- Sherwin-Williams (SHW, Financial) maintains a steady dividend payout, signaling financial stability.

- Analysts foresee potential growth in SHW's stock price with a notable upside potential.

- The GF Value indicates a slight overvaluation, advising cautious optimism.

Sherwin-Williams (SHW) has declared a consistent quarterly dividend of $0.79 per share, aligning with its previous distributions. This results in a forward yield of 0.93%. Shareholders who wish to receive the dividend must be on record by August 15, the same date as the ex-dividend date, with the payout scheduled for September 5.

Wall Street Analysts' Insights

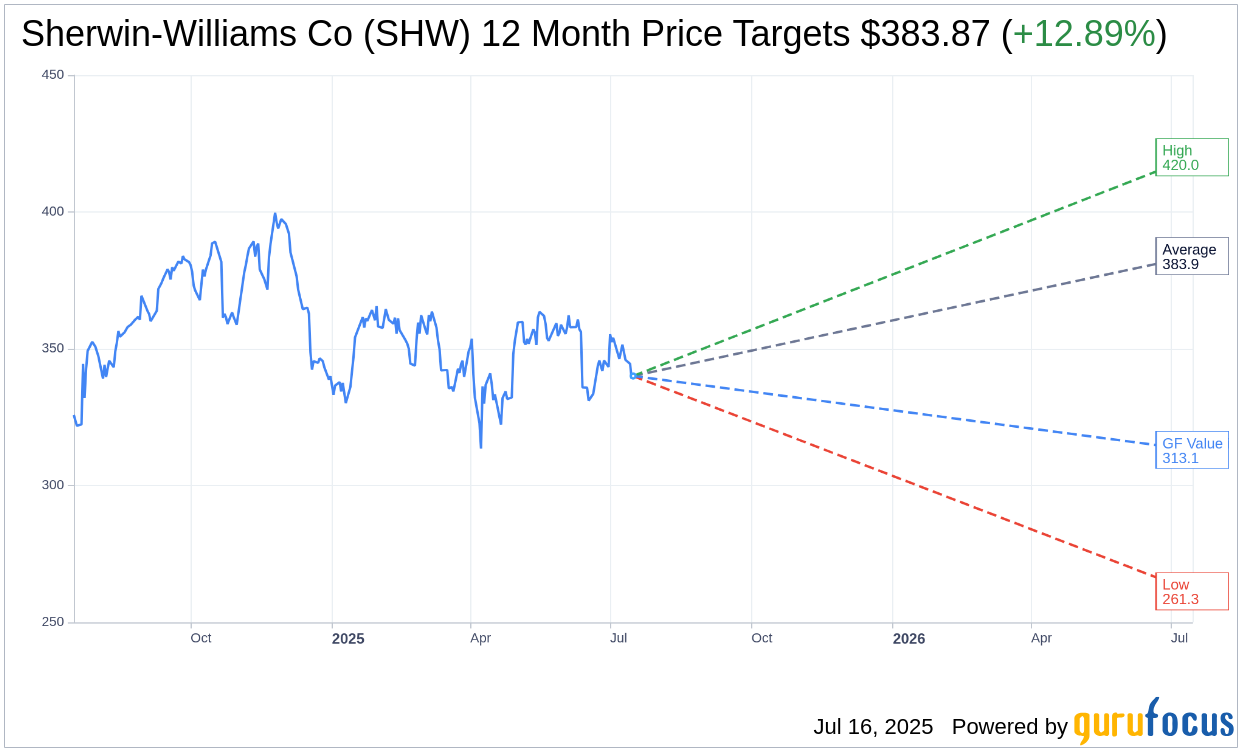

According to the one-year price targets provided by 21 analysts, Sherwin-Williams Co (SHW, Financial) holds an average target price of $383.87. The projections range from a high estimate of $420.00 to a low of $261.34. These estimates suggest a potential upside of 12.89% from the current share price of $340.05. Investors seeking detailed forecast data can explore the Sherwin-Williams Co (SHW) Forecast page.

Moreover, SHW's stock is currently rated at 2.4 by 29 brokerage firms, which falls under the "Outperform" category. The rating scale extends from 1 to 5, where 1 embodies a Strong Buy recommendation, and 5 indicates a Sell.

GuruFocus Value Assessment

GuruFocus estimates that the GF Value for Sherwin-Williams Co (SHW, Financial) in one year is projected at $313.05. This indicates a potential downside of 7.94% from the current market price of $340.05. The GF Value is a calculated estimation of the stock's fair market value, derived from its historical trading multiples, past growth metrics, and anticipated future performance. For further in-depth analysis, visit the Sherwin-Williams Co (SHW) Summary page.