Key Takeaways:

- Darzalex's impressive Q2 2025 net sales boost Genmab's revenue stream through royalty agreements with J&J.

- Genmab's stock presents substantial upside potential based on both analysts' price targets and GuruFocus' GF Value estimates.

- Analysts rate Genmab as "Outperform," highlighting confidence in its growth prospects.

Genmab's Financial Milestone: Darzalex Sales Surge

Genmab A/S (GMAB, Financial) has reported a remarkable achievement in the second quarter of 2025, with Darzalex reaching net sales of $3,539 million. The U.S. market contributed $2,017 million, while international sales accounted for $1,521 million. This significant revenue is bolstered by Genmab's profitable royalty arrangements under its global license agreement with Johnson & Johnson (JNJ).

Analyst Insights: Price Targets and Recommendations

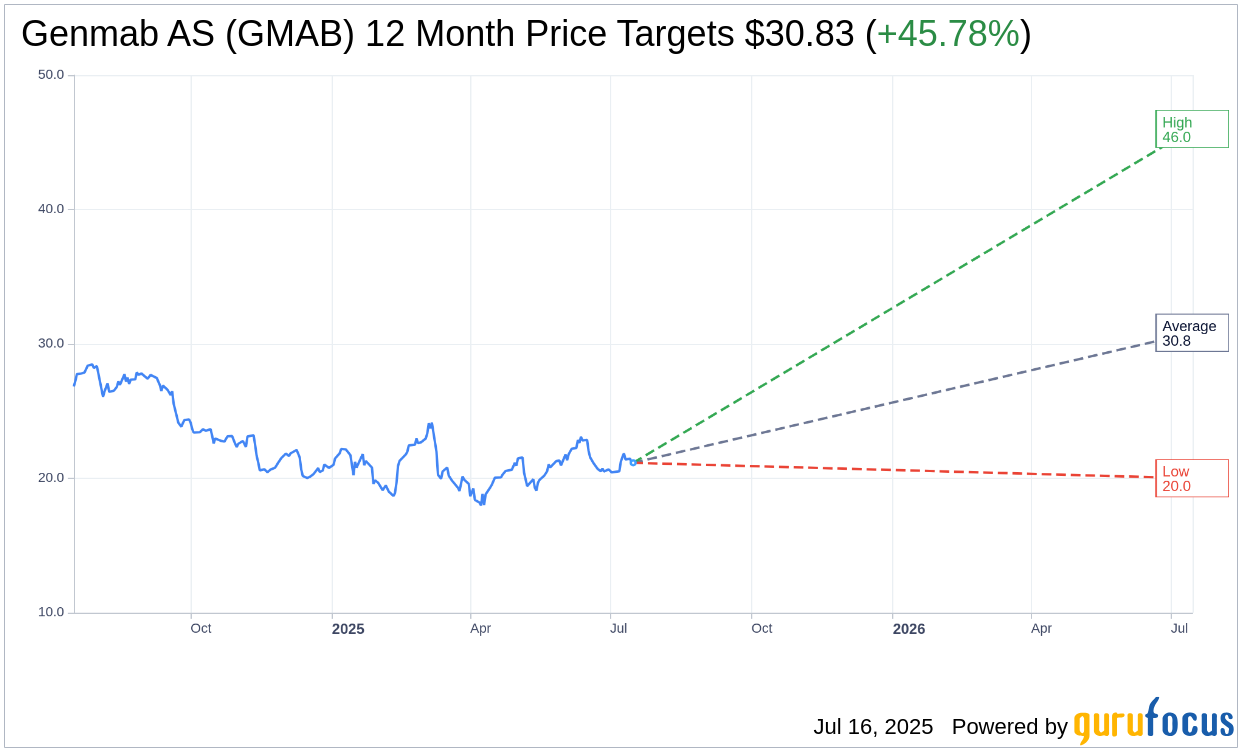

The future looks promising for Genmab AS (GMAB, Financial) according to projections by 9 analysts, who have set an average one-year price target of $30.83. This includes a high estimate of $46.00 and a low of $20.00, indicating an optimistic upside potential of 45.78% from the current trading price of $21.15. Investors can explore more in-depth data on the Genmab AS (GMAB) Forecast page.

Brokerage Sentiment: Outperform Status

Genmab AS (GMAB, Financial) has caught the attention of 12 brokerage firms, which collectively provide an average recommendation of 2.0, classifying the stock as "Outperform." This rating, derived from a scale where 1 signals Strong Buy and 5 indicates Sell, underscores the positive market sentiment surrounding Genmab's trajectory.

GF Value Projection: A Major Upside

According to GuruFocus estimates, Genmab AS (GMAB, Financial) is poised for impressive growth, with an estimated GF Value of $51.21 in a year, implying a potential upside of 142.13% from the current price of $21.15. The GF Value represents GuruFocus' assessment of the fair market value for the stock, derived from historical trading multiples, past growth data, and future business performance projections. For more details, visit the Genmab AS (GMAB) Summary page.