Quick Summary:

- TSMC is set to announce record Q2 earnings, showcasing a remarkable 40% revenue surge due to escalating AI demand.

- Analyst projections suggest an earnings per share of $2.31, with global expansion strategies poised to mitigate forex risks.

- Wall Street offers an average price target of $234.62, implying a slight downside from the current share price.

Taiwan Semiconductor Manufacturing Company (TSMC ticker: TSM) continues to be a headline maker as excitement builds around its upcoming Q2 earnings report on July 17. Analysts are forecasting the company to reveal a record-breaking earnings quarter, buoyed by a striking 40% revenue increase, largely attributed to the burgeoning demand for artificial intelligence technologies. The projected earnings per share stand at $2.31, underscoring strong performance metrics. Despite facing challenges from foreign exchange fluctuations, TSMC’s strategic global expansion is anticipated to counterbalance these risks and reinforce investor confidence.

Wall Street Analysts Forecast

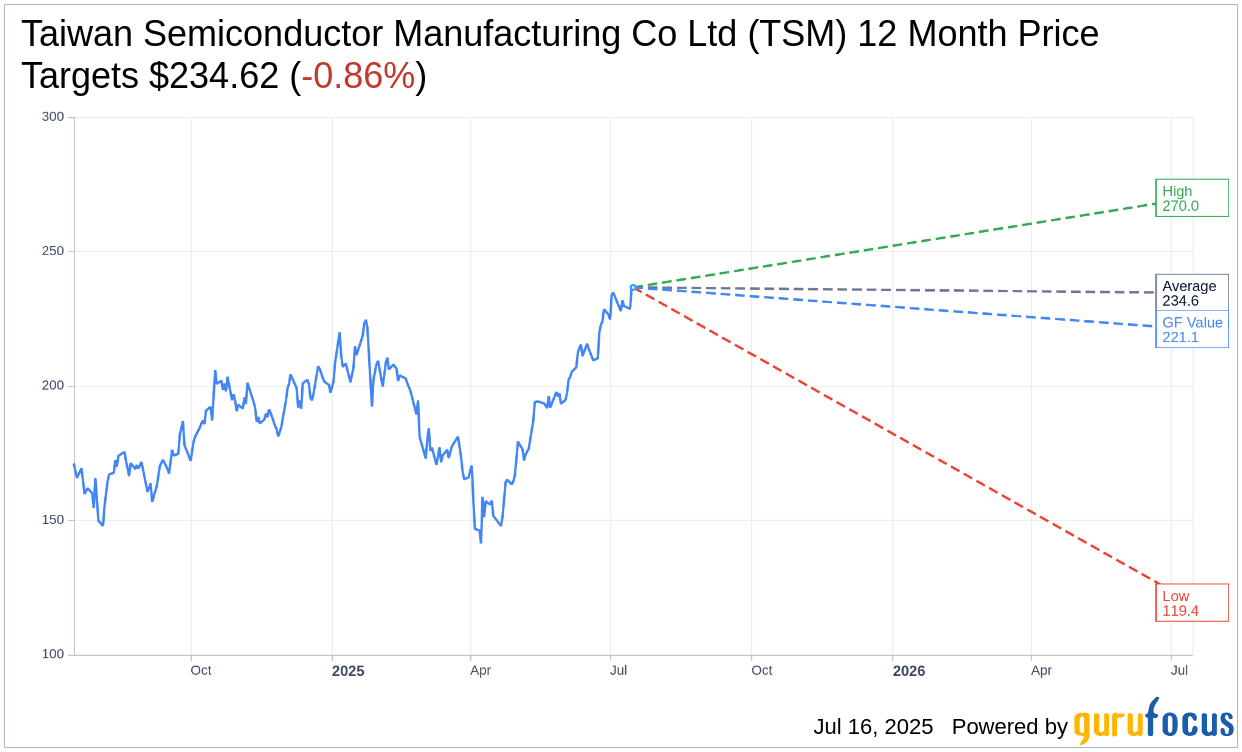

When assessing the one-year price targets from a group of 17 analysts, the average target price for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) comes in at $234.62. The estimates range from a high of $270.00 to a low of $119.37. This average target indicates a slight downside of 0.86% from the current trading price of $236.67. Investors seeking more detailed projections can explore further insights on the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

The consensus recommendation, according to 19 brokerage firms, assigns Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) an average brokerage recommendation rating of 1.6, denoting an "Outperform" status. This rating sits on a scale of 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell.

According to GuruFocus estimates, the projected GF Value for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) over the next year is $221.11. This suggests a potential downside of 6.57% from the current price of $236.67. The GF Value is an insightful metric representing what the stock's fair trading value should be, derived from historical multiples and anticipated business performance. Additional comprehensive data is available on the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Summary page.