UBS has adjusted its target price for Palmer Square (PSBD, Financial), raising it slightly from $14 to $14.50. Despite this upward revision, the investment firm maintains a Neutral stance on the stock, suggesting a balanced view on its potential performance. Investors might want to keep an eye on PSBD for any future developments that could influence its market trajectory.

Wall Street Analysts Forecast

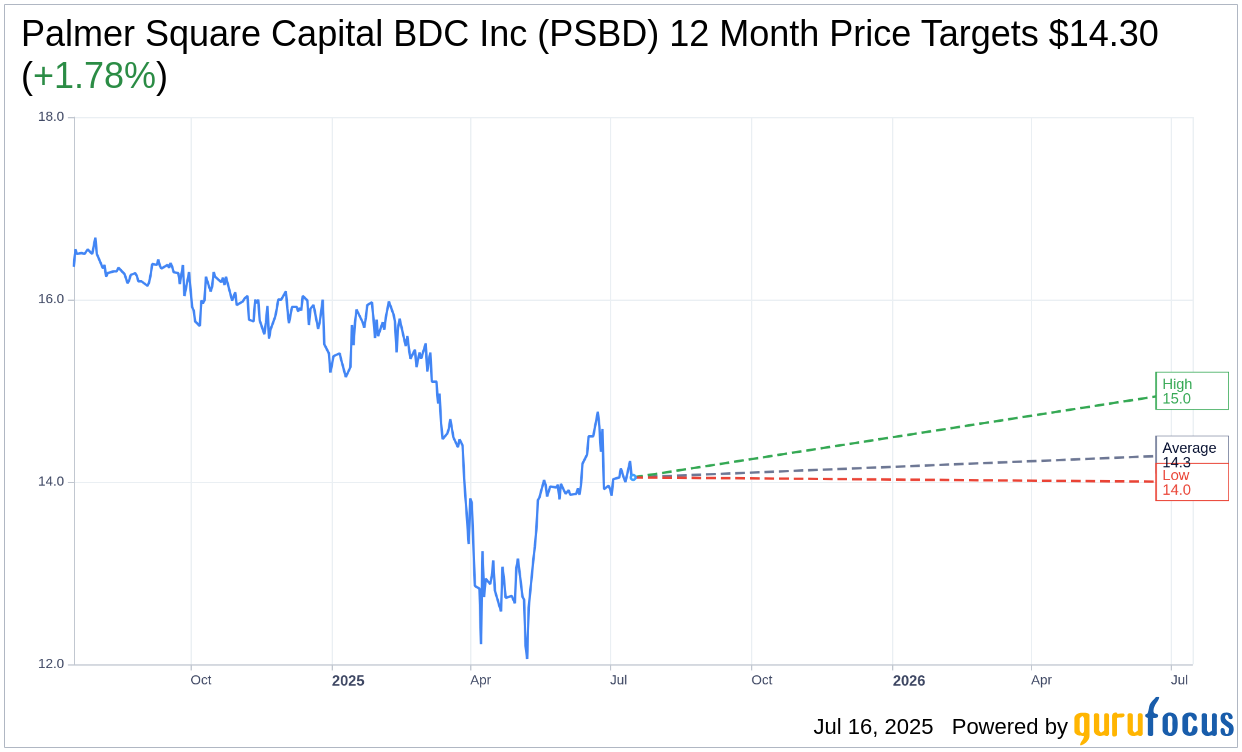

Based on the one-year price targets offered by 5 analysts, the average target price for Palmer Square Capital BDC Inc (PSBD, Financial) is $14.30 with a high estimate of $15.00 and a low estimate of $14.00. The average target implies an upside of 1.78% from the current price of $14.05. More detailed estimate data can be found on the Palmer Square Capital BDC Inc (PSBD) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Palmer Square Capital BDC Inc's (PSBD, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

PSBD Key Business Developments

Release Date: May 07, 2025

- Total Investment Income: $31.2 million for Q1 2025, down 10.3% from $34.8 million in the prior year period.

- Net Investment Income: $12.9 million or $0.40 per share for Q1 2025, compared to $16.3 million or $0.52 per share in the prior year period.

- Net Realized and Unrealized Losses: $21.3 million for Q1 2025, compared to gains of $6.6 million in Q1 2024.

- NAV per Share: $15.85 at the end of Q1 2025, down from $16.50 at the end of Q4 2024.

- Total Assets: $1.4 billion as of March 31, 2025.

- Total Net Assets: $515.8 million as of March 31, 2025.

- Debt-to-Equity Ratio: 1.50 times at the end of Q1 2025.

- Available Liquidity: $229.5 million as of March 31, 2025.

- Capital Deployment: $104.3 million deployed in Q1 2025.

- Dividend: $0.39 per share for Q1 2025, including a $0.03 supplemental distribution.

- Stock Repurchase: 98,399 shares repurchased at an average price of $14.89, totaling $1.5 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Palmer Square Capital BDC Inc (PSBD, Financial) deployed $104.3 million of capital in the first quarter, demonstrating active investment management.

- The company generated a total investment income of $31.2 million and net investment income of $12.9 million, reflecting strong financial performance.

- PSBD paid a $0.39 per share dividend, including a $0.03 supplemental distribution, showcasing its commitment to returning capital to shareholders.

- The company maintains a diversified portfolio with 96% senior secured loans, indicating a focus on high-quality investments.

- PSBD's investment strategy is designed to perform well during periods of market volatility, leveraging its nimble portfolio structure.

Negative Points

- Total investment income decreased by 10.3% compared to the prior year, attributed to a falling rate environment impacting the predominantly floating rate loan portfolio.

- The company experienced net realized and unrealized losses of $21.3 million in the first quarter, reflecting market challenges.

- Net asset value (NAV) per share declined from $16.50 at the end of the fourth quarter of 2024 to $15.85 at the end of the first quarter of 2025.

- The portfolio's fair value decreased by approximately 5.2% from the end of the fourth quarter of 2024.

- PSBD's cautious approach to deploying capital in the current volatile market environment may limit immediate growth opportunities.