DiaMedica Therapeutics, Inc. (DMAC, Financial) has shared promising interim findings from the first phase of its Phase 2 study concerning DM199, developed for treating preeclampsia. This biopharmaceutical company reported that the trial met the predetermined safety and efficacy targets during the initial dosage escalation stage, underscoring DM199's therapeutic promise. DM199, known as rinvecalinase alfa, is a recombinant form of the KLK1 protein, which is believed to aid in blood pressure regulation and vascular health.

The study observed a dose-dependent reduction in systolic and diastolic blood pressure, with the highest reductions noted in Cohort 9 shortly after infusion. The combined results of Cohorts 6-9 showed statistically significant reduction in blood pressure at intervals of five minutes, 30 minutes, and 24 hours post-infusion, demonstrating lasting effects. Importantly, DM199 did not transfer to the placenta and showed no serious adverse reactions, with mild side effects like nausea, headache, and flushing noted.

Additionally, DM199 significantly lowered the pulsatility index by 13.2% after two hours, indicating improved uterine artery blood flow and placental perfusion, which may enhance fetal development and alter disease progression. The ongoing Phase 2 trial will continue to expand enrollment based on these findings, targeting further exploration of DM199's potential in addressing this significant unmet medical need.

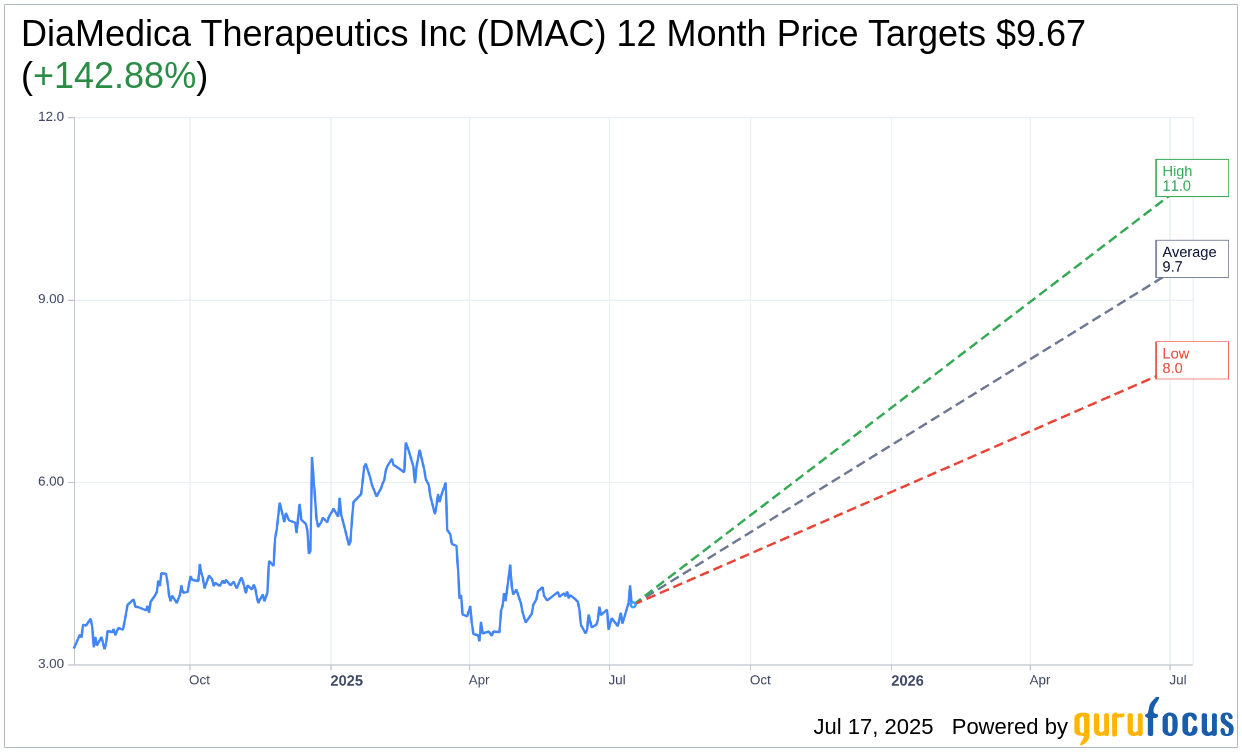

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for DiaMedica Therapeutics Inc (DMAC, Financial) is $9.67 with a high estimate of $11.00 and a low estimate of $8.00. The average target implies an upside of 142.88% from the current price of $3.98. More detailed estimate data can be found on the DiaMedica Therapeutics Inc (DMAC) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, DiaMedica Therapeutics Inc's (DMAC, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

DMAC Key Business Developments

Release Date: May 14, 2025

- Cash and Investments: $37.3 million as of March 31, 2025.

- Current Liabilities: $4.7 million as of March 31, 2025.

- Working Capital: $32.8 million as of March 31, 2025.

- Net Cash Used in Operating Activities: $7.1 million for Q1 2025.

- Research and Development Expenses: $5.7 million for the three months ended March 31, 2025.

- General and Administrative Expenses: $2.5 million for the three months ended March 31, 2025.

- Net Other Income: $443,000 for the three months ended March 31, 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- DiaMedica Therapeutics Inc (DMAC, Financial) is making substantial progress in its clinical development programs, particularly in the preeclampsia and stroke areas.

- The company is close to identifying a target dose for its phase 2 preeclampsia trial, with preliminary top-line results expected between June and July.

- Enrollment in the stroke program is progressing steadily, with participant enrollment reaching between the 20th and 25th percentile mark.

- The company has engaged an experienced stroke neurologist to support site engagement and maintain enrollment momentum in the Remedy II trial.

- DiaMedica Therapeutics Inc (DMAC) has a strong financial position with a total combined cash and investments of $37.3 million as of March 31, 2025, providing a runway into Q3 of 2026.

Negative Points

- The company's net cash used in operating activities increased to $7.1 million for the first quarter of 2025, up from $6.7 million in the same period of 2024.

- Research and development expenses rose significantly to $5.7 million for the three months ended March 31, 2025, compared to $3.7 million for the same period in 2024.

- General and administrative expenses increased to $2.5 million for the three months ended March 31, 2025, from $2.1 million in the same period of 2024.

- The company anticipates that R&D expenses will moderately increase in future periods due to the continuation of the Remedy II trial and expansion of the DM 199 clinical development program.

- Interest income decreased, resulting in a net other income of $443,000 for the three months ended March 31, 2025, compared to $597,000 for the same period in 2024.