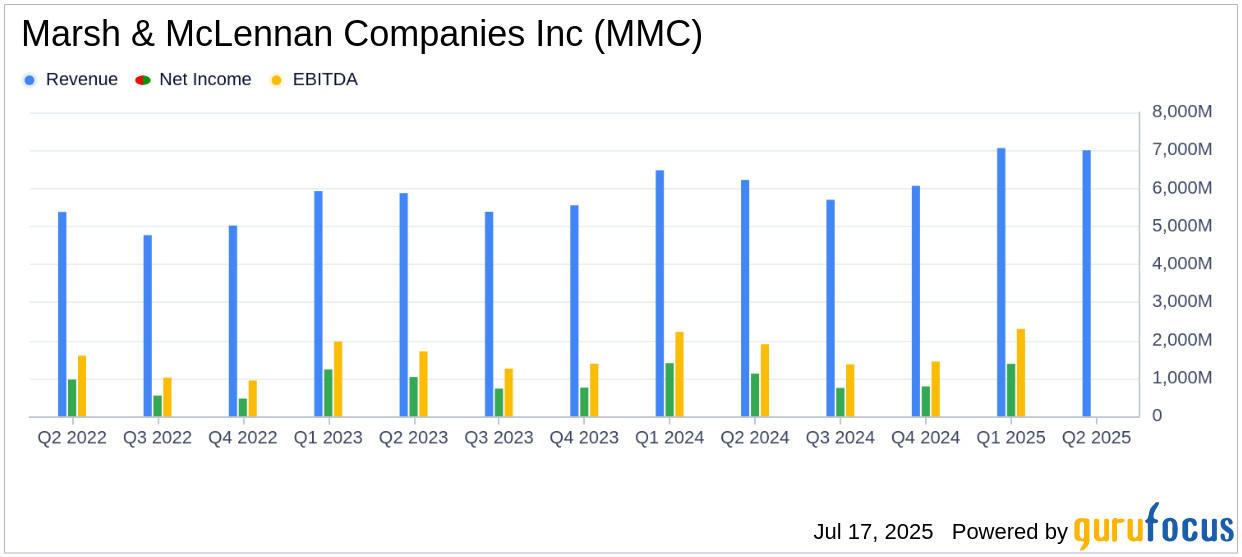

On July 17, 2025, Marsh & McLennan Companies Inc (MMC, Financial) released its 8-K filing for the second quarter of 2025, showcasing a robust financial performance that exceeded analyst expectations. The company reported a GAAP earnings per share (EPS) of $2.45, surpassing the estimated EPS of $2.43. Additionally, the company's revenue reached $7.0 billion, exceeding the analyst estimate of $6,924.39 million.

Company Overview

Marsh & McLennan Companies Inc (MMC, Financial) is a leading professional services firm providing advice and solutions in risk, strategy, and human capital. The company operates through two main segments: risk and insurance services, and consulting. The risk and insurance services segment includes Marsh, an insurance broker, and Guy Carpenter, a risk and reinsurance specialist. The consulting division comprises Mercer, a provider of human resource services, and Oliver Wyman, a management and economic consultancy. Approximately half of its revenue is generated outside the United States.

Performance and Challenges

Marsh & McLennan's second-quarter performance was marked by a 12% increase in revenue compared to the same period last year, with underlying revenue growth of 4%. The company's operating income rose by 11% to $1.8 billion, while adjusted operating income increased by 14% to $2.1 billion. These results highlight the company's ability to maintain momentum across its business segments and leverage acquisitions effectively.

However, the company faces challenges such as geopolitical and macroeconomic conditions, including fluctuations in foreign exchange rates and changes in insurance premium rates. These factors could potentially impact the company's future performance.

Financial Achievements

Marsh & McLennan's financial achievements in the second quarter underscore its strong position in the industry. The company reported a net income attributable to the company of $1.2 billion, with an adjusted EPS increase of 11% to $2.72. The company's ability to increase its dividend by 10% to $0.900 per share reflects its commitment to returning value to shareholders.

Key Financial Metrics

Key metrics from the income statement include a consolidated revenue of $7.0 billion, a 12% increase from the previous year. Operating expenses totaled $5.145 billion, leading to an operating income of $1.829 billion. The balance sheet and cash flow statements indicate a strong financial position, with significant cash flow generation supporting ongoing share repurchases and dividend payments.

John Doyle, President and CEO, stated, "We had another solid quarter with 12% revenue growth reflecting continued momentum across our business and the contribution from acquisitions. We generated 4% underlying revenue growth, 14% growth in adjusted operating income, and 11% growth in adjusted EPS. In addition, we recently announced a 10% increase in our dividend."

Segment Performance

The Risk & Insurance Services segment reported a revenue of $4.6 billion, a 15% increase, with operating income rising 11% to $1.4 billion. The Consulting segment saw a 7% increase in revenue to $2.4 billion, with operating income up 11% to $456 million. These results demonstrate the company's ability to capitalize on growth opportunities in both segments.

Analysis and Conclusion

Marsh & McLennan's strong financial performance in the second quarter of 2025 highlights its resilience and strategic execution in a dynamic environment. The company's ability to exceed analyst estimates and increase shareholder returns through dividends and share repurchases positions it well for future growth. However, ongoing geopolitical and economic challenges may pose risks that require careful navigation.

Explore the complete 8-K earnings release (here) from Marsh & McLennan Companies Inc for further details.