Summary:

- Taiwan Semiconductor Manufacturing Company (TSM, Financial) posts strong EPADR but misses revenue estimates.

- Analyst projections highlight potential growth driven by the AI industry's demand.

- Current stock analysis suggests mixed signals with varying target prices and GF Value estimates.

Financial Highlights and Earnings Report

Taiwan Semiconductor Manufacturing Company (TSM) made headlines with its impressive GAAP EPADR of $2.47, exceeding forecasts by $0.14. Despite this achievement, the company reported revenue of $30.07 billion, which missed expectations by $1.23 billion. Analysts remain optimistic about TSM's future, driven by the burgeoning demand within the artificial intelligence sector.

Wall Street Analysts' Price Predictions

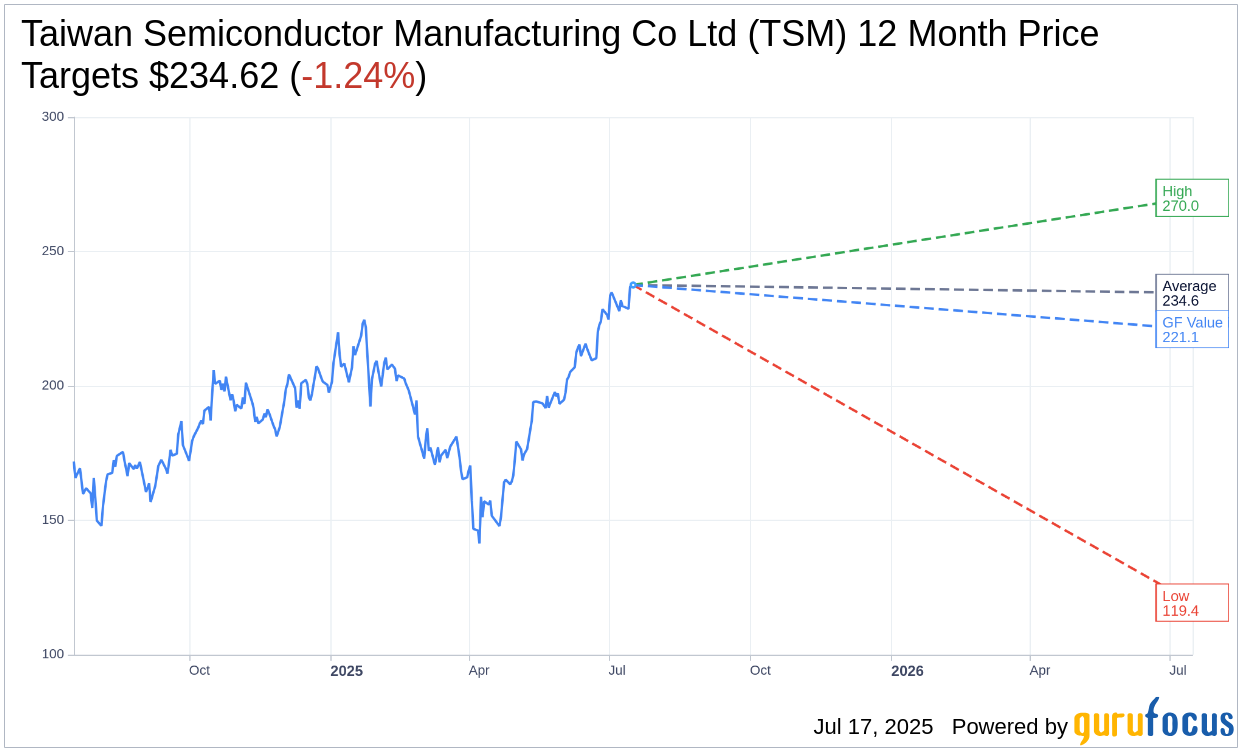

Seventeen analysts have provided one-year price targets for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial), arriving at an average target of $234.62. The range is broad, with the highest estimate at $270.00 and the lowest at $119.37. This average target suggests a slight downside of 1.24% from the current stock price of $237.56. For detailed target data, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

Brokerage Recommendations and Analyst Ratings

In terms of brokerage recommendations, Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) holds an average rating of 1.6 from 19 brokerage firms, positioning it in the "Outperform" category. This rating is part of a scale where 1 indicates Strong Buy and 5 suggests Sell, reflecting positive sentiment among analysts.

Understanding GuruFocus Metrics

GuruFocus estimates position TSM's GF Value at $221.11 over the next year, which implies a potential downside of 6.92% from the current price of $237.56. This GF Value represents GuruFocus' assessment of the fair trading value of the stock, derived from historical trading multiples and growth projections. For a more comprehensive analysis, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) Summary page.