As investors navigate the ever-changing landscape of semiconductor stocks, ASML Holding (ASML, Financial) has caught attention due to its recent share dip, presenting potential growth opportunities. Here are the key highlights:

- Evercore ISI maintains an "Outperform" rating on ASML, with a target of €803, despite concerns over future margins.

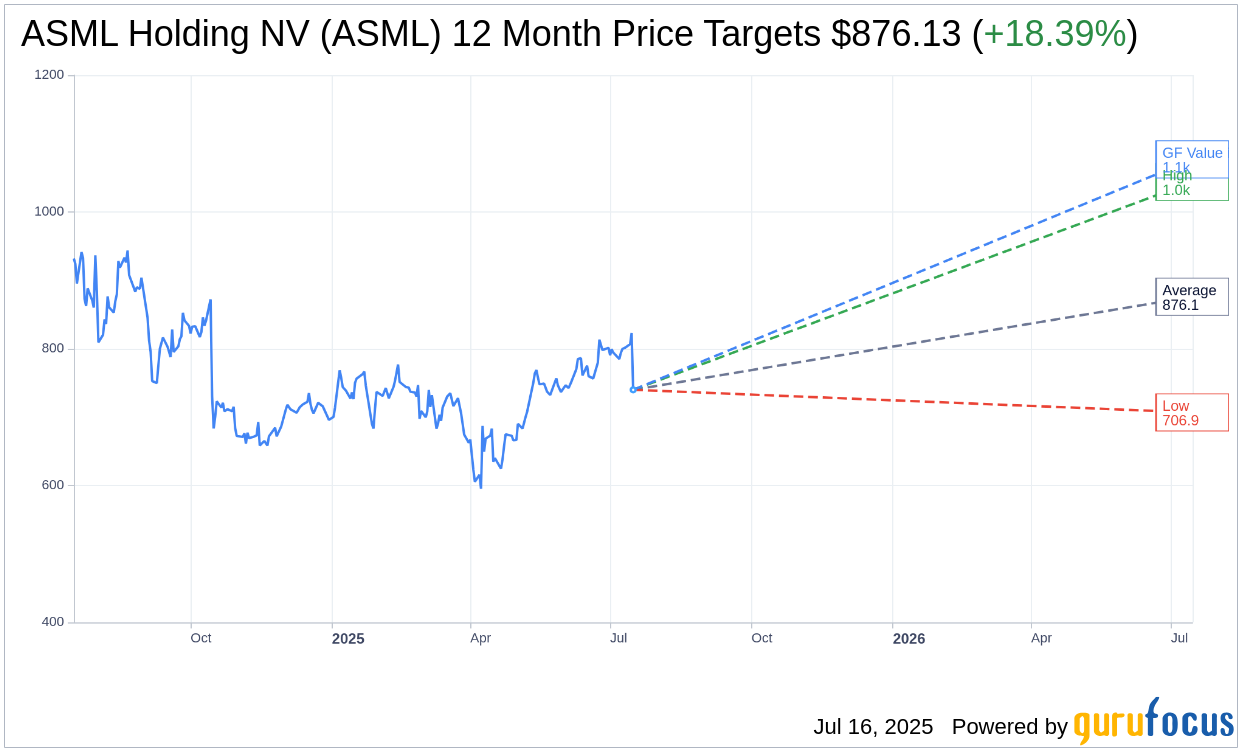

- Wall Street analysts see an average upside potential of 18.39% with a one-year target price of $876.13.

- GuruFocus estimates a substantial 45.52% upside based on its GF Value, suggesting ASML may be undervalued.

Evercore ISI's Perspective

Evercore ISI has observed the recent decline of ASML Holding's shares following its Q2 results as a strategic entry point for investors. The firm continues to rate ASML as “Outperform” with a target price set at €803 on Euronext. While there is an expectation of reduced margins in the latter half of the year, the robust demand driven by artificial intelligence remains a catalyst for ASML's revenue targets looking into 2025.

Analyst Consensus and Price Targets

According to predictions from 12 analysts, the average price target for ASML Holding NV (ASML, Financial) over a one-year horizon is $876.13, with estimates ranging from a high of $1,044.01 to a low of $706.91. This average target indicates an upside potential of 18.39% from the current share price of $740.02. For more detailed projections, refer to the ASML Holding NV (ASML) Forecast page.

Brokerage Recommendations

The consensus from 16 brokerage firms places ASML Holding NV (ASML, Financial) at an average recommendation of 2.0, signaling an "Outperform" status. This rating system ranges from 1 to 5, where 1 is a Strong Buy and 5 suggests a Sell, illustrating confidence in ASML's future performance.

Evaluating ASML's GF Value

According to GuruFocus, the estimated GF Value for ASML Holding NV (ASML, Financial) projects the stock at $1076.88 in one year, corresponding to a potential upside of 45.52% from the current trading price of $740.02. This GF Value represents GuruFocus' assessment of the stock's fair market value, calculated from historical trading multiples and forecasts for the company's future performance. For more exhaustive data, visit the ASML Holding NV (ASML) Summary page.