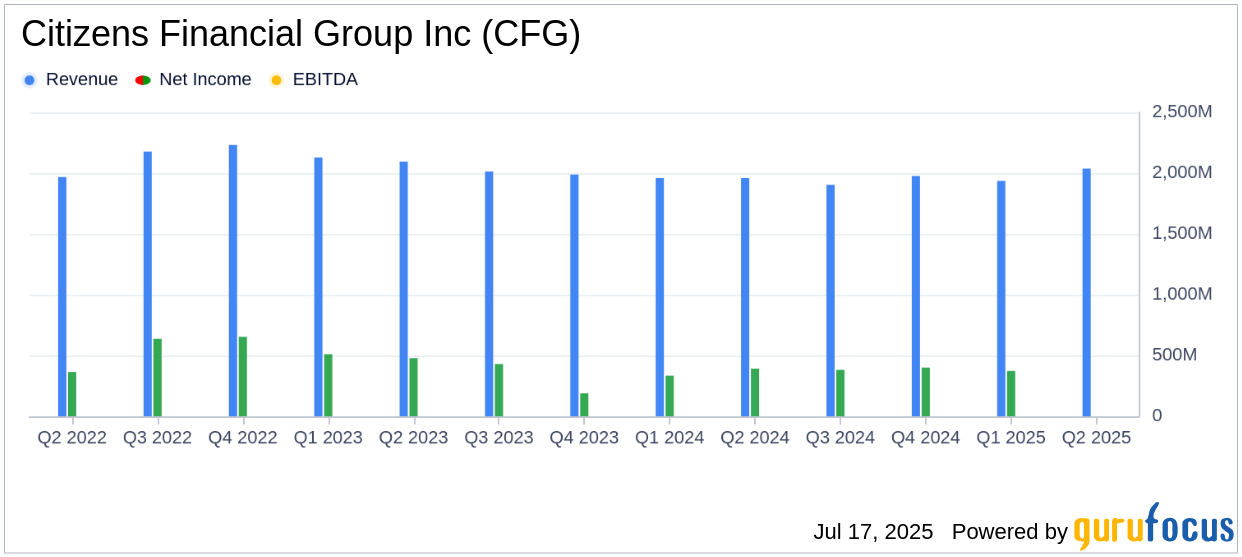

On July 17, 2025, Citizens Financial Group Inc (CFG, Financial) released its 8-K filing for the second quarter of 2025, reporting a net income of $436 million and an earnings per share (EPS) of $0.92. This performance exceeded analyst estimates of $0.88 EPS and $2,007.76 million in revenue. CFG achieved $2,037 million in total revenue.

Company Overview

Citizens Financial Group Inc, headquartered in Providence, Rhode Island, is a bank holding company offering a wide range of retail and commercial banking products and services. The company operates through segments such as Commercial Banking, Consumer Banking, Non-Core, and Others, with the Consumer Banking segment being the primary revenue generator.

Performance Highlights

CFG's second-quarter results showcased a robust performance with a 3% sequential growth in net interest income (NII) and a 10% increase in fee income. The company's net interest margin (NIM) improved by 5 basis points to 2.95%, reflecting effective asset management and cost control. The efficiency ratio also improved to 64.8%, indicating disciplined expense management.

Financial Achievements and Metrics

CFG's pre-provision net revenue (PPNR) rose by 16% quarter-over-quarter to $718 million, highlighting strong operational efficiency. The company's return on tangible common equity (ROTCE) increased to 11.0%, up from 9.6% in the previous quarter, demonstrating enhanced profitability.

| Metric | 2Q25 | 1Q25 | 2Q24 |

|---|---|---|---|

| Total Revenue ($ millions) | 2,037 | 1,935 | 1,963 |

| Net Income ($ millions) | 436 | 373 | 392 |

| Diluted EPS ($) | 0.92 | 0.77 | 0.78 |

| Net Interest Margin (%) | 2.95 | 2.90 | 2.87 |

Income Statement and Balance Sheet Insights

CFG's income statement reflected a strong revenue performance, with net interest income reaching $1,437 million, a 3% increase from the previous quarter. Noninterest income also saw a significant rise, driven by higher card, wealth, and mortgage fees. On the balance sheet, period-end loans and leases grew to $139.3 billion, while deposits slightly decreased to $175.1 billion.

Commentary from Leadership

“We are pleased to report strong results today that came in ahead of expectations, paced by strong NII and fee growth, disciplined expense management, and credit results that are trending favorably,” said Chairman and CEO Bruce Van Saun.

Analysis and Outlook

CFG's strong financial performance in Q2 2025, characterized by higher-than-expected EPS and revenue, underscores the company's effective strategic initiatives and operational efficiency. The positive trends in net interest income and fee growth, coupled with disciplined expense management, position CFG well for sustained growth. The company's focus on enhancing its Private Bank and leveraging new technologies through its 'Reimagining the Bank' initiative is expected to drive future benefits.

CFG's robust capital position, with a CET1 ratio of 10.6%, and its commitment to shareholder returns through dividends and share repurchases further enhance its attractiveness to investors. As CFG continues to navigate market uncertainties, its strategic focus and financial resilience are likely to support its long-term growth trajectory.

Explore the complete 8-K earnings release (here) from Citizens Financial Group Inc for further details.