Aemetis (AMTX, Financial) has appointed a new Chief Financial Officer for its subsidiary in India, Universal Biofuels. The company has selected Anjaneyulu Ganji for the role, who previously served as the Group CFO at Dodla Dairy Limited. Under his financial leadership, Dodla Dairy achieved annual revenues of $450 million and is based in Hyderabad, India.

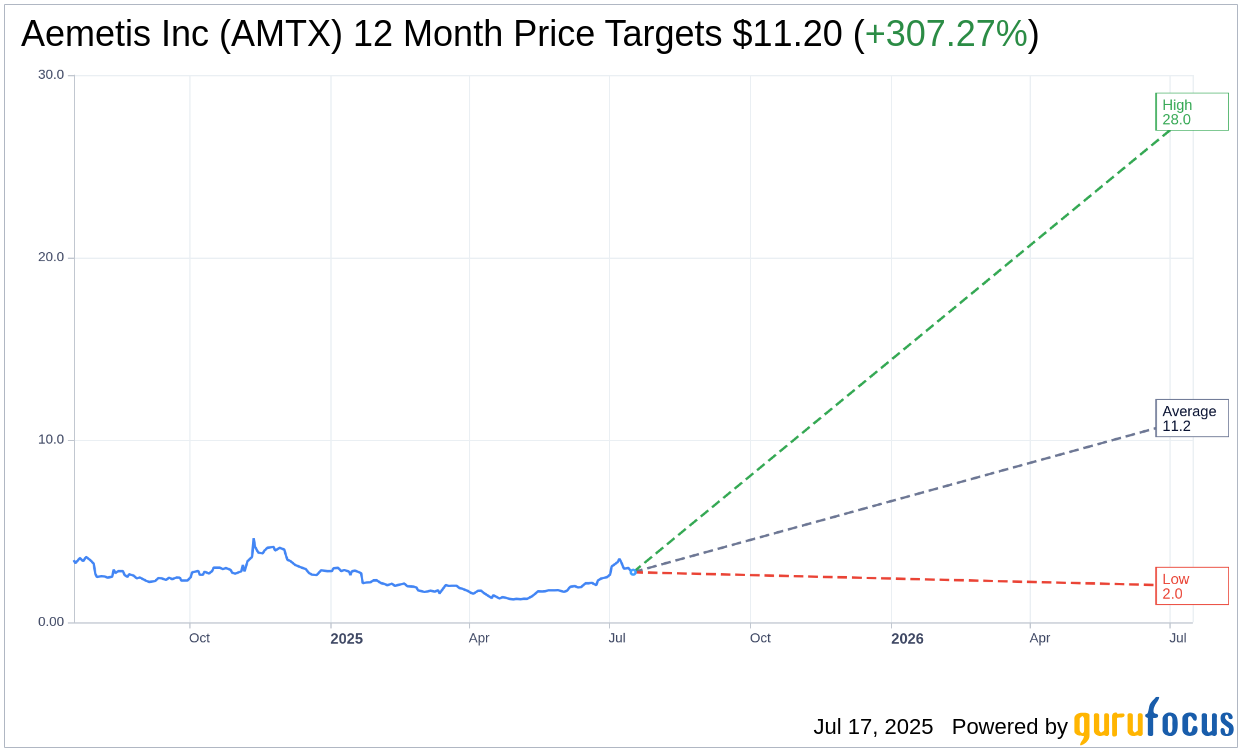

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Aemetis Inc (AMTX, Financial) is $11.20 with a high estimate of $28.00 and a low estimate of $2.00. The average target implies an upside of 307.27% from the current price of $2.75. More detailed estimate data can be found on the Aemetis Inc (AMTX) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Aemetis Inc's (AMTX, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Aemetis Inc (AMTX, Financial) in one year is $6.66, suggesting a upside of 142.18% from the current price of $2.75. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Aemetis Inc (AMTX) Summary page.

AMTX Key Business Developments

Release Date: May 08, 2025

- Revenue: $42.9 million, down from $72.6 million last year.

- Operating Loss: $15.6 million, reflecting a $1.6 million increase in SG&A expenses.

- Interest Expense: $13.7 million.

- Net Loss: $24.5 million, roughly flat versus Q1 last year.

- Cash: $500,000 at the end of the quarter.

- Debt Repayment: $15.4 million.

- Investment: $1.8 million into carbon intensity reduction and dairy RNG expansion.

- Ethanol Plant Revenue: Increased by $1.7 million due to stronger ethanol pricing.

- RNG Volumes: Up 17% year over year.

- Dairy RNG Production Capacity: Expected to reach 550,000 MMBTUs this year, growing to 1 million MMBTU annually by 2026.

- USDA Financing: $50 million guaranteed for dairy operations.

- LCFS Revenue: Expected to start in Q3 with pathway approvals.

- Mechanical Vapor Recompression System: $30 million project to reduce natural gas use by 80%, adding $32 million in annual cash flow starting in 2026.

- Grants and Tax Credits: $20 million secured for ethanol plant system.

- India Biodiesel Deliveries: Resumed in April after a six-month pause.

- Investment Tax Credits: $19 million in cash proceeds from Q1 2025 sales.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Aemetis Inc (AMTX, Financial) expects revenue to rebound in Q2 2025 due to resumed biodiesel shipments in India.

- The company is scaling its dairy RNG production, aiming to reach 550,000 MMBTUs in 2025 and 1 million MMBTUs by 2026.

- Aemetis Inc (AMTX) has secured $20 million in grants and tax credits for its ethanol plant's mechanical vapor recompression system, expected to add $32 million in annual cash flow starting in 2026.

- The company is preparing for an IPO of its India subsidiary, targeting late 2025 or early 2026, which could provide significant capital for expansion.

- Aemetis Inc (AMTX) is positioned to benefit from regulatory tailwinds, including the California Low Carbon Fuel Standard amendments and federal renewable fuel standards, potentially generating significant revenue from LCFS credits and D3 RINs.

Negative Points

- Revenue for Q1 2025 was $42.9 million, down from $72.6 million the previous year, primarily due to delayed biodiesel contracts in India.

- The company reported a net loss of $24.5 million, roughly flat compared to Q1 last year.

- Interest expense rose to $13.7 million, reflecting the company's capital structure and investment base.

- Cash at the end of the quarter was only $500,000 following significant debt repayment and investment into carbon intensity reduction and dairy RNG expansion.

- The approval process for LCFS pathways has been slow, taking about two years, which delays revenue recognition from these credits.