KeyBanc has increased its price target for Entergy (ETR, Financial) from $85 to $88, while maintaining an Overweight rating on the stock. The firm is optimistic about Entergy's prospects, highlighting its anticipated industrial sales growth on the Gulf Coast and the rising demand for AI. Entergy is seen as a compelling growth opportunity, with a notable long-term earnings per share compound annual growth rate exceeding 8%, leading the industry. According to KeyBanc, the recent dip in Entergy's share price is attributed to profit-taking and exposure reductions, representing a potential buying opportunity for investors with a long-term outlook.

Wall Street Analysts Forecast

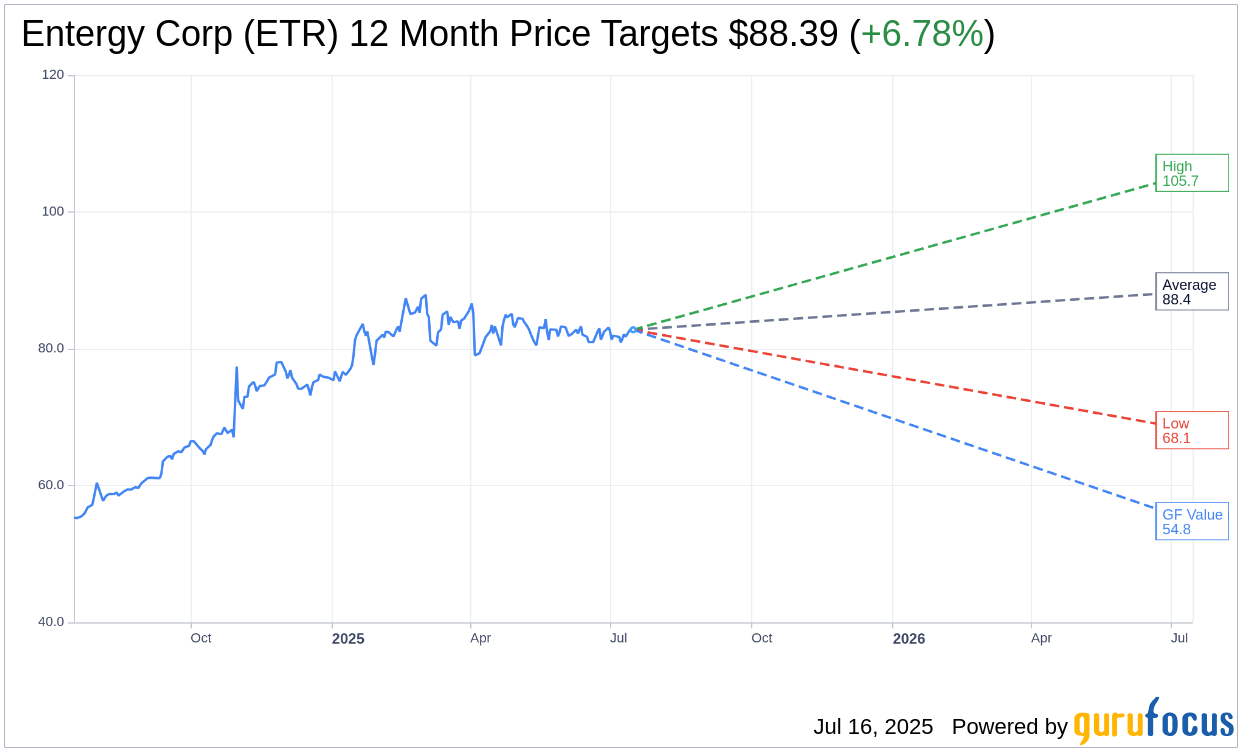

Based on the one-year price targets offered by 16 analysts, the average target price for Entergy Corp (ETR, Financial) is $88.40 with a high estimate of $105.72 and a low estimate of $68.10. The average target implies an upside of 6.78% from the current price of $82.78. More detailed estimate data can be found on the Entergy Corp (ETR) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Entergy Corp's (ETR, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Entergy Corp (ETR, Financial) in one year is $54.79, suggesting a downside of 33.81% from the current price of $82.78. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Entergy Corp (ETR) Summary page.

ETR Key Business Developments

Release Date: April 29, 2025

- Adjusted Earnings Per Share (EPS): $0.82 for the first quarter.

- Retail Sales Growth: Weather-adjusted retail sales growth at 5.2%.

- Industrial Sales Increase: 9.3% increase in industrial sales.

- Interest Expense and Depreciation: Higher due to investments.

- Equity Transactions: $1.5 billion block equity forward executed, securing equity needs into 2027.

- Tax Credits: Potential positive impact from nuclear production tax credits not included in outlooks.

- Capital Plan: More than $5 billion of renewable investments through 2028.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Entergy Corp (ETR, Financial) reported strong adjusted earnings per share of $0.82 for the first quarter, keeping them on track for their 2025 guidance.

- The company announced significant industrial growth with new investments from Hyundai Motor Group, CF Industries, and Woodside, expected to boost economic development in Louisiana.

- Entergy Corp (ETR) is executing on its capital plan, with projects like the Orange County Advanced Power Station and Delta Blues Advanced Power Station on schedule and budget.

- The company received regulatory approvals for several key projects, including a $0.5 billion transmission project in Louisiana and a combined cycle gas plant in Mississippi.

- Entergy Corp (ETR) has secured its equity needs into 2027, ensuring access to capital needed to execute its capital plan.

Negative Points

- Higher interest expenses and depreciation due to investments partially offset the favorable effects of higher retail sales volume.

- The company faces potential impacts from tariffs, which could affect capital expenditures, though they estimate the impact to be approximately 1% of their $37 billion, four-year capital plan.

- There is macroeconomic uncertainty that might weigh on industrial activity, although Entergy Corp (ETR) remains optimistic about long-term growth.

- The timing of new customer ramps and potential volatility in sales could affect the company's financial performance.

- Entergy Corp (ETR) is managing potential risks related to the availability and transferability of renewable tax credits, which could impact their financial outlook.