KeyBanc has raised its price target for Trade Desk (TTD, Financial) from $80 to $95, maintaining an Overweight rating on the stock. The firm anticipates that Trade Desk will report a revenue of at least $691 million and provide Q3 guidance indicating approximately $715 million in revenue. According to KeyBanc, the company’s execution appears to be on track, and management is expected to continue with a strategy of exceeding expectations and offering conservative forecasts.

As concerns regarding competition from Amazon and execution issues diminish, KeyBanc foresees potential for stock multiple expansion for Trade Desk (TTD, Financial).

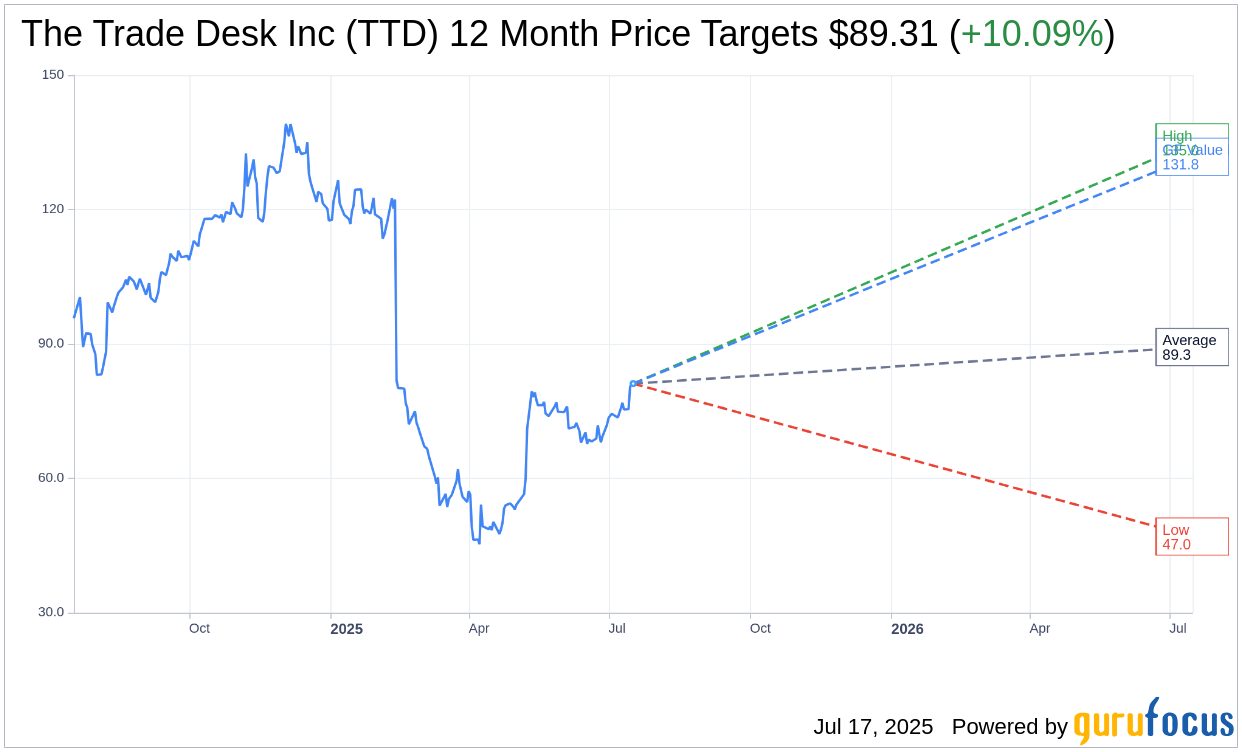

Wall Street Analysts Forecast

Based on the one-year price targets offered by 33 analysts, the average target price for The Trade Desk Inc (TTD, Financial) is $89.31 with a high estimate of $135.00 and a low estimate of $47.00. The average target implies an upside of 10.09% from the current price of $81.13. More detailed estimate data can be found on the The Trade Desk Inc (TTD) Forecast page.

Based on the consensus recommendation from 40 brokerage firms, The Trade Desk Inc's (TTD, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Trade Desk Inc (TTD, Financial) in one year is $131.79, suggesting a upside of 62.44% from the current price of $81.13. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Trade Desk Inc (TTD) Summary page.

TTD Key Business Developments

Release Date: May 08, 2025

- Revenue: $616 million, a 25% increase year over year.

- Adjusted EBITDA: $208 million, representing a 34% margin.

- Net Income: Adjusted net income of $165 million or $0.33 per fully diluted share.

- Free Cash Flow: $230 million in Q1.

- Cash and Equivalents: Approximately $1.7 billion at the end of the quarter.

- Share Repurchase: $386 million of Class A common stock repurchased.

- CTV Growth: CTV remains the largest and fastest-growing advertising channel.

- Geographical Revenue Split: North America represented about 88% of spend; international represented about 12%.

- Operating Expenses: $433 million, up 23% from a year ago, excluding stock-based compensation.

- Q2 Revenue Outlook: Expected to be at least $682 million, reflecting 17% year over year growth.

- Q2 Adjusted EBITDA Outlook: Estimated to be approximately $259 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Trade Desk Inc (TTD, Financial) reported a 25% year-over-year revenue growth, surpassing expectations despite economic uncertainty.

- Kokai platform adoption accelerated, with two-thirds of clients now using it, leading to significant improvements in campaign performance.

- The company continues to gain market share in the digital marketing industry, outperforming other scaled players.

- Innovations like OpenPath and the acquisition of Sincera are enhancing supply chain transparency and efficiency.

- The Trade Desk Inc (TTD) maintains a strong balance sheet with $1.7 billion in cash and no debt, allowing for strategic investments and share repurchases.

Negative Points

- Economic volatility and macro uncertainties are impacting client confidence, posing challenges for future growth.

- The company faces competitive pressures from major players like Google and Amazon, which could impact market dynamics.

- Despite strong performance, the company acknowledges the need for continuous upgrades and improvements to maintain its competitive edge.

- The Trade Desk Inc (TTD) operates in a complex and rapidly changing digital advertising landscape, requiring constant adaptation.

- The company is exposed to risks associated with regulatory changes and antitrust rulings affecting major competitors like Google.