Summary:

- PNC Financial Services (PNC, Financial) boosts full-year net interest income growth projection to 7% following robust Q2 performance.

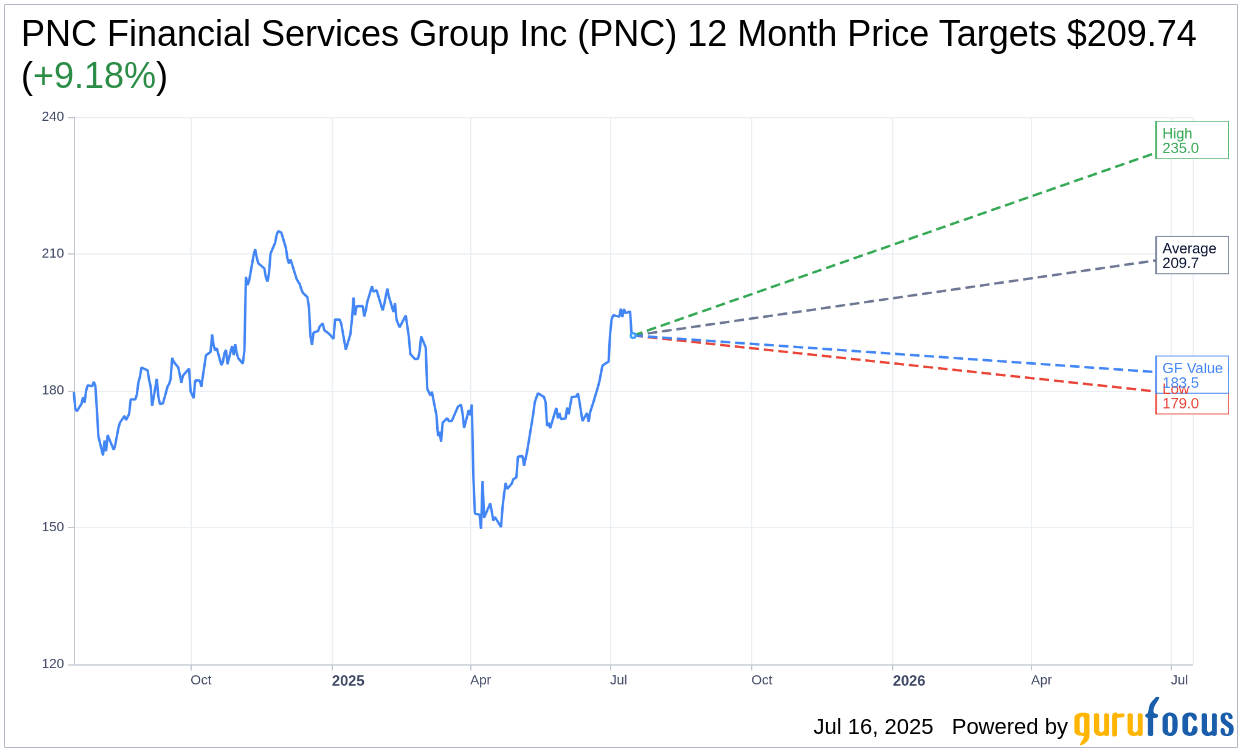

- Current average price target from analysts suggests a potential 9.18% upside for PNC stock.

- PNC's GF Value indicates a suggested downside of 4.46% from its current market value.

PNC Financial Services' Promising Outlook

PNC Financial Services Group Inc (PNC) has announced an optimistic revision to its full-year net interest income growth forecast, now anticipating a 7% increase. This adjustment follows a strong performance in the second quarter, where the company reported GAAP earnings per share of $3.85, surpassing analysts' expectations. Additionally, PNC generated revenue of $5.66 billion, exceeding the anticipated $5.06 billion.

Insights from Wall Street Analysts

Wall Street analysts remain positive about PNC Financial Services, with 19 analysts providing a one-year average price target of $209.74. The range of targets includes a high estimate of $235.00 and a low estimate of $179.00, suggesting a potential upside of 9.18% from the current share price of $192.11. For a deeper dive into these forecasts, visit the PNC Financial Services Group Inc (PNC, Financial) Forecast page.

Brokerage Firms' Recommendations

According to a consensus from 24 brokerage firms, PNC Financial Services Group Inc holds an average brokerage recommendation of 2.2, indicating an "Outperform" status. This rating scale ranges from 1 to 5, where 1 represents a Strong Buy, and 5 indicates a Sell recommendation.

Evaluating PNC's GF Value

GuruFocus' estimate of the GF Value for PNC Financial Services Group Inc over the next year stands at $183.54, implying a potential downside of 4.46% from the current price of $192.11. The GF Value is derived from historical trading multiples, past business growth, and projected future performance. More comprehensive details are available on the PNC Financial Services Group Inc (PNC, Financial) Summary page.