Clearside Biomedical (CLSD, Financial) has initiated a comprehensive evaluation of strategic alternatives to enhance its SCS platform and drug development pipeline. To aid in this assessment, the company has engaged Piper Sandler. The potential strategies under consideration include selling, licensing, or monetizing certain assets and technologies; exploring collaborations and partnerships; or pursuing mergers, acquisitions, and joint ventures.

The CEO expressed confidence in the company's unique suprachoroidal delivery platform, citing its effectiveness in targeting difficult retinal diseases requiring sustained treatments. The SCS Microinjector facilitates a reliable, repeatable non-surgical method to deliver therapies directly to the macula, retina, and choroid. The company has commercialized its first product using this platform in the U.S., with approvals also secured in Singapore and Australia, and is awaiting regulatory decisions in China and Canada.

Clearside has reported positive Phase 2b clinical outcomes for its CLS-AX treatment for wet AMD, marking it as a leader in TKI clinical trial results. Plans for Phase 3 have been aligned with the FDA. Additionally, its partners continue to advance related clinical programs using the SCS Microinjector. The company's dedicated team has been pivotal in these achievements, showcasing the platform's potential in addressing severe ophthalmic disorders.

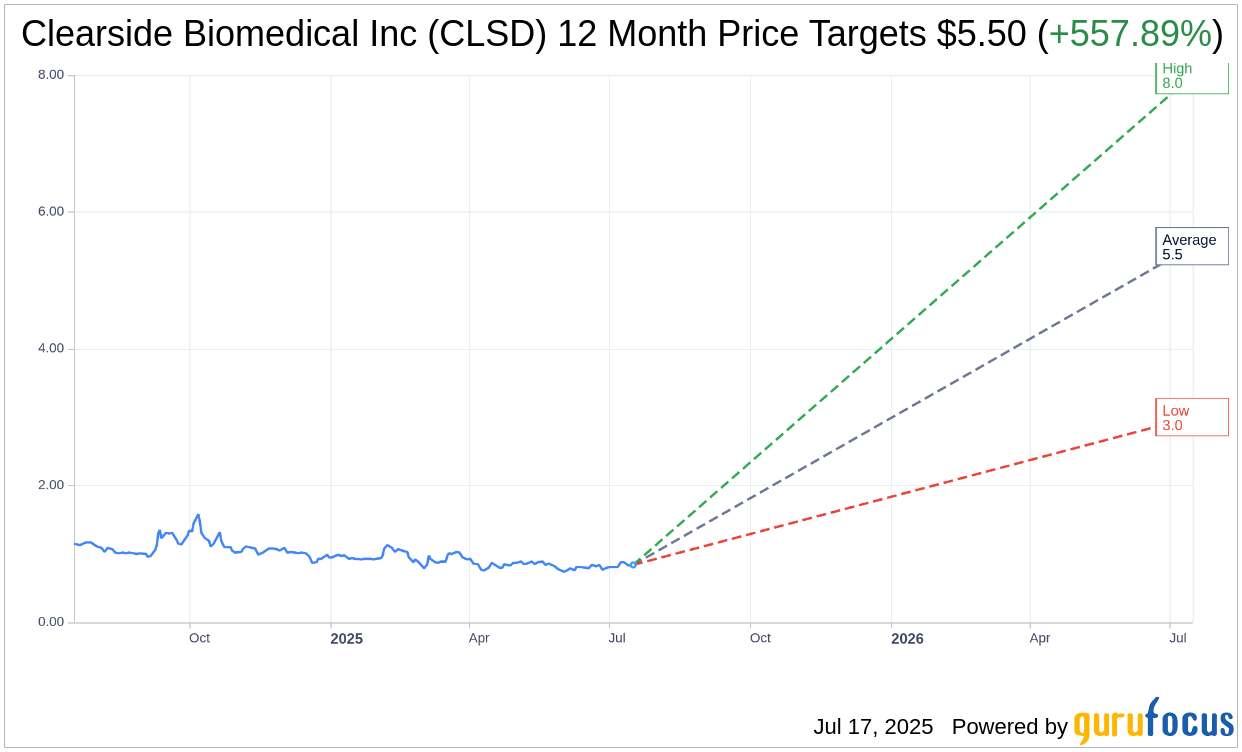

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Clearside Biomedical Inc (CLSD, Financial) is $5.50 with a high estimate of $8.00 and a low estimate of $3.00. The average target implies an upside of 557.89% from the current price of $0.84. More detailed estimate data can be found on the Clearside Biomedical Inc (CLSD) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Clearside Biomedical Inc's (CLSD, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Clearside Biomedical Inc (CLSD, Financial) in one year is $0.37, suggesting a downside of 55.74% from the current price of $0.836. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Clearside Biomedical Inc (CLSD) Summary page.