In recent developments, JP Morgan analyst Anupam Rama has updated their coverage on Replimune Group (REPL, Financial), a biotechnology company, maintaining an "Overweight" rating while also raising the price target. This strategic move highlights continued confidence in Replimune Group's potential growth.

The new price target for REPL has been set at $19.00, a notable increase from the previous target of $16.00. This change represents an 18.75% upward adjustment, indicating a strong positive outlook in the company's performance and future prospects.

The decision to maintain an "Overweight" rating suggests that JP Morgan sees sustained opportunity for ROI, expecting Replimune Group to outperform the average returns of the market. The analysis was released on July 16, 2025, underscoring JP Morgan's continued support for (REPL, Financial)'s strategic direction.

Investors and stakeholders in Replimune Group (REPL, Financial) will likely view this price target raise as a positive indicator for the company's future market performance. As the company continues to advance its pipeline and expand its market footprint, the updated analysis by JP Morgan could influence investment decisions in the upcoming quarters.

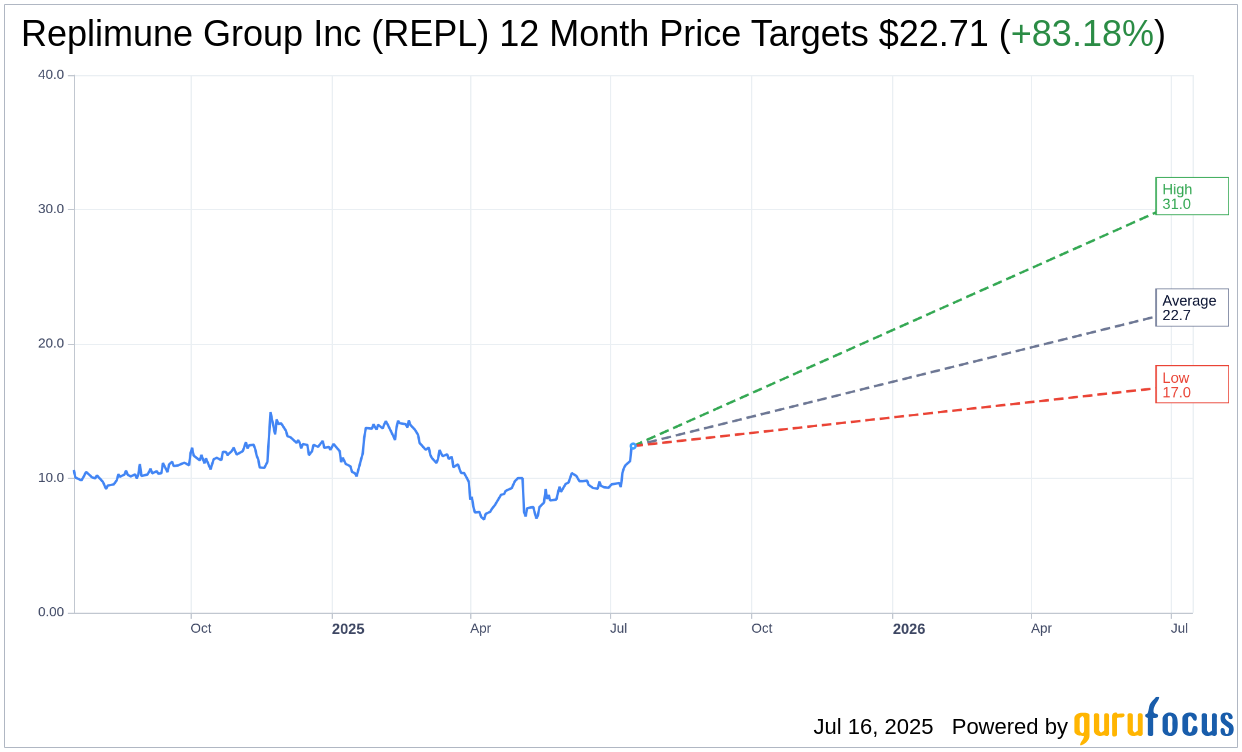

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Replimune Group Inc (REPL, Financial) is $22.71 with a high estimate of $31.00 and a low estimate of $17.00. The average target implies an upside of 83.18% from the current price of $12.40. More detailed estimate data can be found on the Replimune Group Inc (REPL) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Replimune Group Inc's (REPL, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.