B. Riley has increased its price target for TTM Technologies (TTMI, Financial) to $50, up from $36, while maintaining a Buy rating on the stock. This adjustment precedes the company's upcoming second-quarter financial report on July 30. The firm anticipates positive developments, driven by strong defense budgets and ongoing growth in the company's data center and networking sectors, which are bolstered by advancements in artificial intelligence.

Wall Street Analysts Forecast

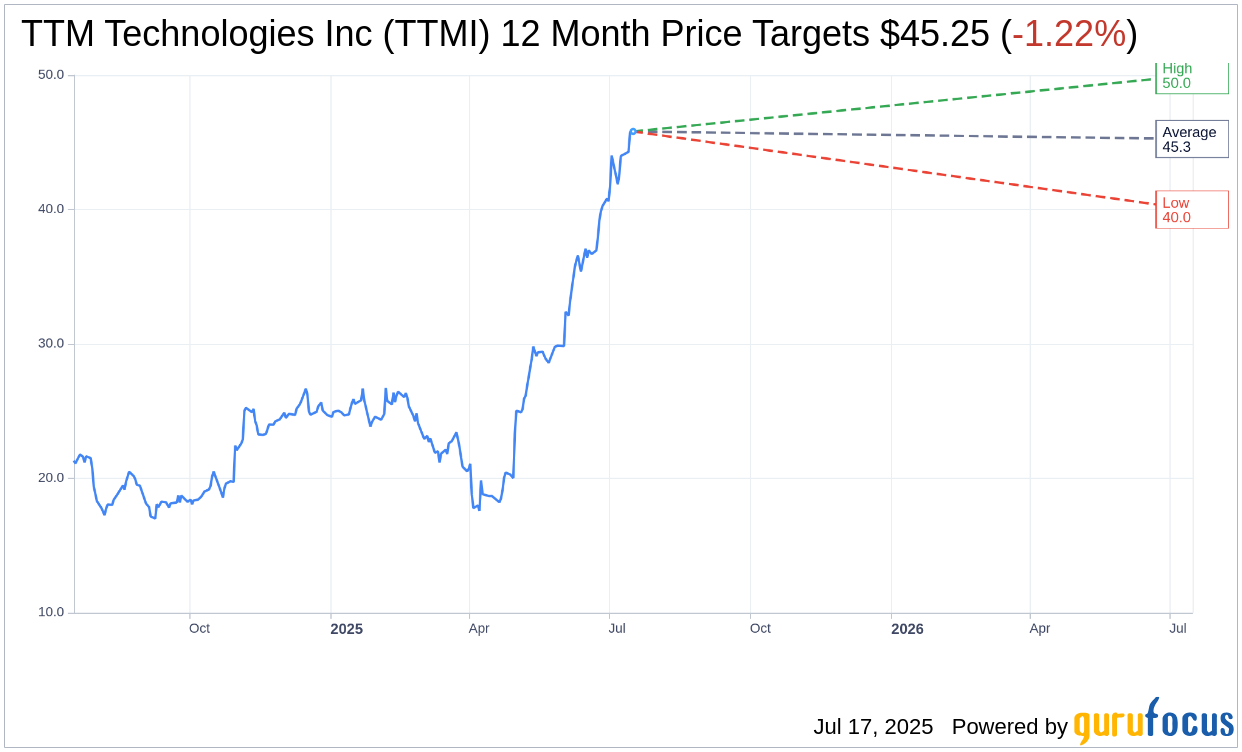

Based on the one-year price targets offered by 4 analysts, the average target price for TTM Technologies Inc (TTMI, Financial) is $45.25 with a high estimate of $50.00 and a low estimate of $40.00. The average target implies an downside of 1.22% from the current price of $45.81. More detailed estimate data can be found on the TTM Technologies Inc (TTMI) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, TTM Technologies Inc's (TTMI, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for TTM Technologies Inc (TTMI, Financial) in one year is $17.83, suggesting a downside of 61.08% from the current price of $45.81. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the TTM Technologies Inc (TTMI) Summary page.

TTMI Key Business Developments

Release Date: April 30, 2025

- Revenue: $648.7 million, a 14% year-over-year increase.

- Net Income (GAAP): $32.2 million or $0.31 per diluted share.

- Net Income (Non-GAAP): $52.4 million or $0.50 per diluted share.

- Gross Margin: 20.8%, up from 18.8% in the prior year.

- Operating Margin (Non-GAAP): 10.5%, a 340 basis points increase from the previous year.

- Adjusted EBITDA: $99.5 million or 15.3% of net sales.

- Cash and Cash Equivalents: $411.3 million at the end of the quarter.

- Book-to-Bill Ratio: 1.10.

- Top 5 Customers: Contributed 45% of total sales.

- 90-Day Backlog: $517.5 million.

- Aerospace and Defense Revenue: 47% of total sales, with a 15% year-on-year growth.

- Data Center Computing Revenue: 21% of total sales, with a 15% year-on-year growth.

- Networking Revenue: 8% of total sales, with a 53% year-on-year growth.

- Automotive Revenue: 11% of total sales, a decline from 13% in the previous year.

- Cash Flow from Operations: Net cash usage of $10.7 million.

- Net Debt/EBITDA: 1.3.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- TTM Technologies Inc (TTMI, Financial) achieved revenue and non-GAAP EPS above the high end of the guided range, with a 14% year-on-year revenue growth.

- The aerospace and defense market, which constitutes 47% of revenues, remains strong with a solid program backlog of approximately $1.55 billion.

- Non-GAAP operating margins reached a record high of 10.5%, up 340 basis points year-on-year, marking the third consecutive quarter of double-digit operating margin performance.

- The company has diversified its manufacturing footprint, reducing exposure to consumer markets and investing in new production capabilities in regions like Malaysia.

- TTM Technologies Inc (TTMI) published its second corporate sustainability report, reflecting a commitment to minimizing environmental impact.

Negative Points

- The automotive end market experienced a year-over-year decline due to continued inventory adjustments and soft demand at several customers.

- TTM Technologies Inc (TTMI) faces potential indirect impacts from tariffs, such as end-market demand weakness and economic slowdown, which are difficult to predict.

- The company's PCB capacity utilization in North America was relatively low at 35% in Q1, indicating potential inefficiencies.

- There is a significant exposure to tariffs on materials and equipment, with approximately 11% of revenues tied to imports into the U.S. from Europe and Asia.

- The Penang facility is currently operating at a loss, with an operating income loss of approximately $11.5 million, although it is expected to reach breakeven by the end of Q3.