Sarepta Therapeutics (SRPT, Financial) has unveiled a comprehensive restructuring plan aimed at fostering long-term growth and ensuring financial stability through 2027. This initiative focuses on enhancing profitability by emphasizing near- and mid-term opportunities, particularly from its siRNA platform. The restructuring involves significant cost-cutting measures to align with strategic priorities, targeting annual savings of approximately $400 million.

The company plans to reduce its workforce by 36%, affecting around 500 employees, which is expected to save about $120 million annually by 2026. Additionally, the reprioritization of the development pipeline is projected to cut non-personnel costs by $300 million each year starting in 2026. Sarepta also anticipates over $100 million in savings by the end of 2025, even after accounting for severance and other one-time charges estimated between $32 million and $37 million.

This strategic overhaul is designed to maintain access to Sarepta's $600 million revolving credit line and ensure sufficient cash flow to manage its financial commitments, including the repayment of a convertible note due in 2027.

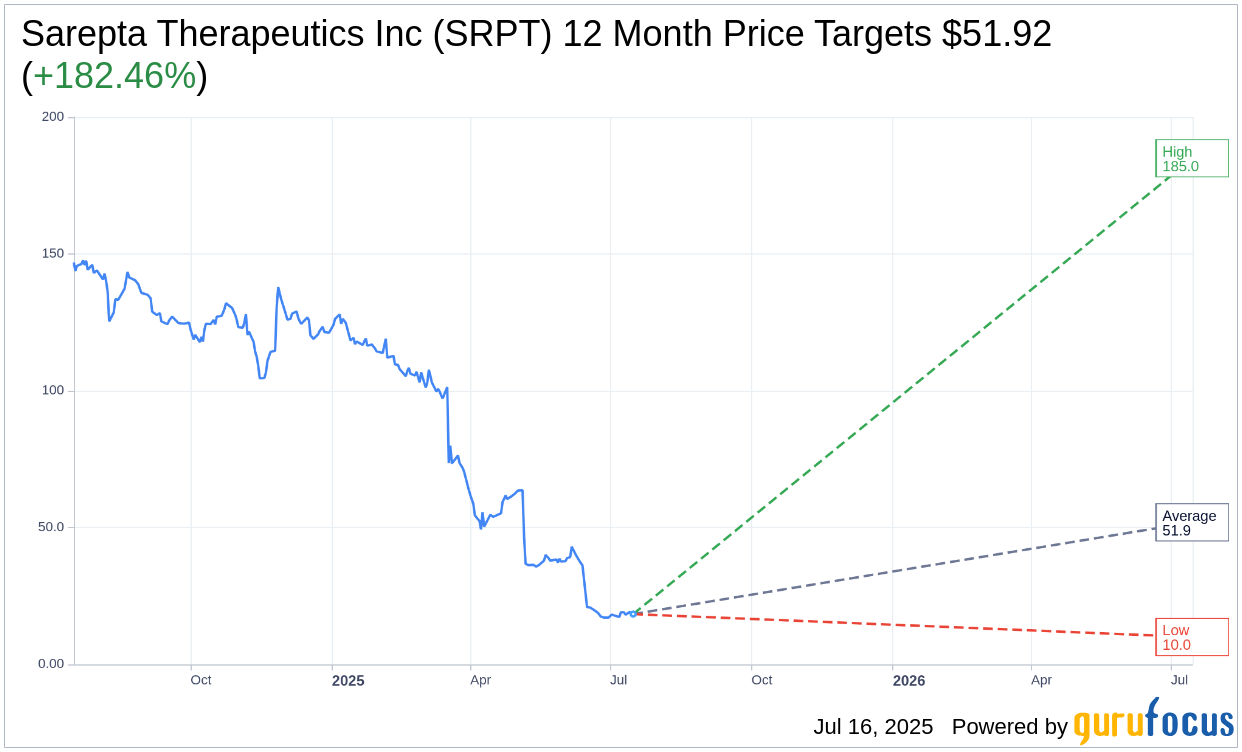

Wall Street Analysts Forecast

Based on the one-year price targets offered by 24 analysts, the average target price for Sarepta Therapeutics Inc (SRPT, Financial) is $51.92 with a high estimate of $185.00 and a low estimate of $10.00. The average target implies an upside of 182.46% from the current price of $18.38. More detailed estimate data can be found on the Sarepta Therapeutics Inc (SRPT) Forecast page.

Based on the consensus recommendation from 27 brokerage firms, Sarepta Therapeutics Inc's (SRPT, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Sarepta Therapeutics Inc (SRPT, Financial) in one year is $216.81, suggesting a upside of 1079.6% from the current price of $18.38. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Sarepta Therapeutics Inc (SRPT) Summary page.

SRPT Key Business Developments

Release Date: May 06, 2025

- Total Net Product Revenue: $612 million, representing 70% growth over the same quarter last year.

- ELEVIDYS Revenue: $375 million, a 180% increase year-over-year.

- PMO Franchise Revenue: $237 million, a 5% increase over the prior year.

- Total Revenues: $745 million, an 80% increase year-over-year.

- Cash Position: $647 million in cash, cash equivalents, investments, and restricted cash.

- Operating Loss (GAAP): $300 million, including $584 million R&D expense related to Arrowhead collaboration.

- Operating Profit (Non-GAAP): $334 million, excluding Arrowhead transaction.

- Revised Revenue Guidance for 2025: $2.3 billion to $2.6 billion.

- R&D Expenses (GAAP): $773 million, a year-over-year increase of $573 million.

- SG&A Expenses (GAAP): $134 million, up 5% year-over-year.

- Net Loss (GAAP): $448 million or $4.60 per share.

- Net Loss (Non-GAAP): $332 million or $3.42 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Sarepta Therapeutics Inc (SRPT, Financial) achieved $612 million in total net product revenue for Q1 2025, representing a 70% growth over the same quarter last year.

- ELEVIDYS sales reached $375 million in Q1, marking a 180% increase over the same quarter last year.

- The company maintains a strong cash position with $647 million in cash, cash equivalents, and investments, plus an additional $600 million available through a revolving credit facility.

- Sarepta Therapeutics Inc (SRPT) has four approved therapies generating significant revenue and growth potential.

- The company is actively working to expand its site capacity and improve administrative processes to enhance patient access to ELEVIDYS.

Negative Points

- Sarepta Therapeutics Inc (SRPT) revised its net product revenue guidance for 2025 to $2.3 billion to $2.6 billion, down from previous expectations.

- A tragic safety event involving a patient death due to acute liver failure has impacted the company's reputation and caused delays in patient infusions.

- The administrative process for gene therapy infusions is complex, leading to delays and impacting revenue timing.

- There is an imbalance in site capacity, with top sites being fully booked, which limits immediate patient access.

- The company faces challenges in educating the broader physician and patient community about the safety and efficacy of ELEVIDYS, impacting uptake.