Summary:

- J.P. Morgan upgrades Hewlett Packard Enterprise (HPE, Financial) to "Overweight" with a $30 price target by December 2026.

- HPE's acquisition of Juniper Networks enhances its networking capabilities.

- Current analyst recommendations project a modest upside for HPE stock.

J.P. Morgan's Optimistic Outlook on HPE

J.P. Morgan has shown confidence in Hewlett Packard Enterprise (NYSE: HPE) by upgrading its rating to "Overweight" and setting an ambitious price target of $30 by December 2026. This upgrade follows HPE's strategic acquisition of Juniper Networks, a move poised to bolster its networking prowess. Although HPE faces certain execution challenges, the potential for significant earnings growth looks promising.

Wall Street Analysts' Forecast and Consensus

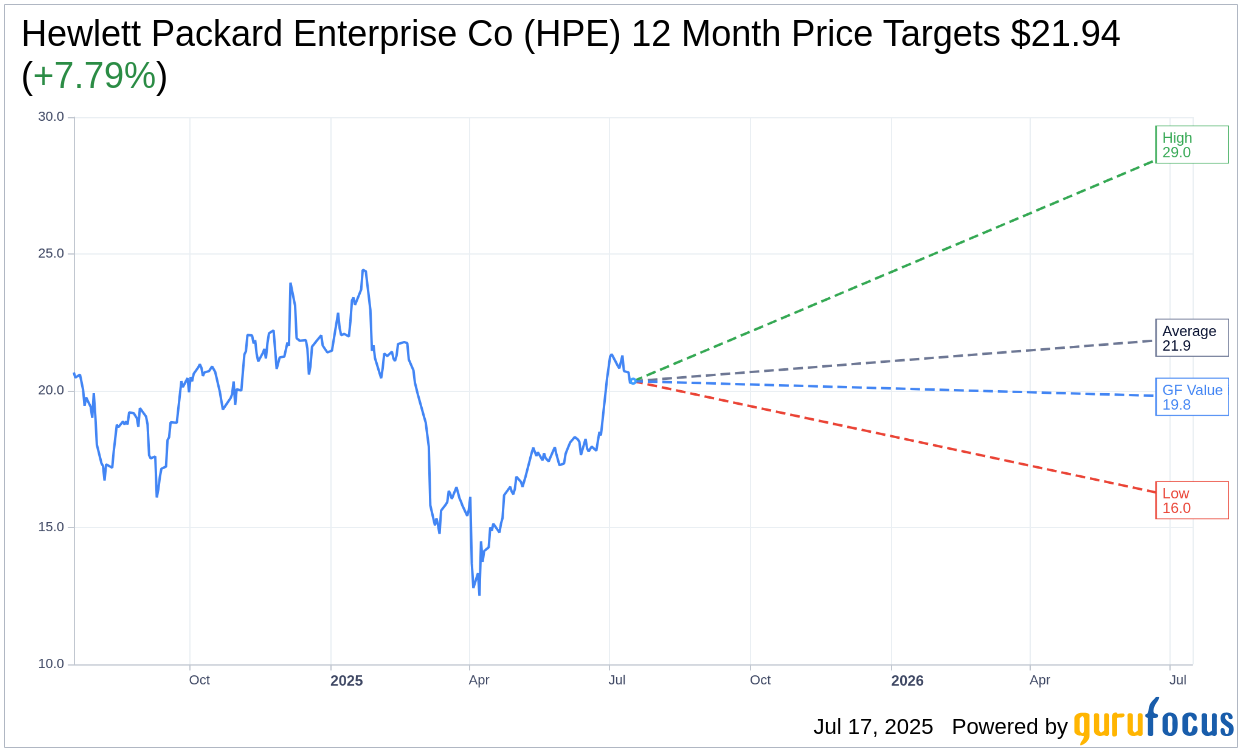

Wall Street maintains a cautiously optimistic outlook on HPE. According to data compiled from 14 analysts, the average price target stands at $21.94. The estimates range from a high of $29.00 to a low of $16.00. This average target indicates a potential upside of 7.79% from the current trading price of $20.35. More insights and detailed projections can be accessed on the Hewlett Packard Enterprise Co (HPE, Financial) Forecast page.

Furthermore, a consensus from 18 brokerage firms reveals that Hewlett Packard Enterprise Co's (HPE, Financial) average brokerage recommendation is pegged at 2.3, suggesting an "Outperform" status. The brokerage recommendation scale varies from 1 to 5, where 1 denotes a Strong Buy and 5 represents a Sell.

GF Value Analysis

Analyzing the GF Value metric, GuruFocus estimates indicate a one-year fair value of $19.78 for Hewlett Packard Enterprise Co (HPE, Financial), suggesting a downside of 2.8% from the current price of $20.35. The GF Value offers investors a calculated fair value based on historical trading multiples, past growth metrics, and future business performance projections. For a more comprehensive understanding, visit the Hewlett Packard Enterprise Co (HPE) Summary page.