On July 16, 2025, UBS analyst Vilas Abraham announced updates regarding TriplePoint Venture Gwth (TPVG, Financial). The investment firm has decided to maintain its 'Neutral' rating for the stock.

In addition to maintaining its rating, UBS has raised its price target for TPVG from $6.50 to $7.00. This adjustment represents a 7.69% increase, reflecting the analyst's updated outlook for the company's stock value

TPVG, listed on the NYSE, continues to draw attention from investors as it navigates the challenges and opportunities within the venture growth sector. The update from UBS comes as a significant indicator for shareholders regarding the stock's expected performance in the current market environment.

Investors and market participants will be closely monitoring how the stock performs following this adjustment from a prominent financial institution like UBS. As always, it's important for stakeholders to stay informed on any further developments concerning TPVG.

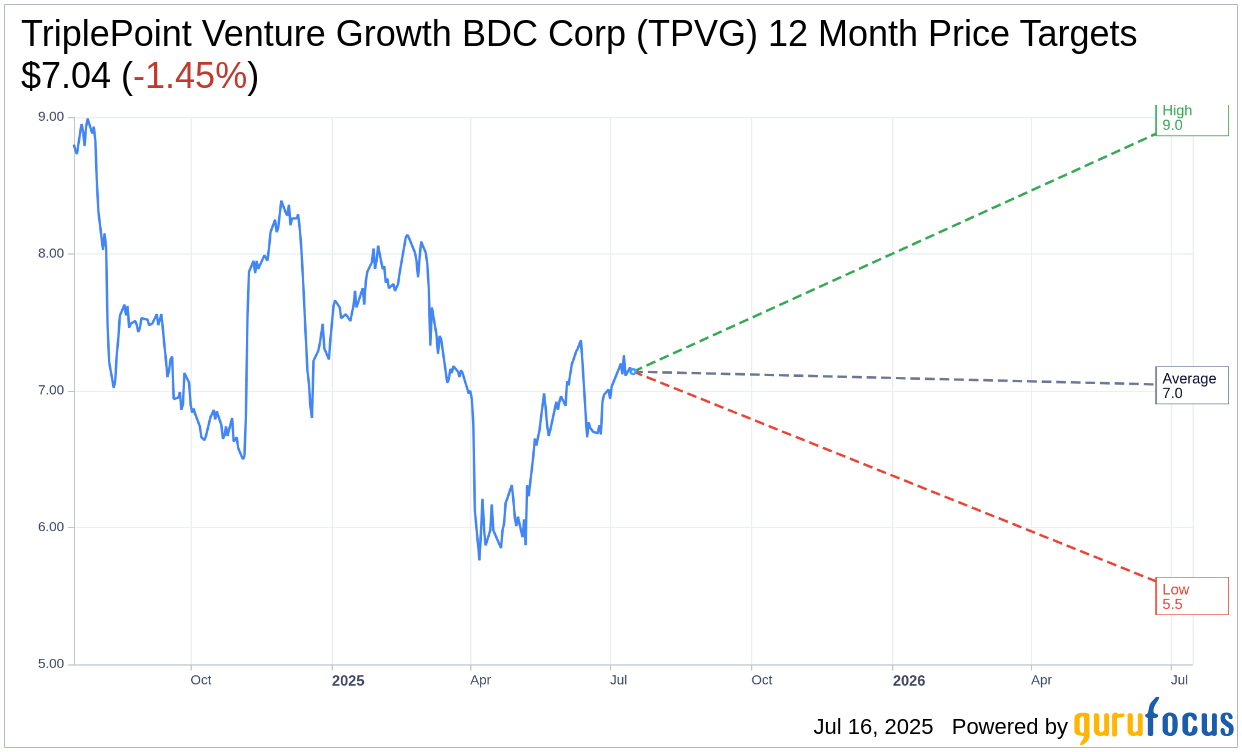

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for TriplePoint Venture Growth BDC Corp (TPVG, Financial) is $7.04 with a high estimate of $9.00 and a low estimate of $5.50. The average target implies an downside of 1.45% from the current price of $7.15. More detailed estimate data can be found on the TriplePoint Venture Growth BDC Corp (TPVG) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, TriplePoint Venture Growth BDC Corp's (TPVG, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.