- Rithm Property Trust (RPT, Financial) maintains its quarterly dividend, with a robust forward yield of 8.89%.

- Analysts forecast a significant upside potential of 122.22% for the stock.

- The investment is rated "Outperform" by brokerage firms, suggesting positive future performance.

Rithm Property Trust (RPT) continues to offer a steady income for investors with its latest quarterly dividend declaration. The company has announced that it will maintain its dividend payout at $0.06 per share. This dividend corresponds to a forward yield of 8.89%, which remains attractive for income-focused investors. The dividend is scheduled for payment on August 29, with shareholders needing to be on record by August 15. The ex-dividend date also falls on August 15.

Wall Street Analysts Forecast

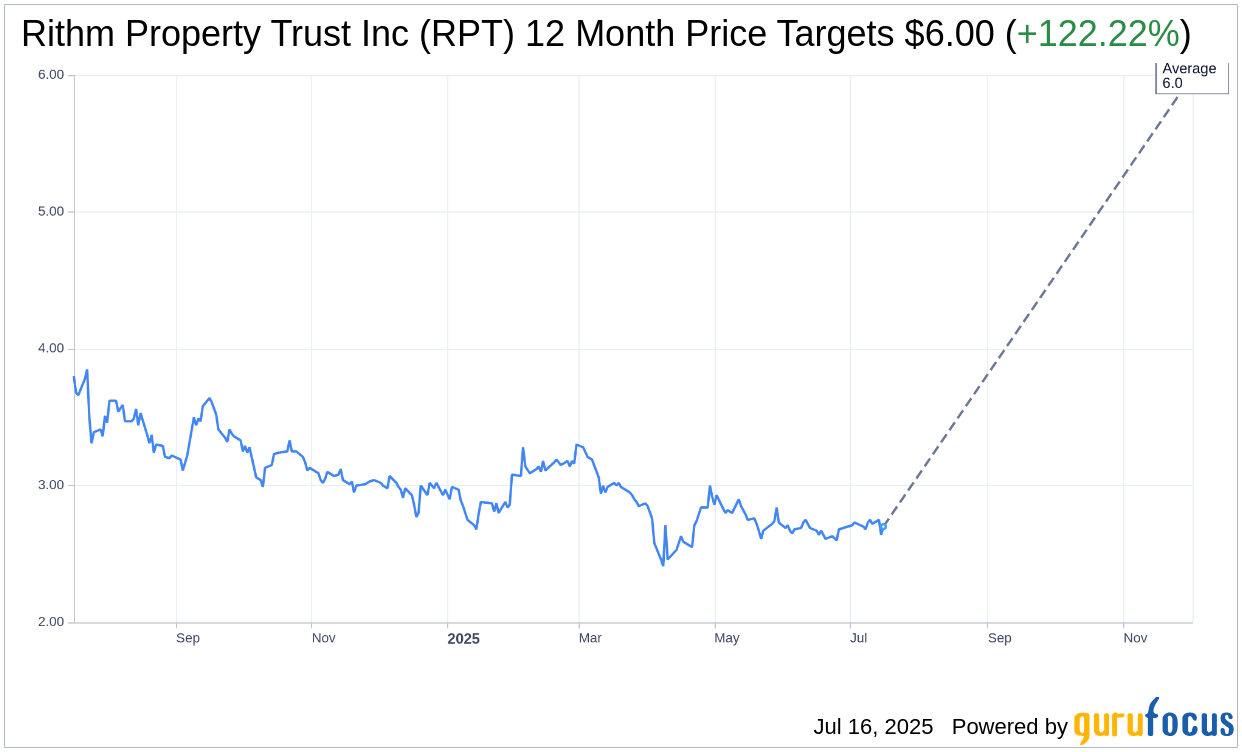

Wall Street analysts have offered insights regarding the future price potential of Rithm Property Trust Inc (RPT, Financial). Based on the analysis of one-year price targets from one analyst, the stock's average target price is set at $6.00. This figure is consistent across high and low estimates, both predicting a significant upside of 122.22% from the current trading price of $2.70. For those seeking more in-depth forecast information, additional details are available on the Rithm Property Trust Inc (RPT) Forecast page.

Brokerage Firm Recommendations

The stock's investment appeal is further affirmed by its average brokerage recommendation, which currently stands at 2.5. This rating falls within the "Outperform" category, based on the input of two brokerage firms. The recommendation scale spans from 1, representing a Strong Buy, to 5, indicating a Sell. This suggests that analysts have a positive outlook on RPT's potential, positioning it as a favorable investment option in the current market landscape.