KeyBanc analyst Sangita Jain has increased the price target for Primoris (PRIM, Financial) from $79 to $98, maintaining an Overweight rating on the company's shares. This revision comes after positive developments from the "One Big Beautiful Bill," which are expected to enhance Primoris' potential in the utility-scale solar and storage sectors. The company's strong presence in these areas, along with a consistently growing power delivery business that is becoming more profitable, positions it well for future success. Additionally, Primoris' role in data center capital expenditures, including fiber networks and energy generation, is often underestimated.

KeyBanc anticipates a shift in the end market focus toward these rapidly growing segments, likely leading to an increase in profit margins and valuation multiples over the next few years. This strategic positioning indicates promising growth avenues for Primoris as it capitalizes on these emerging opportunities.

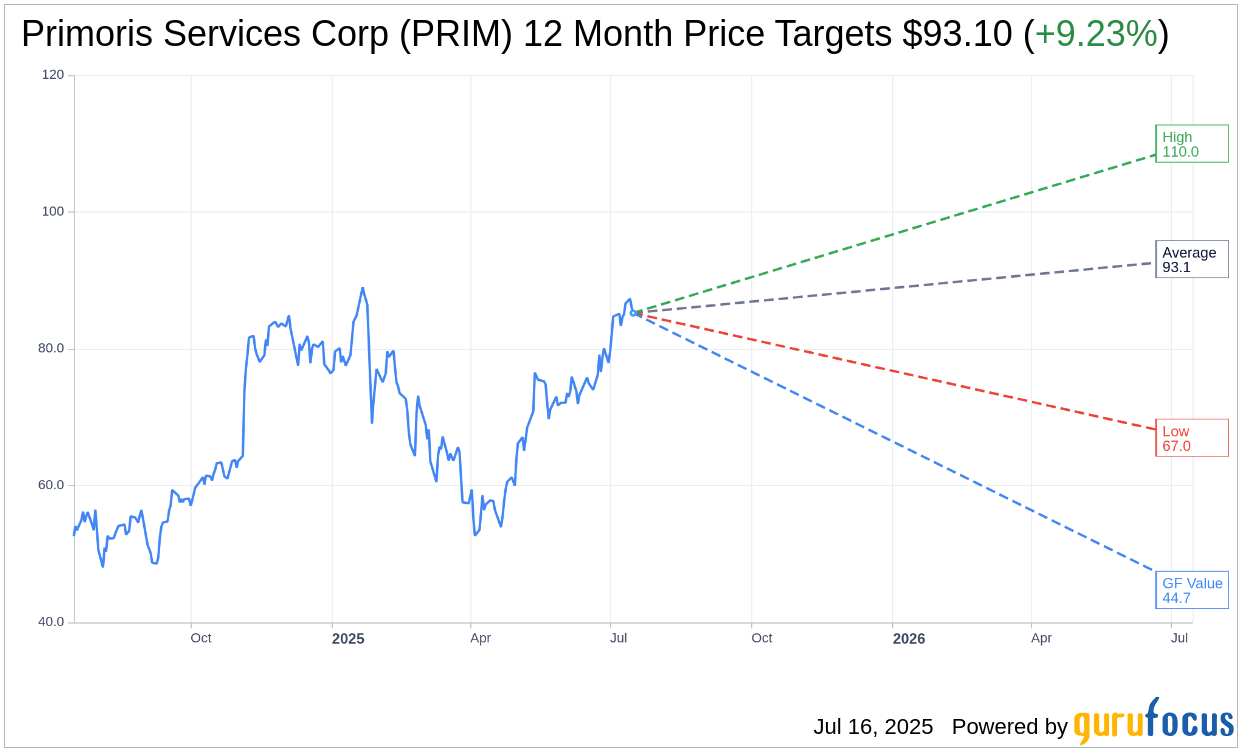

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Primoris Services Corp (PRIM, Financial) is $93.10 with a high estimate of $110.00 and a low estimate of $67.00. The average target implies an upside of 9.23% from the current price of $85.23. More detailed estimate data can be found on the Primoris Services Corp (PRIM) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Primoris Services Corp's (PRIM, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Primoris Services Corp (PRIM, Financial) in one year is $44.74, suggesting a downside of 47.51% from the current price of $85.23. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Primoris Services Corp (PRIM) Summary page.

PRIM Key Business Developments

Release Date: May 06, 2025

- Revenue: $1.6 billion, an increase of $235 million or 16.7% from the prior year.

- Gross Profit: Approximately $171 million, an increase of $37 million or 28% from the prior year.

- Gross Margin: 10.4% for the quarter compared to 9.4% in the prior year.

- Utilities Segment Revenue: Increased by over $75 million or 15.5% from the prior year.

- Energy Segment Revenue: Increased by $161 million or 17% from the prior year.

- SG&A Expenses: $99.5 million, an increase of $10.9 million compared to the prior year.

- Net Interest Expense: $7.8 million, down around $10.2 million from the prior year.

- Cash from Operations: $66.2 million, an increase of nearly $95 million from the prior year.

- Liquidity: $652 million, including $352 million of cash and $300 million in available borrowing capacity.

- Backlog: $11.4 billion, a decrease from $11.9 billion at the end of 2024.

- EPS Guidance: Full year EPS guidance of $3.70 to $3.90 per share, adjusted EPS guidance of $4.20 to $4.40 per share.

- Adjusted EBITDA Guidance: $440 million to $460 million for the full year 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Primoris Services Corp (PRIM, Financial) reported a 16.7% increase in revenue for the first quarter, driven by growth in both the Energy and Utilities segments.

- The company achieved a significant increase in gross profit, up 28% from the prior year, with improved profitability in the power delivery business.

- Primoris Services Corp (PRIM) saw record revenue in renewables, particularly in utility-scale solar projects, contributing to top-line and operating income growth.

- The Utilities segment exceeded expectations with higher revenue and gross profit, driven by increased activity in gas operations and communications.

- The company maintained strong liquidity with $652 million, including $352 million in cash, and authorized a new share purchase program, reflecting confidence in its financial position.

Negative Points

- There is ongoing uncertainty regarding global trade, tariff, and regulatory policies, which could impact future project economics and timing.

- The Energy segment experienced a decrease in backlog due to the timing of new solar awards, which could affect future revenue visibility.

- SG&A expenses increased by $10.9 million compared to the prior year, driven by higher personnel costs and severance expenses.

- The company faces potential risks from tariffs and regulatory changes, particularly in the solar and battery storage markets.

- Prolonged economic and regulatory uncertainty could lead to customers rethinking project economics and timing in 2026 and beyond.