Taiwan Semiconductor Manufacturing Company (TSM, Financial) posted revenues of $30.07 billion for the second quarter. This performance was primarily driven by significant demand in the AI and high-performance computing (HPC) sectors. The company anticipates continued robust demand for its advanced process technologies as it progresses into the third quarter of 2025. TSMC's financial outlook remains optimistic, supported by its leadership in cutting-edge semiconductor technology.

Wall Street Analysts Forecast

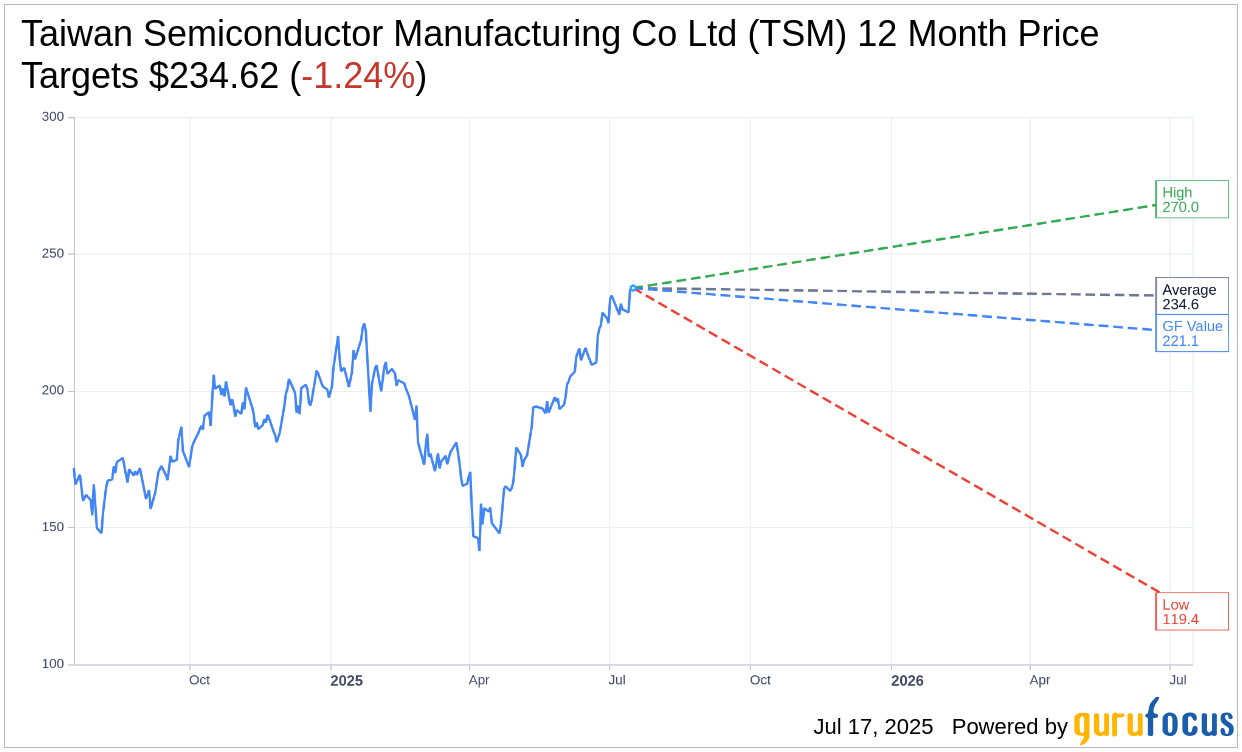

Based on the one-year price targets offered by 17 analysts, the average target price for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) is $234.62 with a high estimate of $270.00 and a low estimate of $119.37. The average target implies an downside of 1.24% from the current price of $237.56. More detailed estimate data can be found on the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Taiwan Semiconductor Manufacturing Co Ltd's (TSM, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) in one year is $221.11, suggesting a downside of 6.92% from the current price of $237.56. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Summary page.

TSM Key Business Developments

Release Date: April 17, 2025

- Revenue: USD25.5 billion for Q1 2025, a decrease of 5.1% in US dollars.

- Gross Margin: 58.8%, a decrease of 0.2 percentage points sequentially.

- Operating Margin: 48.5%, a decrease of 0.5 percentage points sequentially.

- EPS: TWD13.94 for Q1 2025.

- ROE: 32.7% for Q1 2025.

- Cash and Marketable Securities: TWD2.7 trillion (USD81 billion) at the end of Q1 2025.

- CapEx: USD10.06 billion for Q1 2025.

- Cash from Operations: TWD626 billion for Q1 2025.

- 3-nanometer Process Technology Revenue: 22% of wafer revenue in Q1 2025.

- 5-nanometer Process Technology Revenue: 36% of wafer revenue in Q1 2025.

- 7-nanometer Process Technology Revenue: 15% of wafer revenue in Q1 2025.

- Advanced Technologies Revenue: 73% of wafer revenue for technologies 7-nanometer and below.

- HPC Revenue: Increased 7% quarter-over-quarter, accounting for 59% of Q1 2025 revenue.

- Smartphone Revenue: Decreased 22%, accounting for 28% of Q1 2025 revenue.

- IoT Revenue: Decreased 9%, accounting for 5% of Q1 2025 revenue.

- Automotive Revenue: Increased 14%, accounting for 5% of Q1 2025 revenue.

- DCE Revenue: Increased 8%, accounting for 1% of Q1 2025 revenue.

- Accounts Receivable Turnover Days: Increased to 28 days.

- Days of Inventory: Increased to 83 days.

- Second Quarter 2025 Revenue Guidance: USD28.4 billion to USD29.2 billion.

- Second Quarter 2025 Gross Margin Guidance: 57% to 59%.

- Second Quarter 2025 Operating Margin Guidance: 47% to 49%.

- Second Quarter 2025 Tax Rate: Around 20%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- TSMC's first quarter revenue was slightly above the midpoint of guidance despite challenges such as smartphone seasonality and an earthquake.

- Advanced technologies, defined as 7-nanometer and below, accounted for 73% of wafer revenue, indicating strong demand for cutting-edge processes.

- TSMC expects a 13% sequential increase in second-quarter revenue, driven by strong demand for 3-nanometer and 5-nanometer technologies.

- The company plans to double its CoWoS capacity in 2025 to meet robust AI-related demand, indicating confidence in future growth.

- TSMC announced an additional $100 billion investment plan to expand its capacity in Arizona, demonstrating commitment to meeting customer demand and geographic flexibility.

Negative Points

- First quarter revenue decreased 3.4% sequentially in NT dollars, impacted by smartphone seasonality.

- Gross margin decreased by 0.2 percentage points due to the earthquake and overseas dilution, with further margin dilution expected from overseas fabs.

- Operating margin decreased by 0.5 percentage points sequentially to 48.5%, reflecting operational challenges.

- TSMC anticipates a 2% to 3% margin dilution impact for the full year 2025 due to overseas fab costs, which could widen to 3% to 4% in later years.

- There are uncertainties and risks from potential tariff policies, which could impact end-market demand and revenue growth.