FAT has launched a new Round Table Pizza outlet in San Marcos, Texas, collaborating with Brame Brands in this venture. According to the company, Texas is a crucial area for Round Table Pizza's growth, with the new location underscoring its expansion strategy. The chain has seen substantial success in both the San Antonio and Dallas markets alongside Brame Brands and aims to continue this positive trend with the San Marcos opening.

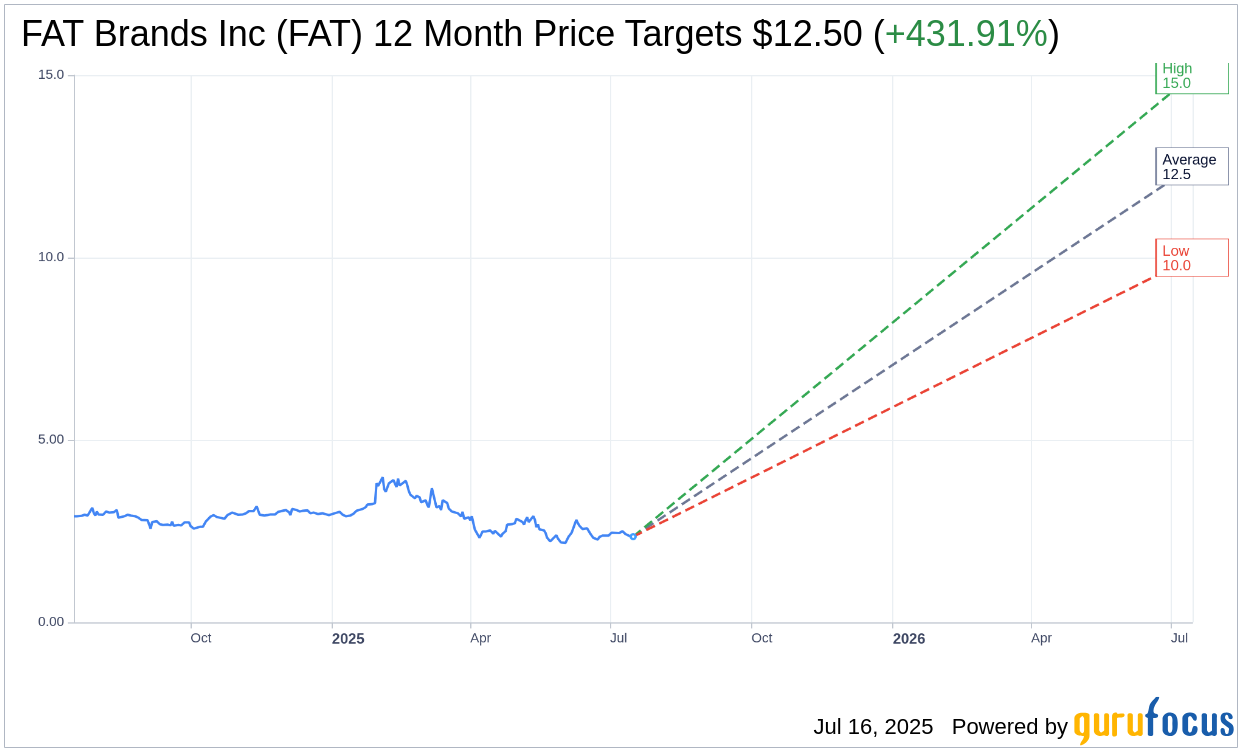

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for FAT Brands Inc (FAT, Financial) is $12.50 with a high estimate of $15.00 and a low estimate of $10.00. The average target implies an upside of 431.91% from the current price of $2.35. More detailed estimate data can be found on the FAT Brands Inc (FAT) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, FAT Brands Inc's (FAT, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FAT Brands Inc (FAT, Financial) in one year is $4.92, suggesting a upside of 109.36% from the current price of $2.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FAT Brands Inc (FAT) Summary page.

FAT Key Business Developments

Release Date: May 08, 2025

- Total Revenue: USD142 million, a 6.5% decrease from USD152 million in the same period last year.

- System-Wide Sales: USD571.1 million, down 1.8% compared to the previous year's quarter.

- Adjusted EBITDA: USD11.1 million, compared to USD18.2 million in last year's quarter.

- Same Store Sales (Casual Dining Segment): Increased approximately 1.6%.

- New Store Openings: 23 units opened in Q1, a 37% increase from Q1 2024.

- Round Table Pizza Same Store Sales: 0.6% increase in the first quarter.

- Digital Sales (Round Table Pizza): Increased 5% sequentially from Q4 to Q1 2025.

- Net Loss Attributable to FAT Brands: USD46 million or USD2.73 per diluted share.

- General and Administrative Expense: Increased to USD33 million from USD30 million in the prior year quarter.

- Cost of Restaurant and Factory Revenues: Decreased to USD96.1 million from USD99.1 million in the prior year quarter.

- Advertising Expense: Decreased to USD11.1 million from USD12.6 million in the prior year period.

- Total Other Expense (Net): USD36 million, compared to USD33.4 million in last year's quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- FAT Brands Inc (FAT, Financial) has a robust development pipeline with commitments for over 1,000 new locations, indicating strong future growth potential.

- The company successfully opened 23 new units in Q1 2025, a 37% increase from Q1 2024, showcasing effective expansion efforts.

- Digital sales at Round Table Pizza increased by 5% sequentially from Q4 2024 to Q1 2025, reflecting strong digital engagement.

- Co-branding initiatives are progressing well, with successful launches of co-branded and tri-branded models, enhancing market presence.

- The Georgia production facility is performing well, with USD8.8 million in first-quarter sales and a 35% margin, indicating strong operational efficiency.

Negative Points

- Total revenue for Q1 2025 decreased by 6.5% compared to the same period last year, reflecting challenges in maintaining sales momentum.

- Net loss attributable to FAT Brands was USD46 million, an increase from the USD38.3 million loss in the prior year quarter, indicating financial strain.

- General and administrative expenses increased to USD33 million due to higher professional fees, impacting overall profitability.

- The company paused its common dividend and started accruing the Series B preferred dividend, reflecting financial constraints.

- Market volatility has delayed the company's ability to raise equity, impacting plans to reduce outstanding debt.