- PNC Financial Services Group reports robust Q2 2025 earnings, driven by significant commercial loan growth.

- Analyst projections suggest a potential upside of over 8% from current stock prices.

- GuruFocus estimates hint at a slight downside, indicating potential overvaluation.

The PNC Financial Services Group, Inc. (PNC, Financial) has delivered impressive financial results for the second quarter of 2025. The company posted a net income of $1.6 billion, translating to earnings of $3.85 per share. Noteworthy is the substantial growth in commercial loans—the highest in a decade. Additionally, PNC continues to make strides in the asset management and retail banking sectors, showcasing its strategic growth initiatives.

Wall Street Analysts Forecast

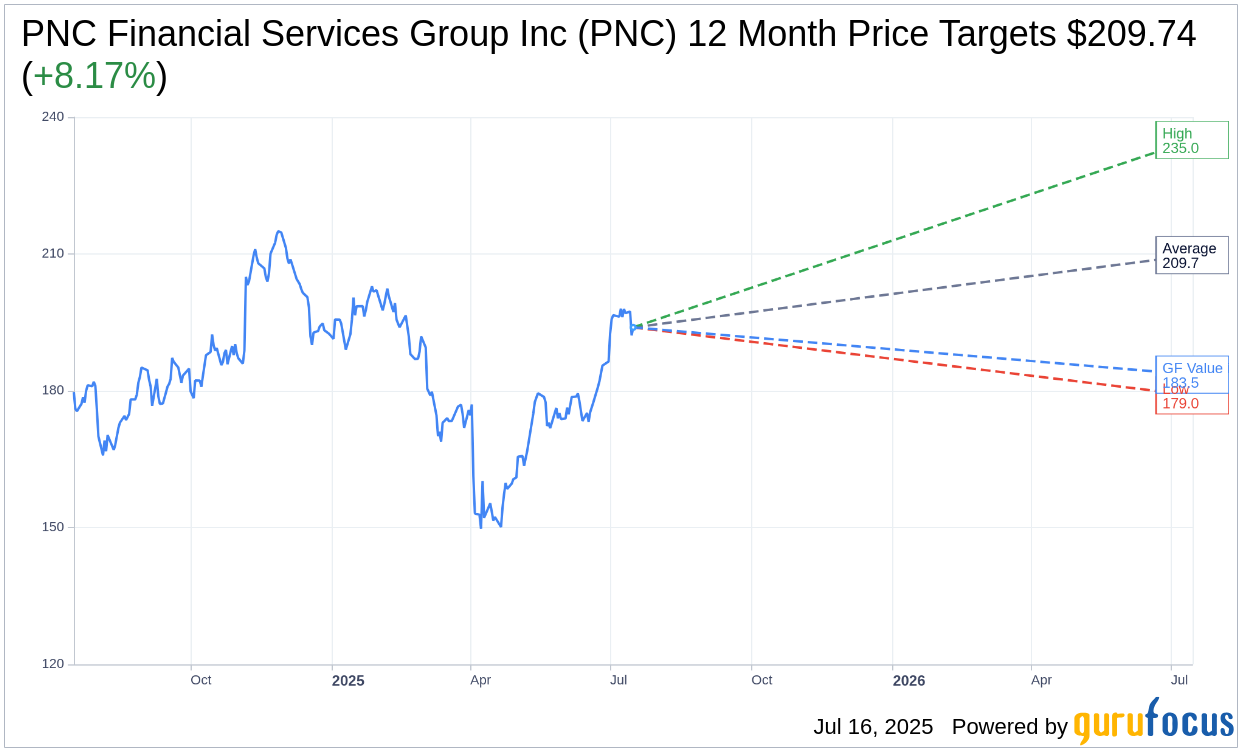

According to insights gathered from 19 Wall Street analysts, the average price target for PNC Financial Services Group Inc (PNC, Financial) stands at $209.74. Estimates range from a high of $235.00 to a low of $179.00, indicating an expectancy of an 8.17% upside from the current trading price of $193.90. Investors can explore detailed estimate data on the PNC Financial Services Group Inc (PNC) Forecast page.

The consensus among 24 brokerage firms holds PNC Financial Services Group Inc (PNC, Financial) at an average recommendation of 2.2, which corresponds to an "Outperform" rating. This rating scale ranges from 1 (Strong Buy) to 5 (Sell), highlighting analysts' optimism towards PNC's prospects.

GuruFocus Estimates

Further analysis from GuruFocus introduces a more conservative angle. The estimated GF Value for PNC Financial Services Group Inc (PNC, Financial) in the coming year is forecasted at $183.54. This presents a downside of 5.34% from the current stock price of $193.90. The GF Value metric reflects the stock's fair trading value, computed from historical trading multiples, along with past and projected business performance assessments. For a comprehensive understanding, investors are encouraged to visit the PNC Financial Services Group Inc (PNC) Summary page.