In its recent Q2 update, PepsiCo (PEP, Financial) emphasized the company's adaptability in navigating a challenging geopolitical and macroeconomic environment. During this period, its North American beverage division showed an improvement in organic volume trends compared to the previous quarter. PepsiCo anticipates that its "One North America" initiative will start yielding benefits next year, further enhancing its performance.

The company also highlighted poppi's role as a complementary addition to its beverage portfolio, reinforcing its diverse offerings. Despite ongoing challenges related to supply chain costs, particularly from certain global inputs, ingredients, and tariff impacts anticipated through 2025, PepsiCo remains confident in its resilience for the remainder of the year. The company is actively working on strategies to mitigate these additional costs.

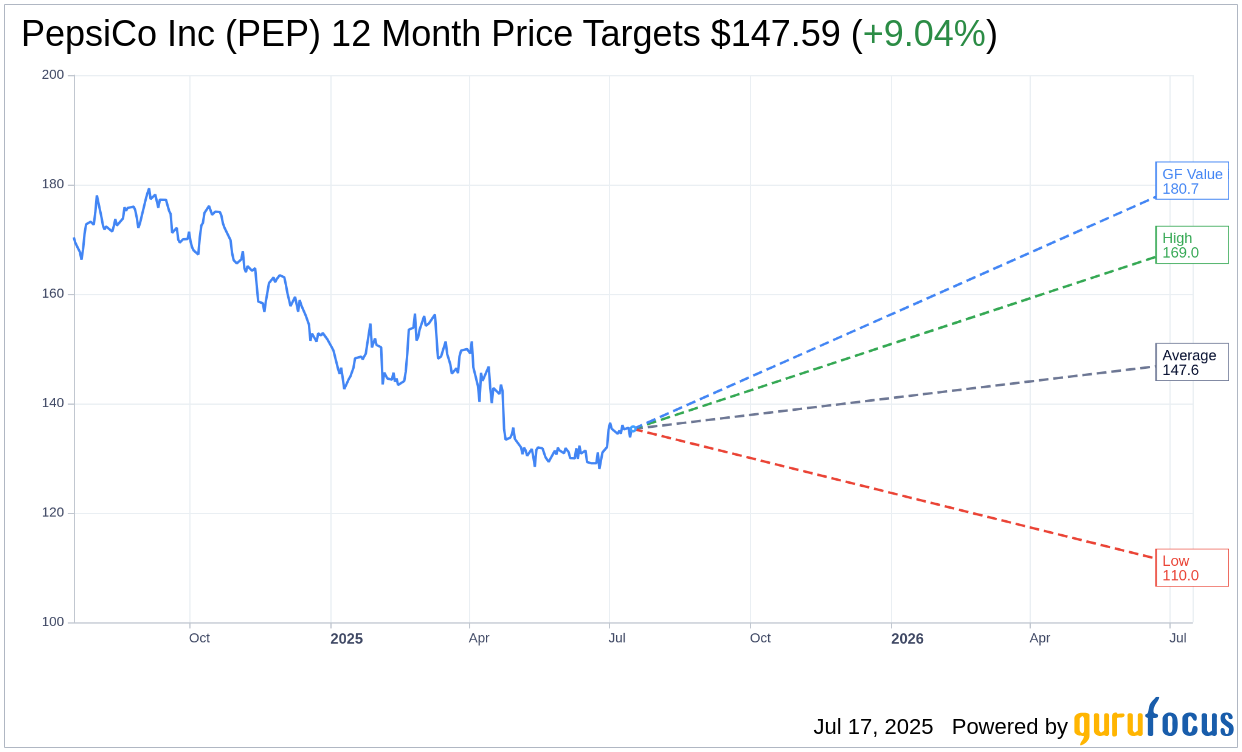

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for PepsiCo Inc (PEP, Financial) is $147.59 with a high estimate of $169.00 and a low estimate of $110.00. The average target implies an upside of 9.04% from the current price of $135.35. More detailed estimate data can be found on the PepsiCo Inc (PEP) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, PepsiCo Inc's (PEP, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for PepsiCo Inc (PEP, Financial) in one year is $180.74, suggesting a upside of 33.54% from the current price of $135.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the PepsiCo Inc (PEP) Summary page.