TD Cowen analyst Steven Alexopoulos has adjusted the price target for Wells Fargo (WFC, Financial) from $83 to $82, maintaining a Hold rating on the stock. The decision follows Wells Fargo's report of higher-than-expected earnings per share for the second quarter of 2025, albeit with revenues falling short of predictions. This earnings beat was largely attributed to a reduction in tax rates, which the firm considers a less robust cause for the improvement. Additionally, the company has revised its net interest income guidance downward, citing weaker market-related NII.

Wall Street Analysts Forecast

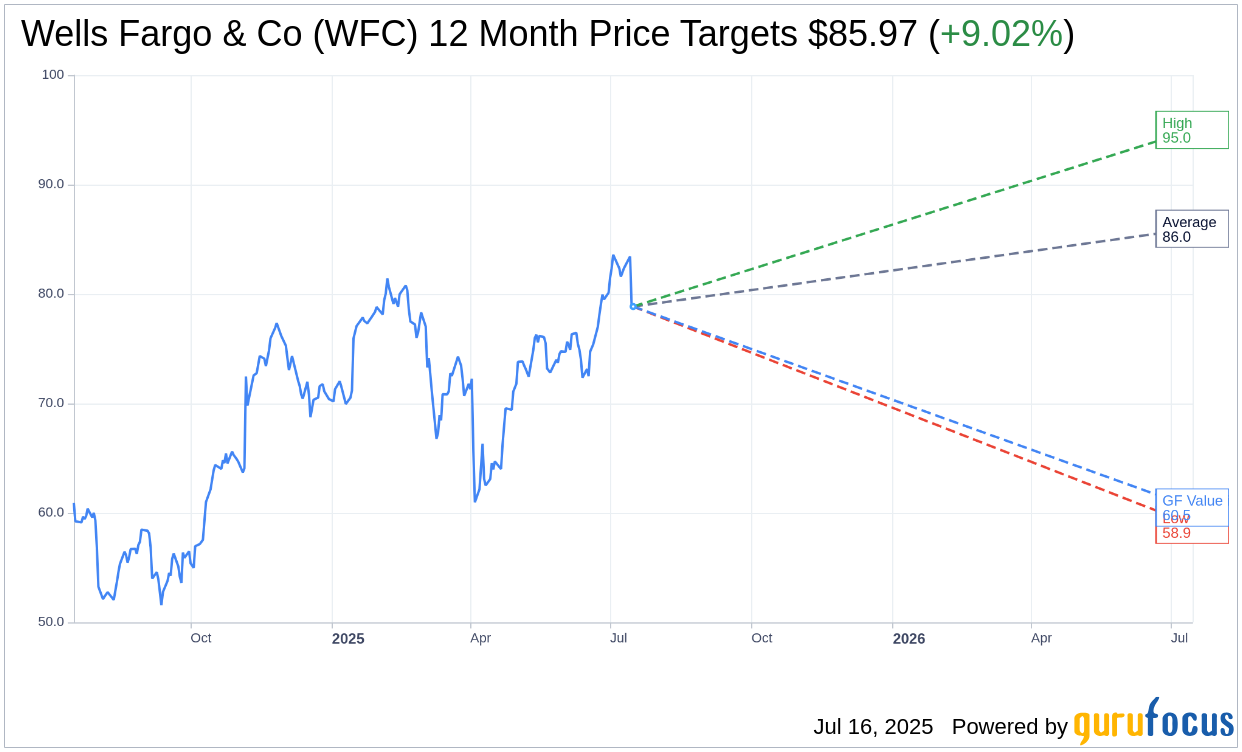

Based on the one-year price targets offered by 22 analysts, the average target price for Wells Fargo & Co (WFC, Financial) is $85.97 with a high estimate of $95.00 and a low estimate of $58.92. The average target implies an upside of 9.02% from the current price of $78.86. More detailed estimate data can be found on the Wells Fargo & Co (WFC) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, Wells Fargo & Co's (WFC, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Wells Fargo & Co (WFC, Financial) in one year is $60.49, suggesting a downside of 23.29% from the current price of $78.86. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Wells Fargo & Co (WFC) Summary page.

WFC Key Business Developments

Release Date: July 15, 2025

- Net Income: $5.5 billion, up from both the first quarter and a year ago.

- Earnings Per Share (EPS): $1.60 per diluted common share.

- Net Interest Income: Increased by $213 million or 2% from the first quarter.

- Non-Interest Income: Increased by $348 million or 4% from a year ago.

- Non-Interest Expense: Increased by $86 million or 1% from a year ago.

- Average Loans: Period-end balances up $10.6 billion from a year ago.

- Average Deposits: Increased 4% from a year ago.

- Credit Card Revenue: Grew 9% from a year ago.

- Auto Revenue: Decreased 15% from a year ago.

- Investment Banking Fees: Up 16% during the first half of the year.

- Common Stock Repurchase: $3 billion repurchased in the second quarter.

- Dividend Increase: Expected to increase by 12.5% to $0.45 per share.

- Allowance for Credit Losses: Relatively stable for the past five quarters.

- Common Shares Outstanding: Reduced by 23% since 2019.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Wells Fargo & Co (WFC, Financial) reported an increase in net income, diluted earnings per share, and return on tangible common equity compared to both the previous quarter and the same period last year.

- The company successfully lifted the asset cap, marking a significant milestone in its transformation and allowing for more aggressive growth in deposits and loans.

- Wells Fargo & Co (WFC) has reduced headcount for 20 consecutive quarters, achieving a 23% decline over five years, which has contributed to disciplined expense management.

- The company has seen growth in fee-based income across all business segments, driven by strategic investments in its businesses.

- Credit performance improved with lower net loan charge-offs and better performance in both consumer and commercial portfolios compared to a year ago.

Negative Points

- Despite the lifting of the asset cap, the company remains cautious about loan commitments due to economic uncertainties.

- Net interest income growth is expected to be modest, with the company facing challenges in balancing capital allocation between growth and maintaining returns.

- The competitive landscape in the middle market and commercial banking sectors remains intense, impacting loan yield expectations.

- The company is still navigating regulatory uncertainties, particularly regarding capital requirements and stress testing processes.

- Wells Fargo & Co (WFC) continues to face challenges in achieving its medium-term return targets, with the current ROTCE including non-recurring gains.