UBS has revised its price target for Morgan Stanley Direct Lending (MSDL, Financial), raising it slightly from $20.50 to $21. Despite this adjustment, the firm maintains a Neutral rating on the stock. This update reflects UBS's ongoing evaluation of MSDL, providing investors with insights into potential market movements and company performance expectations.

Wall Street Analysts Forecast

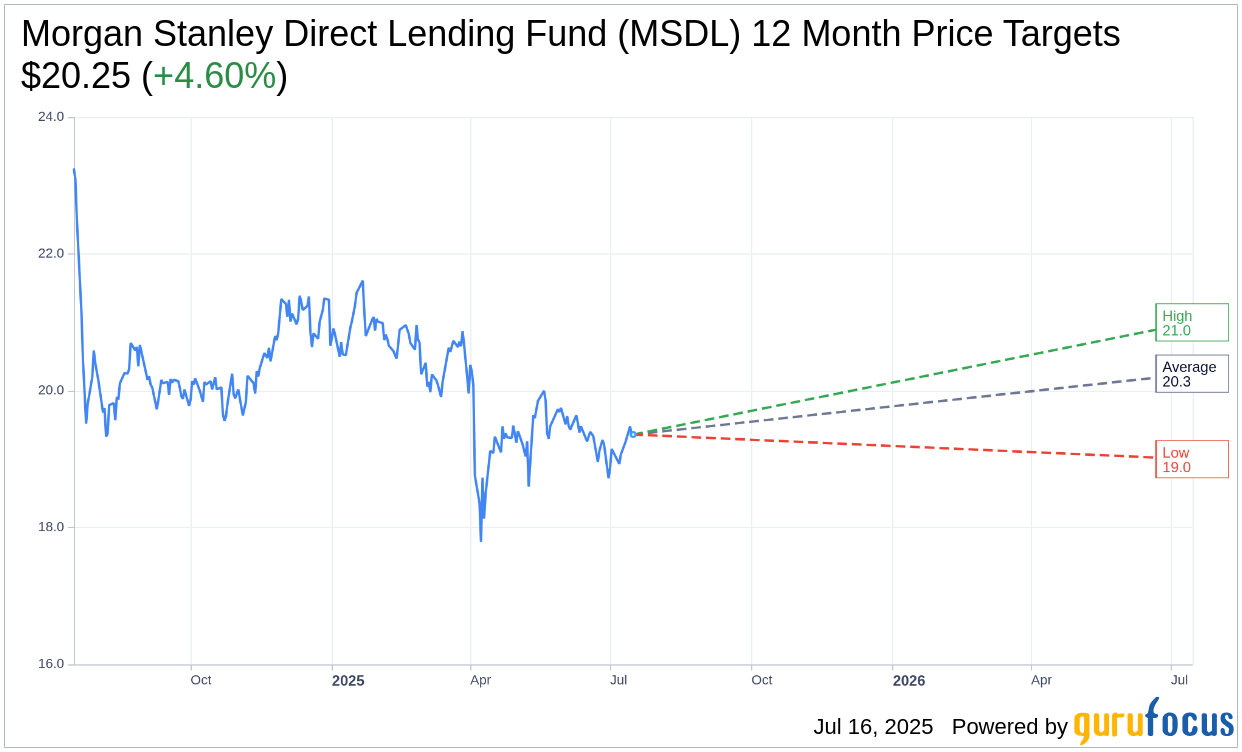

Based on the one-year price targets offered by 4 analysts, the average target price for Morgan Stanley Direct Lending Fund (MSDL, Financial) is $20.25 with a high estimate of $21.00 and a low estimate of $19.00. The average target implies an upside of 4.60% from the current price of $19.36. More detailed estimate data can be found on the Morgan Stanley Direct Lending Fund (MSDL) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Morgan Stanley Direct Lending Fund's (MSDL, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

MSDL Key Business Developments

Release Date: May 09, 2025

- Net Investment Income: $0.52 per share, exceeding the $0.50 dividend declared.

- New Investment Commitments: Approximately $233 million.

- Repayments: $202 million with seven portfolio companies fully repaid.

- Debt to NAV Ratio: Increased from 1.08 times to 1.11 times.

- Total Portfolio at Fair Value: $3.8 billion.

- Weighted Average Yield on Debt: 10.2% at cost and 10.3% at fair value.

- Total Investment Income: $101 million for the first quarter.

- Total Net Expenses: $55.2 million for the first quarter.

- Net Change in Unrealized Losses: $17 million.

- Total Assets: $3.9 billion.

- Total Net Assets: $1.8 billion.

- NAV per Share: $20.65, compared to $20.81 in the prior period.

- Regular Distribution: $0.50 per share for the current and second quarter.

- Estimated Spillover Net Investment Income: $71 million or $0.80 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Morgan Stanley Direct Lending Fund (MSDL, Financial) generated strong performance in the first quarter with net investment income of $0.52 per share, exceeding the $0.50 dividend declared.

- New investment commitments increased to approximately $233 million, showcasing MSDL's ability to leverage its origination engine for quality deal flow.

- MSDL's sponsor-backed direct lending business in North America surpassed $20 billion in committed capital, marking a significant milestone.

- The portfolio's credit quality remains strong, with over 98% of the total portfolio at an internal risk rating of 2 or better.

- MSDL successfully extended its secured revolving credit facility, increasing total commitment by $150 million to $1.45 billion, and lowered borrowing costs.

Negative Points

- The tariff-driven volatility has delayed the anticipated recovery in M&A activity, impacting deal flow.

- MSDL's debt to NAV increased modestly from 1.08 times to 1.11 times, indicating a rise in leverage.

- The net change in unrealized losses was $17 million, driven by credit spread widening within the secondary market.

- Net investment income declined from the prior quarter, partly due to the expiration of IPO-related fee waivers.

- One portfolio company, Continental Battery, was placed on non-accrual status, although non-accruals remain low at 20 basis points of the portfolio at cost.