Pagaya (PGY, Financial) has revised its adjusted EBITDA forecast for the second quarter, narrowing the range to $86 million from an earlier estimate of $75 million to $90 million. Additionally, the company has increased its projection for Q2 network volume to $2.6 billion, up from the previous range of $2.3 billion to $2.5 billion.

The company's Chief Financial Officer, Evangelos Perros, highlighted the effective execution across their network, emphasizing a focus on consistent and profitable growth.

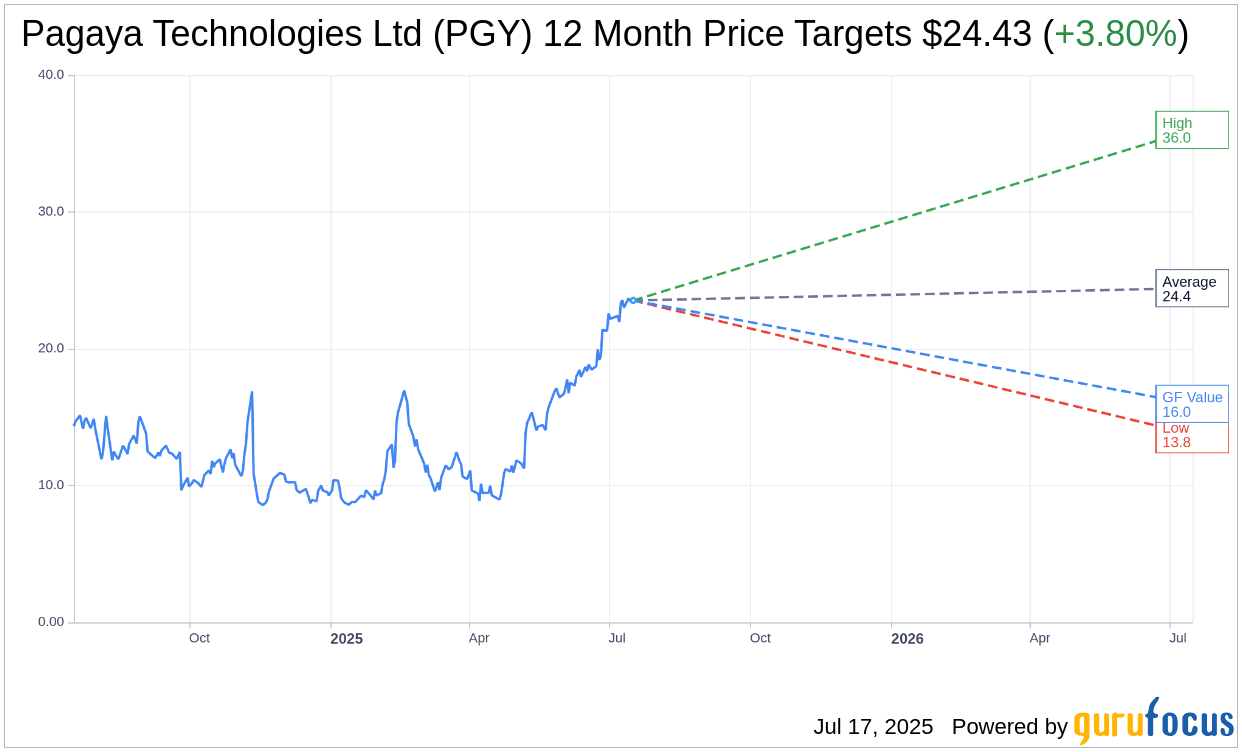

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Pagaya Technologies Ltd (PGY, Financial) is $24.43 with a high estimate of $36.00 and a low estimate of $13.75. The average target implies an upside of 3.80% from the current price of $23.53. More detailed estimate data can be found on the Pagaya Technologies Ltd (PGY) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Pagaya Technologies Ltd's (PGY, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Pagaya Technologies Ltd (PGY, Financial) in one year is $15.97, suggesting a downside of 32.13% from the current price of $23.53. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Pagaya Technologies Ltd (PGY) Summary page.

PGY Key Business Developments

Release Date: May 07, 2025

- Revenue Growth: Increased by 18% year over year, reaching an annualized run rate of nearly $1.2 billion.

- Fee Revenue Less Production Costs (FRLPC): Grew by 26%, reaching an annualized run rate of over $460 million.

- Adjusted EBITDA: Grew 100% to an annualized equivalent of approximately $320 million.

- GAAP Net Income: Achieved positive GAAP net income of $8 million for the quarter.

- Network Volume: In line with the year-ago levels at $2.4 billion, slightly below guidance due to lower SFR volume.

- Personal Loans Volume Growth: Increased by 17% from year-ago levels.

- Revenue and Other Income: Increased by 18% to a record $290 million.

- Adjusted EBITDA Margin: Increased by more than 10 percentage points to 27%.

- Interest Expense: $21 million, down approximately $5 million sequentially.

- Cash and Cash Equivalents: $230 million as of March 31st.

- Investments in Loans and Securities: $760 million as of March 31st.

- Full Year Revenue Guidance: Increased to a range of $1.175 to $1.3 billion.

- Full Year GAAP Net Income Guidance: Increased to a range of $10 million to $45 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Pagaya Technologies Ltd (PGY, Financial) achieved positive GAAP net income of $8 million, ahead of their second-quarter guidance and for the first time as a public company.

- Revenue grew by 18% year over year, reaching an annualized run rate of nearly $1.2 billion.

- Fee revenue less production costs (FRLPC) grew by 26%, reaching an annualized run rate of over $460 million.

- Adjusted EBITDA doubled to an annualized equivalent of approximately $320 million, demonstrating strong operational efficiency.

- The company has diversified its funding sources, including a forward flow agreement with Blue Owl Capital to purchase up to $2.4 billion in loans over 24 months.

Negative Points

- Network volume was slightly below guidance, primarily due to lower SFR volume.

- There is ongoing macroeconomic and geopolitical uncertainty, which could impact future performance.

- Interest expense remains a concern, although it has decreased from previous quarters.

- The company faces potential credit-related losses, with net credit-related losses reported at $24 million for the quarter.

- The market volatility and potential changes in consumer health and credit performance remain risks that the company needs to manage carefully.