General Electric (GE, Financial) has announced plans to elevate capital returns to its shareholders by 20% between 2024 and 2026, targeting an approximate increase to $24 billion. The company also aims to maintain a strategy of returning at least 70% of its free cash flow to shareholders via dividends and share buybacks beyond 2026. This commitment underscores GE's focus on enhancing shareholder value and confidence over the long term.

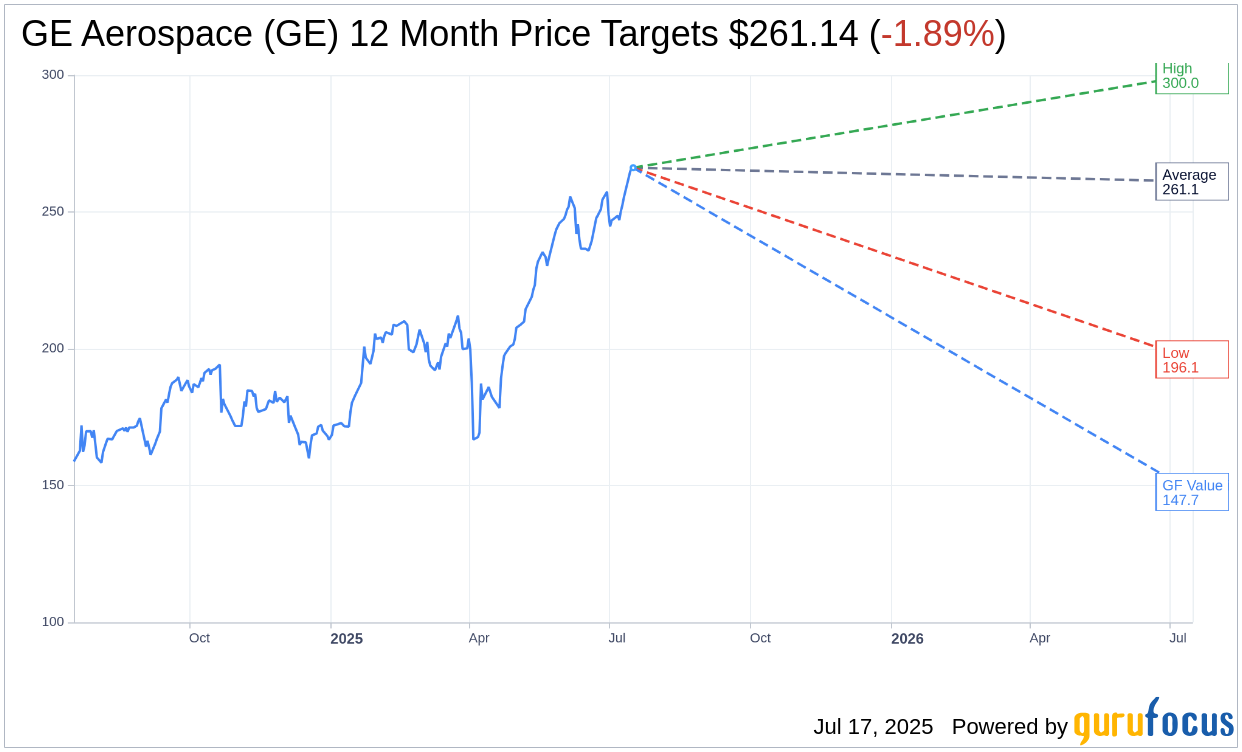

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for GE Aerospace (GE, Financial) is $261.14 with a high estimate of $300.00 and a low estimate of $196.11. The average target implies an downside of 1.89% from the current price of $266.18. More detailed estimate data can be found on the GE Aerospace (GE) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, GE Aerospace's (GE, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for GE Aerospace (GE, Financial) in one year is $147.69, suggesting a downside of 44.51% from the current price of $266.18. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the GE Aerospace (GE) Summary page.

GE Key Business Developments

Release Date: April 22, 2025

- Orders Growth: Up 12%.

- Revenue Growth: Up 11%.

- Profit: $2.1 billion, up 38%.

- Margins: 23.8%.

- Earnings Per Share (EPS): $1.49, up 60% year over year.

- Free Cash Flow: $1.4 billion.

- Commercial Engines & Services Revenue Growth: Up 17%.

- Defense Units Growth: Up 5%.

- Defense Profit Growth: Up 16%.

- R&D Spending: Approximately $3 billion annually.

- Backlog: Over $170 billion.

- Commercial Services Backlog: Over $140 billion.

- Spare Parts Revenue Growth: Up more than 20%.

- Internal Shop Visit Revenue Growth: Up 11%.

- LEAP External Shop Visits Growth: Over 60%.

- Guidance for 2025: Revenue growth low double-digit, profit $7.8 billion to $8.2 billion, EPS $5.10 to $5.45, free cash flow $6.3 billion to $6.8 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- GE Aerospace (GE, Financial) reported a strong start to 2025 with orders up 12% and revenue growing 11%, driven by double-digit growth in both services and equipment.

- The company achieved a significant profit increase of 38% to $2.1 billion, leading to expanded margins of 23.8%.

- Commercial Engines & Services (CES) saw a 31% increase in orders and a 17% rise in revenue, contributing to a 35% growth in operating profit year over year.

- Defense & Propulsion Technologies (DPT) experienced a solid quarter with defense units growing 5% and profit increasing 16%.

- GE Aerospace (GE) is investing $1 billion in US manufacturing and hiring over 5,000 US workers, supporting domestic manufacturing revitalization efforts.

Negative Points

- Heightened tariffs are expected to result in additional costs, with GE Aerospace (GE) estimating a $500 million impact despite efforts to mitigate it.

- Spare parts delinquency has increased over two times year over year, indicating challenges in converting orders to revenue due to supply chain dynamics.

- The company is taking a cautious approach with a slower second half expected, resulting in departures up low-single digits for the full year.

- Total engine units were down 6%, with LEAP engine deliveries down 13%, attributed to a slower start to material inputs.

- The macroeconomic backdrop remains uncertain, with potential impacts from tariffs, a slowdown in airframer delivery schedules, and a global recession not factored into the guidance.