Jefferies analyst Andy Barish has downgraded Starbucks (SBUX, Financial) from Hold to Underperform, maintaining a price target of $76. According to Barish, the company's stock is currently overvalued given the expected pace of its fundamental improvements. Jefferies' analysis of credit and debit card data, alongside foot traffic and app usage, indicates potential downside risks to the U.S. sales projections for the third and fourth quarters. Additionally, the firm highlights that Starbucks faces complex operational and personnel issues that may take longer to resolve. These challenges, coupled with ongoing investments, are likely to impact the company's earnings negatively.

Wall Street Analysts Forecast

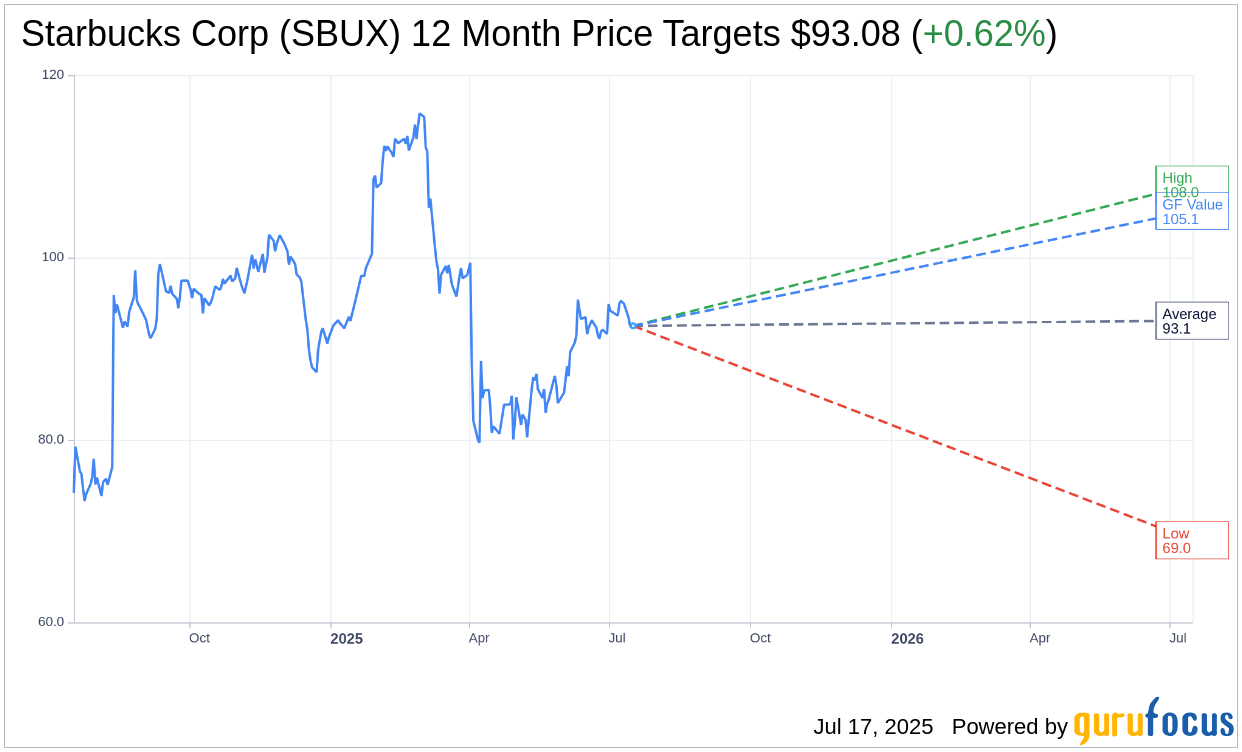

Based on the one-year price targets offered by 31 analysts, the average target price for Starbucks Corp (SBUX, Financial) is $93.08 with a high estimate of $108.00 and a low estimate of $69.00. The average target implies an upside of 0.62% from the current price of $92.51. More detailed estimate data can be found on the Starbucks Corp (SBUX) Forecast page.

Based on the consensus recommendation from 39 brokerage firms, Starbucks Corp's (SBUX, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Starbucks Corp (SBUX, Financial) in one year is $105.12, suggesting a upside of 13.63% from the current price of $92.51. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Starbucks Corp (SBUX) Summary page.

SBUX Key Business Developments

Release Date: April 29, 2025

- Total Revenue: $8.8 billion.

- Global Net New Store Growth: 213 coffeehouses.

- Global Comparable Store Sales: Decline of 1%.

- Global Operating Margin: 8.2%.

- Earnings Per Share (EPS): $0.41, down 38% from the prior year.

- US Comparable Store Sales: Decline of 2%.

- US Transaction Decline: Improved to negative 4%.

- US Ticket Growth: 3%.

- Canada Comparable Store Sales: Positive with 12.5% higher food sales.

- China Comparable Store Sales: Flat with positive transactions and expanding margins.

- Consolidated Operating Margin Contraction: 450 basis points from the prior year.

- G&A Decline: 3% versus the prior year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Starbucks Corp (SBUX, Financial) reported a total company revenue of $8.8 billion with a global net new store growth of 213 coffeehouses.

- The company has launched a new Green Apron service model to improve peak throughput and customer experience, which will be scaled to more than 2,000 US locations by the end of the fiscal year.

- Starbucks Corp (SBUX) has seen early indicators of recovery in its North America business, with partner engagement up and turnover dropping to a new recorded low.

- The Canadian business has returned to positive comps with positive transaction growth, indicating a successful turnaround in that market.

- The company is focusing on brand and coffee storytelling, with a new US brand campaign that generated record-breaking customer engagement and drove the second highest Monday gross sales day ever.

Negative Points

- Starbucks Corp (SBUX) reported a global comparable store sales decline of 1% and a global operating margin of 8.2%, which are below expectations.

- Earnings per share (EPS) for the quarter were $0.41, down 38% from the prior year, reflecting expense deleverage and heightened investments.

- The US market experienced a 2% decline in comparable store sales, with transaction declines improving but still at negative 4%.

- The company's Q2 consolidated operating margin contracted by 450 basis points from the prior year, primarily due to additional labor costs.

- Starbucks Corp (SBUX) is facing challenges in China, with comparable store sales flat for the quarter, although there are signs of progress with positive transactions and expanding margins.