Deutsche Bank has reinstated its analysis of Shift4 Payments (FOUR, Financial), issuing a Buy recommendation and setting a price target of $120. The firm's prior stance on the stock was a Hold. This move comes as part of Deutsche Bank's renewed evaluation of 25 companies within the payments, processors, and IT services sectors, where they have designated 9 stocks as Buys and 14 as Holds, with 2 under restricted ratings.

Both the payments and IT services sectors have notably underperformed the S&P 500 Index so far this year. This lag is attributed to heightened investor expectations for 2025, which were initially spurred by optimism surrounding the November elections but have since been deemed overly ambitious. Current challenges, including trade uncertainties and consumer spending anxieties, contribute to a murky outlook for the industry, reminiscent of the last half-decade's uncertainties.

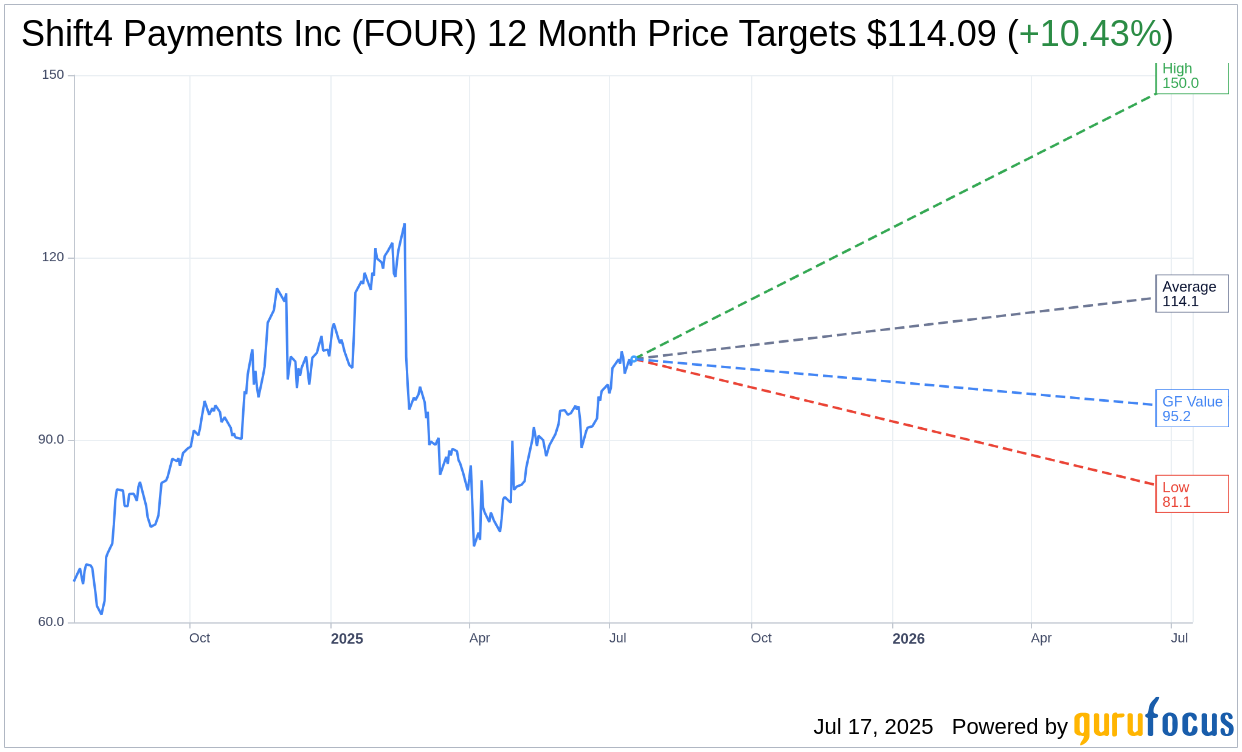

Wall Street Analysts Forecast

Based on the one-year price targets offered by 23 analysts, the average target price for Shift4 Payments Inc (FOUR, Financial) is $114.09 with a high estimate of $150.00 and a low estimate of $81.14. The average target implies an upside of 10.43% from the current price of $103.32. More detailed estimate data can be found on the Shift4 Payments Inc (FOUR) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, Shift4 Payments Inc's (FOUR, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Shift4 Payments Inc (FOUR, Financial) in one year is $95.22, suggesting a downside of 7.84% from the current price of $103.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Shift4 Payments Inc (FOUR) Summary page.

FOUR Key Business Developments

Release Date: April 29, 2025

- Volume Growth: Increased 35% year-over-year to $45 billion.

- Gross Revenue Less Network Fees: Grew 40% to $369 million.

- Adjusted EBITDA: Increased 38% to $169 million.

- Adjusted EBITDA Margins: Achieved 46%, slightly above the guidance of 45%.

- Adjusted EPS: Delivered $1.07 per share.

- Subscription and Other Revenue: Reached $93 million, up 77% year-over-year.

- Adjusted Free Cash Flow: $71 million, representing 42% adjusted free cash flow conversion.

- GAAP Net Income: $20 million.

- GAAP Diluted EPS: $0.20 per share.

- Net Leverage: Approximately 2.4 times.

- Cash and Cash Equivalents: $1.2 billion as of March 31.

- Full Year 2025 Guidance: Gross revenue less network fees between $1.66 billion and $1.73 billion; Adjusted EBITDA between $840 million and $865 million.

- Q2 2025 Guidance: Gross revenue less network fees between $405 million and $415 million with adjusted EBITDA margins of approximately 50%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Shift4 Payments Inc (FOUR, Financial) reported a 35% year-over-year increase in volumes to $45 billion for Q1 2025.

- Gross revenue less network fees grew by 40% to $369 million, indicating strong financial performance.

- Adjusted EBITDA increased by 38% to $169 million, with margins slightly above guidance at 46%.

- The company raised its full-year 2025 guidance, reflecting confidence in its ability to execute and deliver growth.

- Shift4 Payments Inc (FOUR) is expanding internationally, now operating in over 50 countries, which is expected to drive future growth.

Negative Points

- The timing of leap year and Easter holiday modestly impacted year-over-year growth in Q1 volumes.

- There is ongoing depreciation of legacy revenue from recent acquisitions, affecting subscription and other revenue.

- The company faces challenges in integrating and unlocking synergies from recent acquisitions, which can take longer than expected.

- Economic uncertainty and potential macroeconomic challenges could impact consumer spending and business performance.

- The international expansion requires significant market education and adaptation to local payment methods, which can be complex and time-consuming.