Universal Health Services, Inc. (UHS, Financial) has recently seen a shift in analyst sentiment following an update from B of A Securities. On July 16, 2025, analyst Kevin Fischbeck downgraded UHS, adjusting the rating from "Neutral" to "Underperform".

In addition to the rating change, B of A Securities also revised their price target for Universal Health Services (UHS, Financial). The new price target is set at $185.00 USD, down from the previous target of $215.00 USD, representing a decrease of approximately 13.95%.

This change in outlook reflects a growing cautiousness towards UHS's future performance, as indicated by the revised "Underperform" rating. Investors and market participants should take note of these changes as they may impact trading strategies related to Universal Health Services (UHS, Financial).

It's important to stay informed on the latest analyst ratings and price targets, as these can provide insights into market expectations and potential shifts in stock valuation.

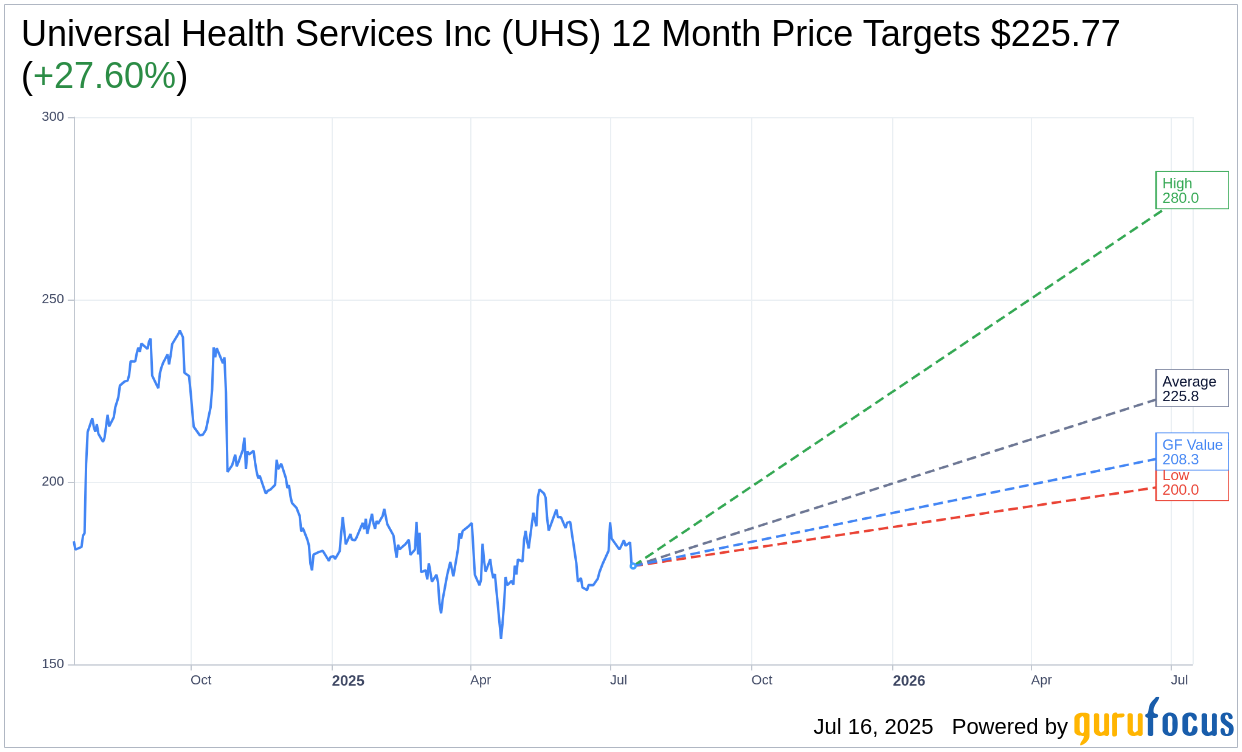

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Universal Health Services Inc (UHS, Financial) is $225.77 with a high estimate of $280.00 and a low estimate of $200.00. The average target implies an upside of 27.60% from the current price of $176.94. More detailed estimate data can be found on the Universal Health Services Inc (UHS) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Universal Health Services Inc's (UHS, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Universal Health Services Inc (UHS, Financial) in one year is $208.35, suggesting a upside of 17.75% from the current price of $176.94. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Universal Health Services Inc (UHS) Summary page.