Key Highlights:

- MP Materials (MP, Financial) initiates a $650 million stock offering, impacting premarket trading.

- The stock is currently priced at $58.55, with analyst targets ranging from $21.60 to $67.00.

- GuruFocus estimates a fair value of $27.65, suggesting a downside of 52.78%.

MP Materials Corp (MP) experienced a significant 6.5% decline in premarket trading following the recent announcement of a substantial $650 million stock offering. The offering comprises 11.8 million shares priced at $55 each, with underwriters being granted a 30-day option to purchase additional shares. The proceeds from this offering are strategically earmarked for facility expansion and further growth initiatives.

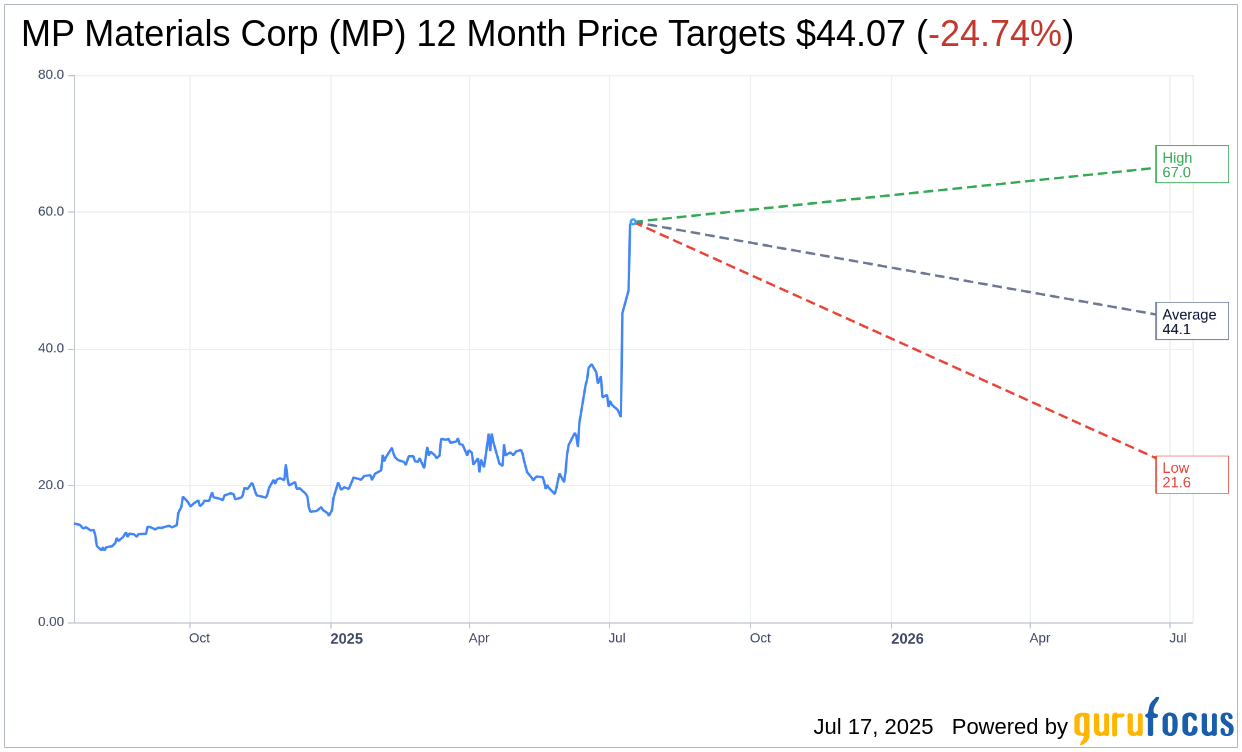

Wall Street Analysts Forecast

According to projections from nine analysts, the average one-year price target for MP Materials Corp is $44.07, with estimates ranging from a high of $67.00 to a low of $21.60. This average target suggests a potential downside of 24.74% from the current trading price of $58.55. Investors seeking more in-depth analysis can access additional data on the MP Materials Corp (MP, Financial) Forecast page.

In terms of consensus recommendations from 11 brokerage firms, MP Materials Corp holds an average recommendation rating of 2.0. This positions the stock as "Outperform," based on a rating scale where 1 is a Strong Buy and 5 represents a Sell.

From the perspective of GuruFocus, the estimated GF Value for MP Materials Corp in one year is calculated to be $27.65. This estimation indicates a significant downside of 52.78% from the current stock price of $58.55. The GF Value represents GuruFocus's assessment of the fair value at which the stock should be traded, derived from historical trading multiples, past business growth, and future performance projections. For further insights, investors are encouraged to explore the detailed data available on the MP Materials Corp (MP, Financial) Summary page.