a potential risk of integration challenges with the acquisition of the Issuer Solutions business, which could impact expected synergies.