Morgan Stanley has adjusted its price target for Teledyne (TDY, Financial), raising it from $535 to $580 while maintaining an Equal Weight rating on the stock. The firm highlights that Aerospace stocks are experiencing record-high multiples, attributing this to the sector's demonstrated resilience. Furthermore, Morgan Stanley anticipates that the current industry trends will persist. As part of their second-quarter preview, the firm notes improvements in the Aerospace supply chain, increased Boeing (BA) production, and consistent air traffic demand. Morgan Stanley continues to show preference for aerospace companies that have a balanced mix of aftermarket and original equipment business.

Wall Street Analysts Forecast

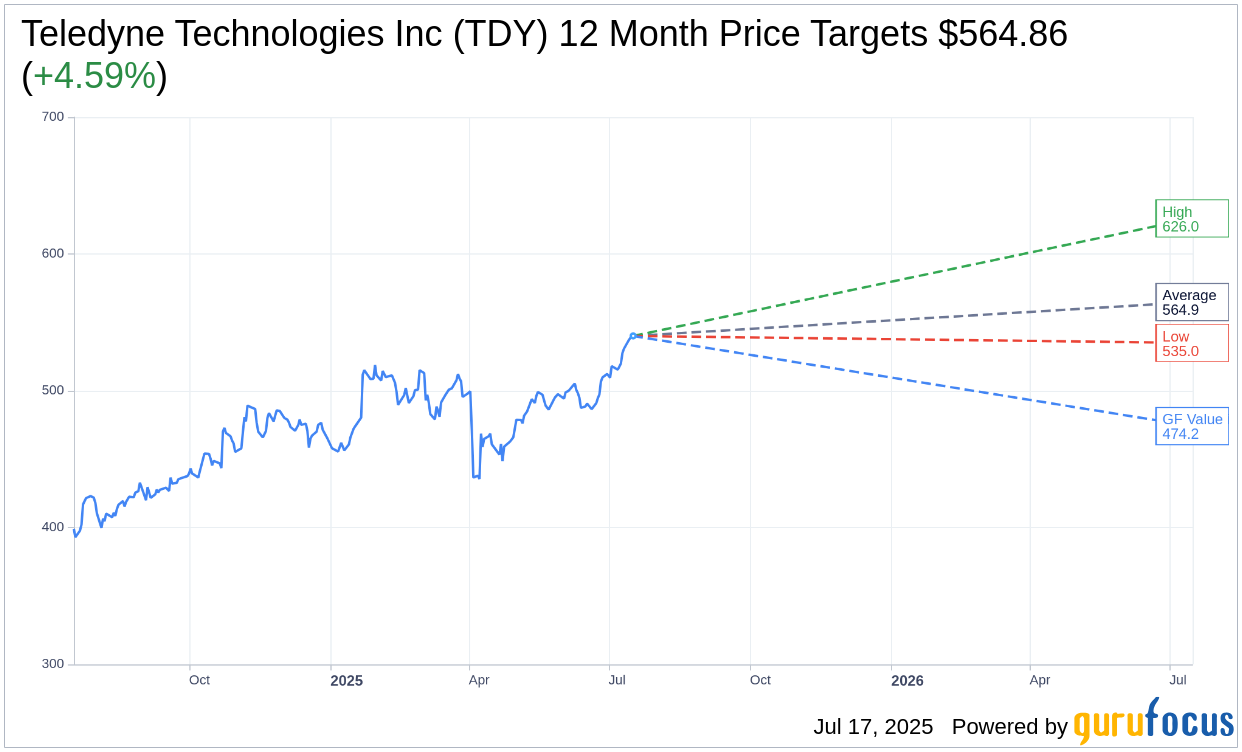

Based on the one-year price targets offered by 11 analysts, the average target price for Teledyne Technologies Inc (TDY, Financial) is $564.86 with a high estimate of $626.00 and a low estimate of $535.00. The average target implies an upside of 4.59% from the current price of $540.06. More detailed estimate data can be found on the Teledyne Technologies Inc (TDY) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Teledyne Technologies Inc's (TDY, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Teledyne Technologies Inc (TDY, Financial) in one year is $474.18, suggesting a downside of 12.2% from the current price of $540.06. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Teledyne Technologies Inc (TDY) Summary page.

TDY Key Business Developments

Release Date: April 23, 2025

- Total Sales Increase: 7.4% year-over-year, with organic growth in every segment.

- Non-GAAP Earnings Per Share: Record for any first quarter.

- GAAP Earnings Per Share: Record for any first quarter.

- Operating Non-GAAP Margin: Record for any first quarter.

- Digital Imaging Sales Increase: 2.2% year-over-year.

- Instrumentation Sales Increase: 3.9% year-over-year, with 2.6% organic growth.

- Marine Instruments Sales Increase: 9.5%, with 6.5% organic growth.

- Environmental Instruments Sales Decrease: 2% year-over-year.

- Instrumentation Operating Margin: Increased 97 basis points to 27%.

- Aerospace and Defense Electronics Sales Increase: 30.6% including acquisitions, 7.8% organic growth.

- Engineered Systems Revenue Increase: 14.9% year-over-year.

- Cash Flow from Operating Activities: $242.6 million, down from $291 million in 2024.

- Free Cash Flow: $224.6 million, down from $275.1 million in 2024.

- Capital Expenditures: $18 million, up from $15.9 million in 2024.

- Depreciation and Amortization Expense: $80.7 million, up from $78 million in 2024.

- Net Debt: $2.5 billion.

- Second Quarter 2025 GAAP EPS Outlook: $4.00 to $4.15 per share.

- Second Quarter 2025 Non-GAAP EPS Outlook: $4.95 to $5.05 per share.

- Full Year 2025 GAAP EPS Outlook: $17.35 to $17.83 per share.

- Full Year 2025 Non-GAAP EPS Outlook: $21.10 to $21.50 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Teledyne Technologies Inc (TDY, Financial) achieved record first-quarter total sales, increasing by 7.4%, marking the greatest growth rate in years.

- The company reported record non-GAAP and GAAP earnings per share and operating margins for any first quarter.

- Orders exceeded sales for the sixth consecutive quarter, indicating strong demand and a healthy backlog.

- The Qioptiq acquisition was successfully closed, contributing to the company's growth and backlog with major new defense contracts.

- Teledyne Technologies Inc (TDY) maintains a balanced mix of commercial and government businesses, providing resilience against economic and political uncertainties.

Negative Points

- Cash flow from operating activities decreased to $242.6 million from $291 million in the previous year, partly due to lower customer cash advances.

- The company anticipates a potential 1% negative impact on annual sales due to market uncertainties, including tariffs.

- Non-GAAP segment margins in Aerospace and Defense Electronics decreased due to transaction and integration costs from recent acquisitions.

- The Digital Imaging segment experienced ongoing weakness in certain markets, such as x-ray detectors for the dental market.

- Teledyne Technologies Inc (TDY) faces potential margin pressures from tariffs, with an estimated $18 million quarterly impact on costs.