Key Highlights:

- GE Aerospace (GE, Financial) shares increase by 0.8% pre-market after surpassing Q2 earnings expectations.

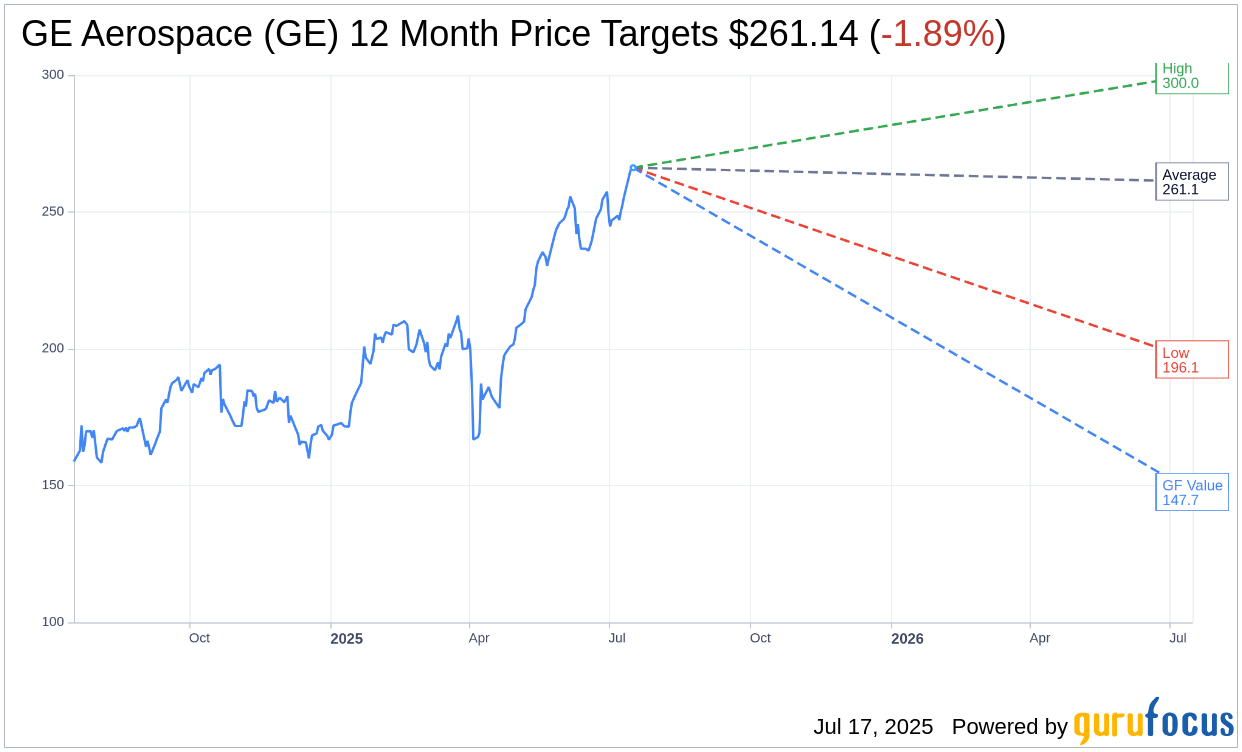

- Analysts set an average price target of $261.14 with an 'Outperform' rating for GE Aerospace.

- GuruFocus estimates suggest a potential downside, highlighting a possible overvaluation.

GE Aerospace's Impressive Performance

GE Aerospace (GE) has been on an upward trajectory, clocking a 0.8% rise in pre-market trading as it inches closer to its all-time high stock price. The company outperformed in its second-quarter earnings, reporting a profit surge to $2.39 billion. This strong performance was bolstered by a significant 33% increase in revenue generated from its commercial engines and services segment. Additionally, GE has raised its earnings and revenue forecasts for 2025.

Analyst Insights and Projections

Leading analysts have set one-year price targets for GE Aerospace (GE, Financial), with an average target of $261.14. The projections vary, featuring a high estimate of $300.00 and a low of $196.11. This average target suggests a downside of 1.89% from the prevailing price of $266.18. Investors can access more detailed estimates on the GE Aerospace (GE) Forecast page.

Brokerage Recommendations

In terms of broker evaluations, 20 firms have collectively rated GE Aerospace with an average recommendation of 1.9, placing it in the "Outperform" category. The rating scale spans from 1, indicating a Strong Buy, to 5, which suggests a Sell.

Understanding GE Aerospace's GF Value Estimate

According to GuruFocus, the estimated GF Value for GE Aerospace (GE, Financial) over the next year stands at $147.69. This projection implies a potential downside of 44.51% from GE's current trading price of $266.18. The GF Value signifies GuruFocus' calculated fair market value of the stock, grounded on historical trading multiples, past business growth, and future business performance forecasts. Detailed insights are accessible on the GE Aerospace (GE) Summary page.